The Adairs Ltd (ASX: ADH) share price continues to climb after the homewares retailer revealed better than anticipated sales growth in its recent trading update.

Adairs shares currently trade at $3.47 per share at the time of writing, representing a 33% premium to where they were prior to COVID-19. Does the Adairs share price still offer good value today?

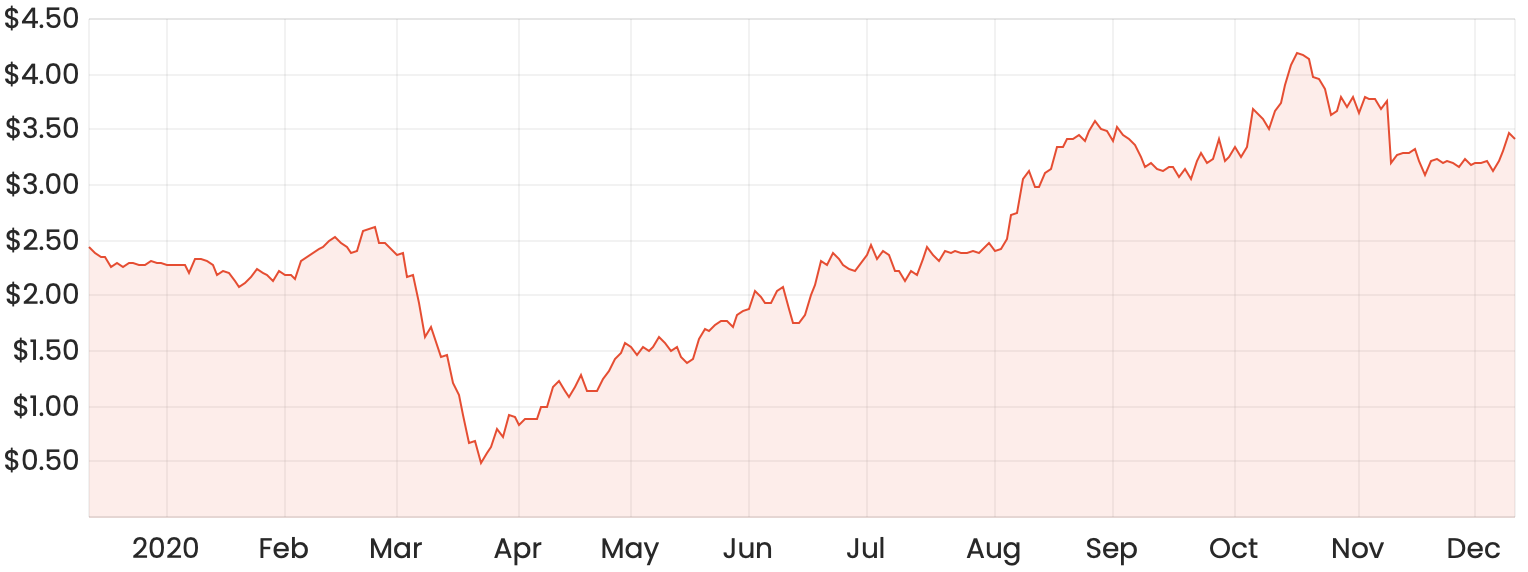

ADH share price chart

What was reported?

Adairs provided 1HFY21 revenue guidance of between $235 and $245 million, up from $179 million in 1HFY20. Despite having 43 stores closed for around 12 weeks during the COVID-19 pandemic, total sales from the first 21 weeks of FY21 managed to grow by 23.4% across the group.

Will the ASX retail boom continue?

I often try not to anchor my investment decisions based on the past performance of an individual company. In saying this, it’s hard to ignore the fact that the last four years haven’t all been smooth sailing for Adairs.

Despite consistent revenue growth since 2016, the company has seen some fairly stagnant and lumpy growth in earnings on a per-share basis. As you could expect, the Adairs share price over these last four years has more or less mirrored its earnings per share (EPS) growth and moved sideways up until this recent boom in retail as a result of COVID-19.

There is no doubt that Adairs has been a beneficiary of the pandemic but for me personally, to invest at this point would be to assume there’s now a sustainable tailwind that will push earnings and the share price subsequently higher.

Only time will tell if this indeed happens, or if we instead see a slowdown in sales towards the second half of next year.

Adairs’ bull case

This is obviously what could go wrong for retailers, but I also think there’s a blue sky case to be made for ASX retail shares in general.

Some market commentators have pointed out that in the lead up to Amazon’s launch in Australia in 2017, the average price/earnings (P/E) ratio of most ASX retailers compressed. In other words, investors thought Amazon would do extremely well, so they attributed a much lower valuation to these smaller companies that were potentially going to get put out of business.

Well, we know that this didn’t actually happen and many of these companies like Adairs and JB Hi-Fi Limited (ASX: JBH) fared extremely well despite the launch of Amazon in Australia. But interestingly, many of these ASX retailers retained that much lower than average P/E ratio compared to before.

Because of this, I think that buying certain ASX retail shares at the moment could potentially offer a relatively asymmetrical return with reduced downside, as they’re trading on low valuations compared to the benchmark.

When P/E multiples are low, it means there are low growth expectations priced in, which is exactly what I would look for in an asymmetrical investment. If it underperforms, the downside might be limited, as the market expected it to happen. But if the results are good, there’s the potential for the P/E to expand and the shares might be re-rated by the market.

Take Adairs for example, with a trailing P/E ratio of just over 16x. In my eyes, this seems relatively cheap considering predicted earnings per share (EPS) growth of 76% in FY21. That’s a forward P/E of just 9x.

Nick Scali Limited (ASX: NCK) is another example of a retailer trading on a low P/E multiple. At the time of writing, its shares trade on a forward P/E of just 10x, despite having forecast EPS growth of 67% for FY21.

Accent Group Limited (ASX: AX1) has a slightly higher forward P/E of just over 18x, but this is still considerably lower than the current ASX average of around 32x.

I source my earnings forecasts from S&P Global Market Intelligence consensus estimates, which are not official guidance figures from these companies, so take these forward-looking valuations with a grain of salt.

Are Adairs shares a buy?

I think some ASX retailers are a buy at the moment, but I’m not 100% convinced on Adairs just yet. When stimulus runs out, which will likely result in a slow down of sales, I think the retailers with the stronger brand image have an advantage over the other players.

For this reason, I’d be more inclined to go with ASX retailers like Nick Scali or Accent Group. I particularly like Accent Group due to its proposed expansion plan in the coming years.

I think Temple & Webster Group Ltd (ASX: TPW) also has a really strong brand, but its valuation is far more stretched than others and for this reason, I wouldn’t be buying shares at current prices.

The unknown future state of retail is definitely looming over some of these valuations, but given the amount of growth anticipated, I believe this could shape up to be an attractive investment opportunity for some retailers.