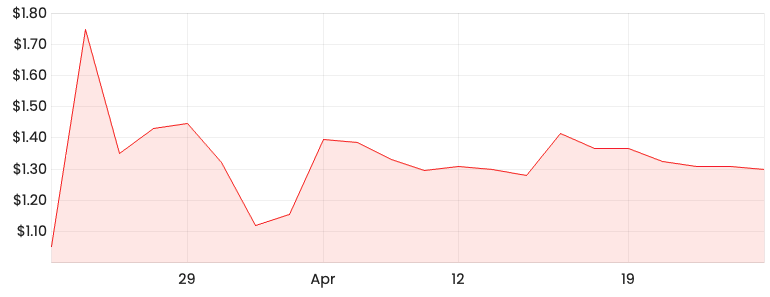

The share price of Airtasker Ltd (ASX: ART) and Nuix Ltd (ASX: NXL) have suffered similar fates in recent times. However, I think these 2 ASX growth shares have room for growth.

It might seem crazy given the recent drop in the share price for both Airtasker and Nuix. Here’s why.

Nuix share price

Nuix is an investigative analytics and intelligence company with a vision of “finding truth in a digital world”.

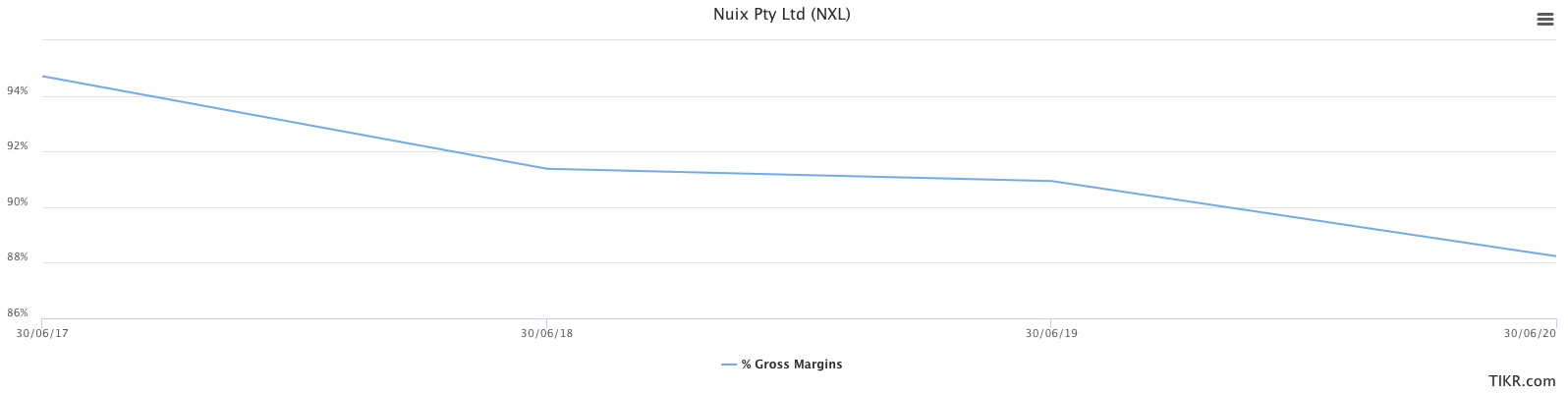

As part of the Rask Investment Philosophy, I prefer to find businesses that have high gross margins. Nuix reminds me of another software-as-a-service (SaaS) company, Xero Limited (ASX: XRO).

Gross margins is revenue minus the cost of goods sold (COGS). Wait, what?

In other words, it’s the money you earn after subtracting money spent on producing the good or service. Say you open a lemonade stall, the COGS would be the lemons purchased.

As you can see, Nuix has even higher margins than Xero.

Even though gross margins for Nuix is trending downwards, it’s still very high.

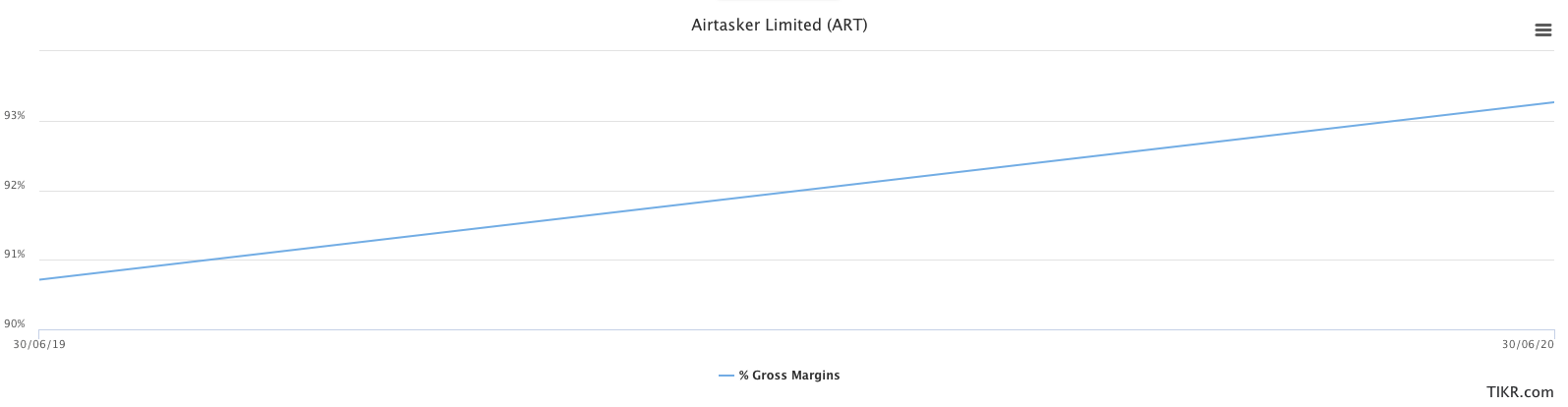

Why are high gross margins important? Let’s take a look at Airtasker first.

Airtasker share price

Airtasker is an online marketplace for local services, connecting people and businesses who need work done (Customers) with people and businesses who want to work (Taskers).

Airtasker has even higher gross margins as illustrated below.

I like businesses with high gross margins because it provides more capital to reinvest into the business over the long term.

More money at the top line means more money at the bottom line or free cash flow.

Once a business hits an inflection point where its growing free cash flow, it provides opportunities for reinvestment and growth.

If you are interested in other ASX growth shares, I suggest getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.