The Flight Centre Travel Group Ltd (ASX: FLT) share price has been savaged by the COVID-19 pandemic, but there are signs of green shoots ahead.

Flight Centre is Australia’s largest travel agency and one of the largest travel agency groups in the world. Flight Centre has business operations in 23 countries and corporate travel management operations spanning 90 countries.

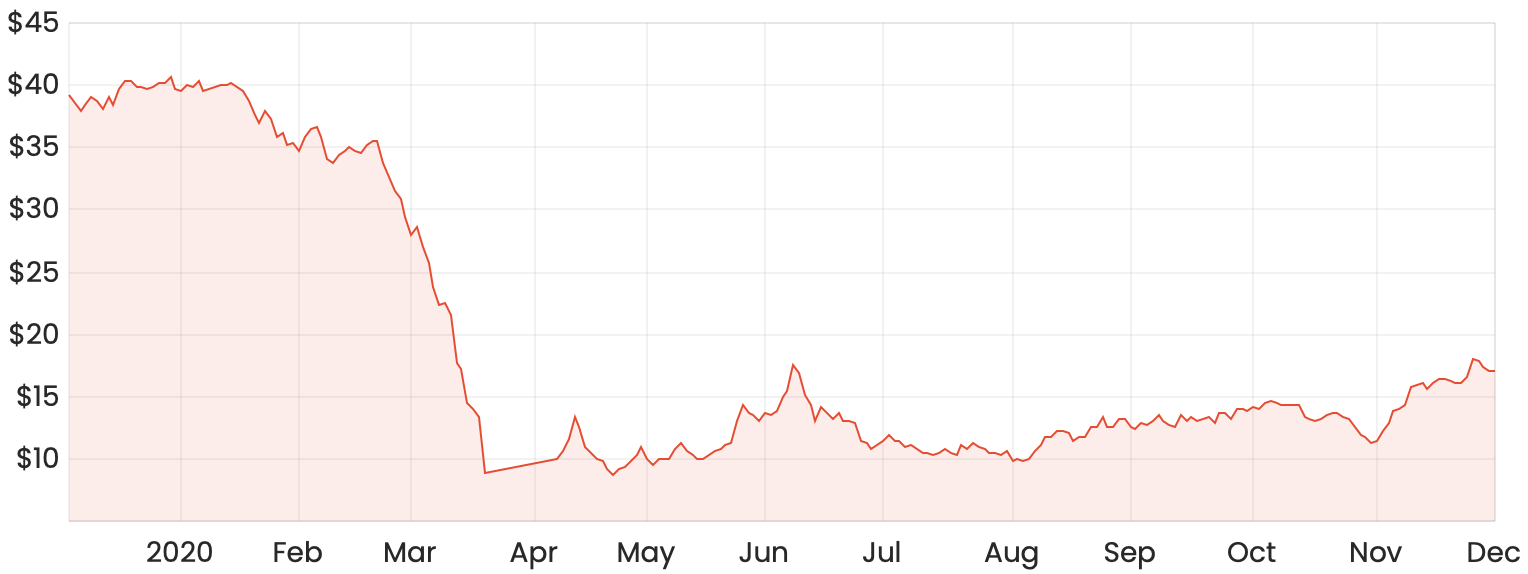

FLT share price crash and takeoff

The Flight Centre share price well and truly collapsed earlier this year during the COVID-19 market crash, losing close to 75% of its market value between 21 February and 19 March. The reasons behind the crash were quite clear: very limited travel equals very little revenue for travel agencies such as Flight Centre.

FLT share price chart

That said, the Flight Centre share price has risen nearly 92% since 19 March, and jumped more than 50% in November alone.

In my view, the recovery has been triggered by two key factors:

1. Improving sentiment

The initial share price crash was the result of panic selling. In other words, many market participants were rushing to the exits at once, in fear that travel will never return to normal. In my view, this pushed the Flight Centre share price down to an irrationally low price, which has begun to recover as sentiment in the wider market has improved.

2. Positive vaccine news

At Flight Centre’s AGM in early November, Managing Director Graham Turner stressed the importance of an effective vaccine to the group’s operational recovery: “While the recovery timeframe is unclear, I am optimistic that travel’s medium term outlook is fairly bright, particularly if there’s an effective vaccine late this calendar year or early in 2021”.

Just days later, the Flight Centre share price received a huge boost when positive news regarding COVID-19 vaccine trials was announced. Shortly after this, biotechnology giant Moderna announced vaccine trial results with even higher efficacy. It now appears that it is not a question of if a vaccine will be available, but more a question of when.

When will global travel activity return to normal?

