The Domain Holdings Australia Ltd (ASX: DHG) share price has dipped upon the release of its half-yearly (HY21) results for 2021. So, what’s the go with the Domain share price?

Domain is a real estate media and technology services business focused on the Australian property market. It earns most of its revenue from offering a digital platform to advertise residential and commercial property listings, as well as for media and developers to promote their products and services to consumers. Domain’s direct competitor in this space is REA Group Limited (ASX: REA).

Domain’s HY21 results

Listings continue to slump

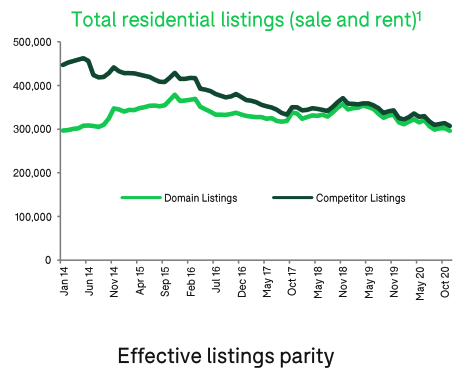

Similar to REA Group, Domain continues to suffer from the downward trend of property listings across Australia, as illustrated below.

The volume of listings is important because it’s the key driver of Domain’s revenue through ‘for sale’ and rental listings across its desktop, mobile and social platforms. As a result, Domain recorded a 5.5% decline relative to the prior corresponding period, HY20 (PCP).

Despite recording lower revenue, Domain managed to post a boost in EBITDA from $45.8 million for HY20 to $54.5 million for HY21, representing an increase of 3.6%. This reflects Domain’s multi-year strategy to rein in costs in the face of challenging headwinds presented by the current property market environment.

Domain noted cost reduction initiatives, along with print volume declines, contributed to a 58% PCP decline in expenses.

Boutique developments on the up

Domain highlighted the developer market seems to be shifting its focus away from large multi-storey apartment projects to smaller boutique developments, and a shift from investor to owner-occupied projects. I think this may translate to lower revenue if these trends continue.

A greater focus on smaller boutique developments will likely mean reduced volume in potential property listings.

The rise in owner-occupied projects will likely result in lower transactional activity within the property market, and as a consequence, lower listings.

Dividend on hold

Given the COVID-19 uncertainty, the board has deferred consideration of a dividend until the FY21 results.

Management’s commmentary

Domain’s CEO and Managing Director, Jason Pellegrino

sounds cautiously upbeat about the future, saying: “It is encouraging to see we are now entering a supportive environment for property, with low-interest rates and high levels of demand. Although we have seen a modest early recovery, property turnover remains well below historic mid-cycle levels. Longer-term there’s an opportunity for stamp duty reform to provide a further step-change to transaction volumes.”

It’s true that the current environment of low-interest rates is driving higher demand but property owners remain reluctant to sell.

My thoughts

It is difficult and almost impossible to predict whether supply will increase but when and if it does, I think the floodgates will open. The pent-up demand for properties will likely push property prices up further, which will likely encourage property owners to list on on the market.

As you can gather, Domain’s business is quite cyclical in nature and I prefer businesses that are not as dependent on macroeconomic factors.

If you want more analysis of Domain, you can check out Cathryn’s analysis of its FY20 results. And in related news, competitor REA released half-year results of its own earlier in the month.

To access more quality share research, I suggest getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.