The Michael Hill International Ltd (ASX: MHJ) share price jumped more than 18% yesterday following a better than anticipated interim trading update for FY21.

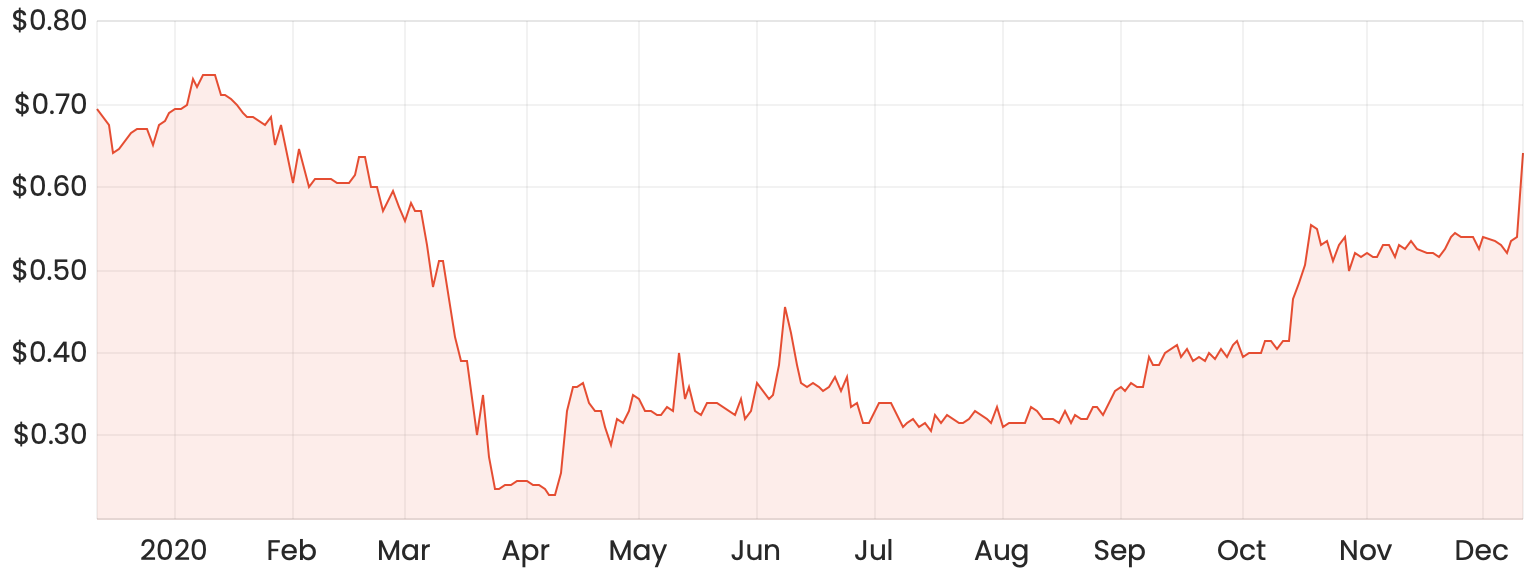

The speciality jewellery retailer was another COVID-19 beneficiary that was undoubtedly boosted by generous government stimulus and superannuation withdrawals. As a result, the Michael Hill share price has nearly tripled since March and currently sits at around 60 cents.

MHJ share price chart

Michael Hill is a jewellery retailer with 289 stores across Australia, New Zealand and Canada. It also has a strong digital offering which has helped to offset the drop in sales resulting from store closures earlier in the year.

What was reported?

Michael Hill’s trading update was for the 22-week period ending 29 November 2020. Same-store sales for the period were up 7.9% on the prior period last year, pushed even higher thanks to online sales which saw a huge 110% increase against last year.

The group saw an additional 200 basis point increase in margins which I presume was the result of the jump in online sales.

The results are strong and I also think the intuition behind it is relatively straightforward. Overseas end-of-year holidays have probably been replaced with some more traditional retail therapy, much to the advantage of some of these retailers. Michael Hill’s Australian stores were the standout with a 14% jump in sales, while New Zealand and Canada saw growth of around 3-5%.

Is the Michael Hill share price a buy today?

While I do think there are a handful of ASX retailers that will manage to continue to perform well over the coming years, there aren’t a lot of structural tailwinds in favour of this sector at the moment, in my opinion.

The ideal time to buy ASX retail shares would’ve been in March or April this year. Of course, this is easy to say in hindsight, but as investors continue to rotate out of tech and retail into the recovery stocks, it might create at least a short-term headwind for some of these companies as we experience a gradual reopening of the economy.

That’s in the short-term, but what about buying shares in Michael Hill as a long-term investment? While I do often try to avoid anchoring my decision on past financial performance, it’s worth taking a look at the five-year MHJ share price chart and some of the financials that reflect it.

Past performance

Since listing in mid-2016, Michael Hill has usually paid out a dividend of around 4-5 cents per share, which is a yield of around 4-8%. It’s important to note however that the yield has mainly been increasing because the MHJ share price has been decreasing over time. Shares have steadily fallen from around $1.75 per share to current levels around the 60 cent mark.

Revenue growth has been stagnant at around $555 million per year. Despite having higher than average gross margins of roughly 60%, earnings per share (EPS) has been gradually been decreasing as well. Its return on equity (ROE) has also been on a decline even before COVID-19.

There would be many factors that would’ve contributed to this gradual decline, but here are a few I’ve identified.

Firstly, it doesn’t seem like Michael Hill was able to transition as well as others into an omnichannel platform. While traditionally only a bricks-and-mortar retailer, embracing an e-commerce element has proven to be difficult with challenges in digital marketing and data strategies.

When sales started to drop, Michael Hill resorted to discounting strategies to help boost sales, but this lowered gross margins and further cut into profitability.

At one stage, Michael Hill had a presence in the US, but it was forced to exit these operations after this segment underperformed significantly and management deemed it not worthy to continue.

To add to this, it looks like there have been some corporate governance issues within the company and some significant turnover of the management team. In July last year, the Michael Hill share price sank after the group reported it had underpaid staff by up to $25 million over the past six years.

Summary

I think it’s important to ask yourself whether you think it’s likely this recent jump in sales will solve the other issues the company was facing prior to COVID-19.

This is up for interpretation, but my own thinking is that it likely won’t and for this reason, I won’t be buying shares in Michael Hill at the moment.

If I had to pick an ASX jewellery retailer, I’d probably choose Lovisa Holdings Ltd (ASX: LOV). Lovisa somehow has the gross margins of a luxury retailer with the high inventory turnover of a discounter. For some further reading on Lovisa, check out this article: Are Lovisa shares a potential COVID-19 turnaround play?