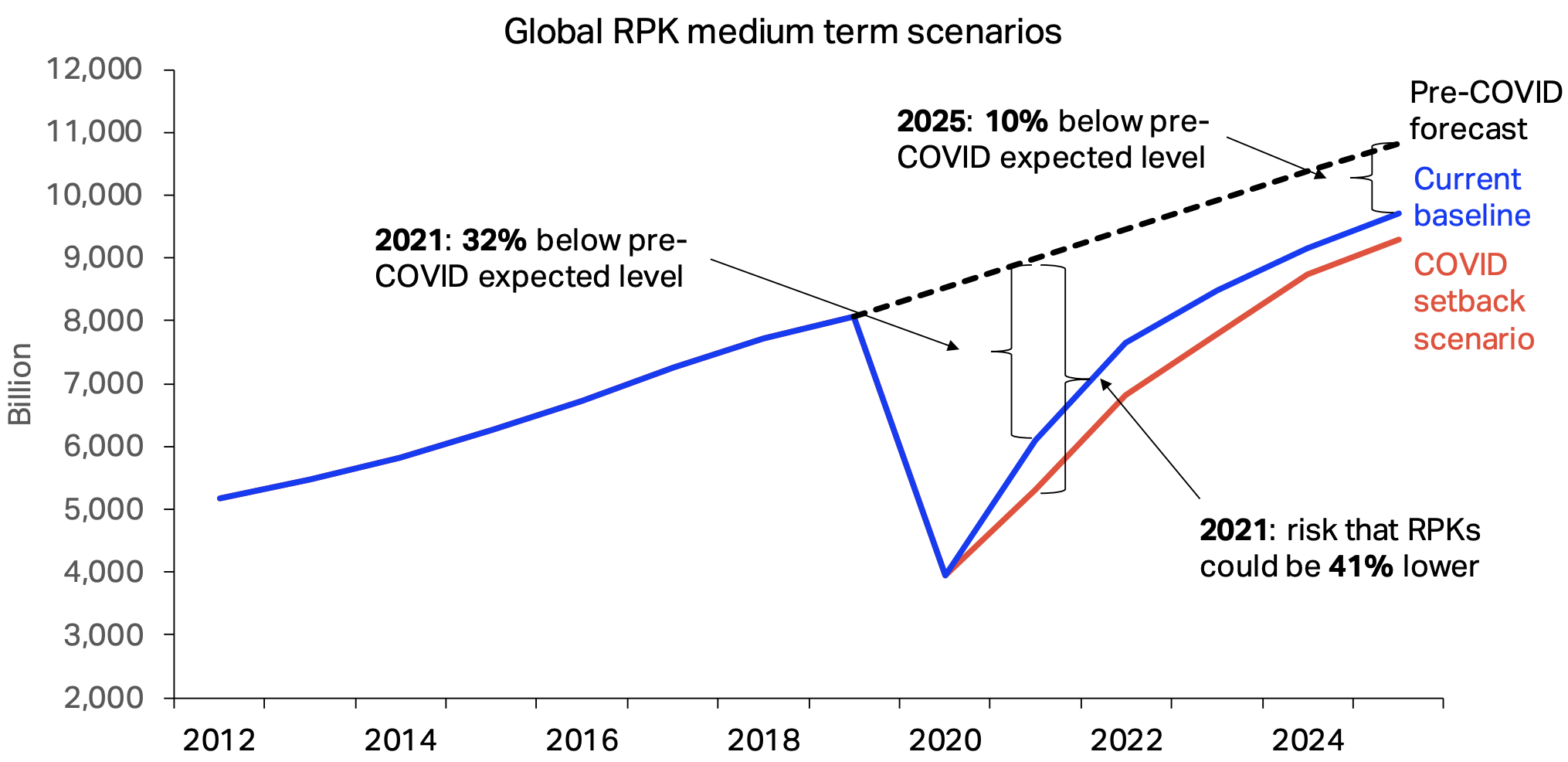

According to the International Air Transport Association (IATA), global air passenger journeys will recover to, and surpass, pre-COVID levels in 2023 or 2024. These forecasts were made in April by IATA, and with recent positive vaccine developments, these forecasts could be conservative.

The below chart comes from an IATA presentation released in May, showing estimates for revenue passenger kilometres (RPK), which represents the number of kilometres travelled by paying passengers.

Is there more upside in the FLT share price?

In my view, there is still considerable upside in the Flight Centre share price. I personally hold shares in Flight Centre purchased at much higher levels.

I remain confident that the current headwinds will transform back into tailwinds supported by growing passenger demand. It is also assuring that Flight Centre has “more than $1b in cash and liquidity also secured to extend runway”.