With talk of rising bond yields and a ‘rotation out of growth’ to more value-oriented companies, dividend-paying stocks could appear more attractive than they have previously.

Here are two ASX shares that I think could make excellent additions to an income portfolio.

Sonic Healthcare

Sydney-based Sonic Healthcare Limited (ASX: SHL) is a high-quality business that has a long track record of dividends, but I also think it’s well-positioned for growth in years to come.

Sonic is involved in laboratory testing/pathology, diagnostic imaging and primary care medical services. It has operations in Australia, the US, Germany, Switzerland, the UK, Belgium, Ireland and New Zealand.

COVID-19 response

Sonic has turned out to be a large beneficiary of the COVID-19 pandemic, with the company performing over 18 million COVID-19 PCR tests in the first half of FY21 in roughly 60 laboratories globally. Sonic’s ability to leverage its existing infrastructure since the onset of COVID saw revenue up 33% to $4.4 billion, and net profit up 166% to $678 million in H1 FY21.

To me it seems likely that as the world eventually overcomes COVID-19 and fewer PCR tests are performed, some of these numbers might normalise. However, the underlying base business has been fairly resilient throughout the duration of COVID.

Management indicated that its global base business revenue (excluding COVID testing) for 1H21 was down just 1% vs 1H20, showing significantly less impact than the first few months of the pandemic.

Progressive dividend policy

Sonic’s business is highly cash generative with $810 million provided by operations in the first half, an increase of 52% on the prior period. Gearing is currently at record low levels and it has roughly $1.3 billion in available liquidity (pre-interim dividend).

The company maintains its progressive dividend policy which typically distributes roughly 75% of its earnings to shareholders. The 30% franked interim dividend for FY21 of 36 cents represents an increase of 6% on FY20.

The final dividend declared for the last two financial years has been 51 cents. While it’s not guaranteed, it seems likely that this will be either matched or increased in FY21.

Magellan

Similar to Sonic, I also see Magellan Financial Group Ltd (ASX: MFG) as a strong pick for income generation, as well as a future growth play. Magellan is an investment manager that has funds under management (FUM) of $100.9 billion as of 31 December, which was up 9% on the prior period.

Magellan’s ability to pay out dividends to shareholders is mostly contingent on the amount of funds under management, which, when high, results in more management fees being collected by the company and therefore, a higher amount of dividends that are able to be distributed.

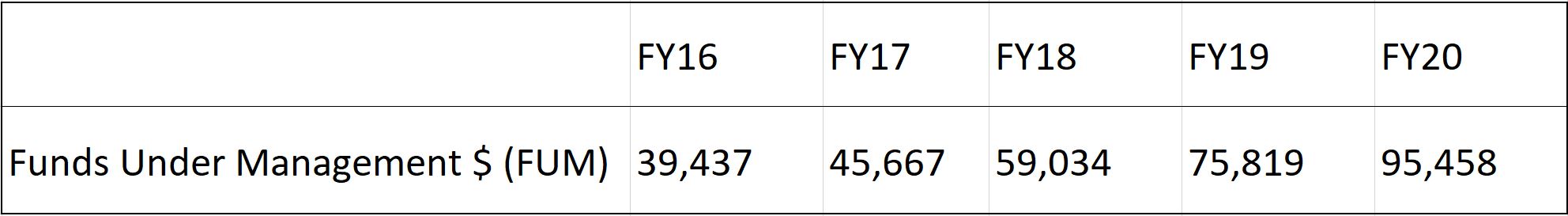

As you can see from the below image, Magellan’s growth trajectory of FUM over the last five years is undeniably impressive, which has led profits and dividends to increase relatively in line with FUM growth.

Some important questions to answer that would guide your investment decision would be:

- How likely is it that Magellan will be able to continue growing FUM at a sustainable level?

- Is its management fee likely to change?

Strong future outlook

Part of the reason why I think Magellan might be able to continue growing its FUM is due to the recent influx of retail investors in the market since the onset of COVID-19. In particular, there’s been a surge in popularity in ETF’s and sustainable investments. Some of Magellan’s new funds listed on Chi-X might be well-positioned to be potential beneficiaries of this trend.

Some of its new funds include the Magellan Sustainable Fund (CXA: MSUF), the MFG Core International Fund (CXA: MCSG) and a retirement product still in the works which could expose itself to a broader audience.

An additional reason why Magellan’s upwards growth trajectory could be sustained over the next several years is an increased need for active management and asset selection if broader indexes underperform in the coming years.

Equity markets have had a strong run over the last several years in the US, partly due to the outperformance of the FAANG companies. Therefore, if your outlook for 2021 or beyond is that some of these growth stocks might underperform from a potential reflation trade, it creates an opportunity for active fund managers to outperform the index and attract more funds from outside investors.

If this is the case, it seems likely that Magellan will be able to maintain current management fees, as investors are willing to pay for outperformance.

Magellan declared an interim dividend of 97.1 cents per share, up 5% from the prior period.