Airtasker Ltd (ASX: ART) was meant to list on the ASX on Monday but the stage is set for the $255 million float today. How does the Airtasker business stack up?

Airtasker is Australia’s leading online marketplace for local services, connecting people and businesses who need work done (Customers) with people and businesses who want to work (Taskers).

You don’t know how to set up a trampoline? Well, Airtasker offers you Taskers who can, it’s essentially a network of Taskers who can solve customer problems.

The company was initiated by co-founders, Tim Fung and Jonathan Lui in March 2012. They had a eureka moment when they moved apartments and asked friends to help with moving. At the time, they thought to themselves, “Why do we bother our busy friends and family to help with all of these tasks when there are so many people who are looking to work and earn money?”.

Rising customers and revenue

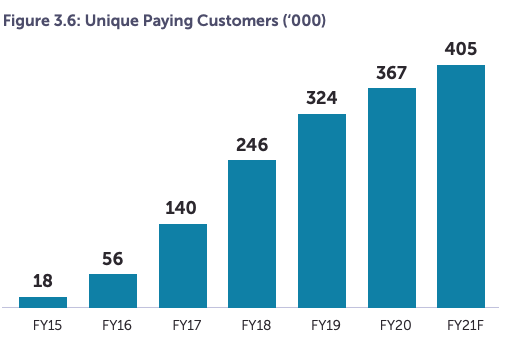

It seems like those quirky Airtasker advertisements really paid off as customers have jumped from around 18,000 in FY15 to 367,000 in FY20. This is showcased below.

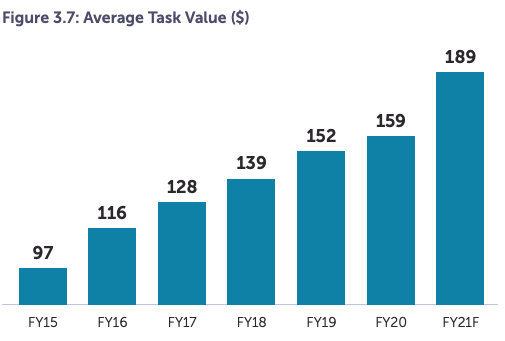

More impressively, as customer numbers have increased, the average task value has also increased. Airtasker notes this is attributed to the increasing use of the marketplace to complete more complex tasks such as those completed by tradespeople, accountants and lawyers.

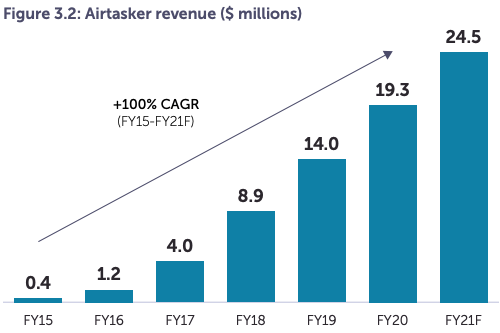

The combination of a growing customer base that was seeking more complicated tasks ultimately meant significant growth in revenue. Revenue grew at a compound rate of 80% from FY15 to FY20 and Airtasker has forecasted FY21 revenue to hit $24.5 million.

Hey Airtasker, how do you make money?

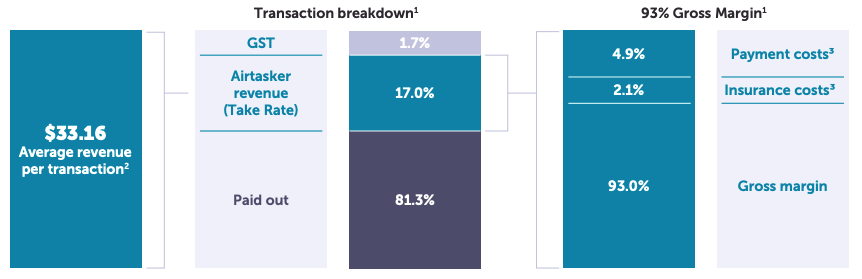

Airtasker earns revenue from service fees paid by the Taskers and booking fees paid by customers. They are charged once the task is completed.

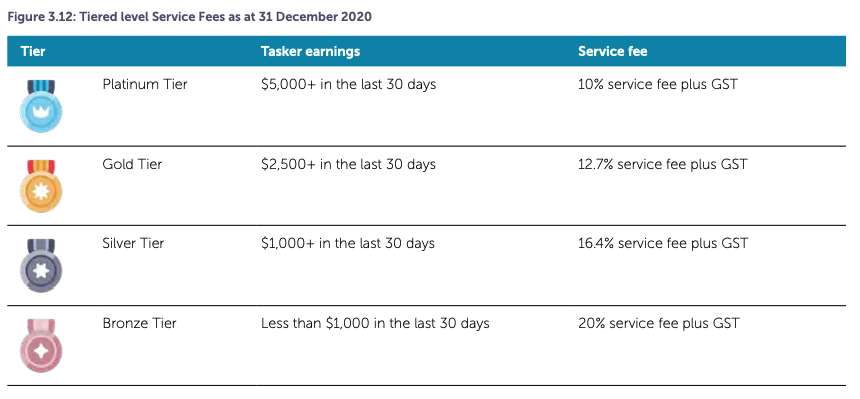

The booking fee ranges between $2.90 and $24.90. As for service fees, Airtasker rewards Taskers who complete a higher value of tasks with lower service fees as seen below.

Once these fees are collected, Airtasker pays third party payment service provider costs e.g. Stripe and Afterpay Ltd (ASX: APT) to process Afterpay payments. The only other additional cost is insurance, which is a premium paid to insurers to provide third party public liability insurance.

The below graph is an illustration of how Airtasker arrives at an average gross margin of 93% based on an average revenue of $33.16 per transaction.

Preliminary thoughts

Strong growth in revenue and customers along with high gross margins makes Airtasker quite attractive. I also think it has built a strong brand as Airtasker is often used in my realm of social conversations when someone needs help with something. How about your social conversations?

I am also cautious at the same time because Airtasker isn’t the first freelance business. A similar business, Freelancer Ltd (ASX: FLN) continues to fall since it listed in 2013.

So, what’s different this time around. Well, I will be digging further into Airtasker this week, so keep an eye out for more articles.

If you are interested in other ASX share ideas, I suggest getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.