Are Australian and global ETFs going to spark the next Global Financial Crisis (GFC)?

That’s the question on just about every investor’s mind.

Or, at least it should be…

Video: Difference Between ETFs & LICs

Will ETFs Spark The Next GFC?

For investors, ETFs are the hottest thing since sliced bread because they make investing easy.

Really easy.

Instead of worrying about which stock to buy, when and how much to pay, every Aussie can shovel their cash into a low-cost, diversified index fund ETF and get the market’s average return, which is pretty good.

Here in Australia, the most popular share ETFs buy and hold the largest 200 or 300 shares, ranked by market capitalisation (a measure of company size).

According to data from the ASX and Betashares, the market for Australia’s listed products (e.g. ETFs) has risen at an incredible 46% per annum since 2001.

I repeat — 46% per year!

Meaning the money inside these products has risen nearly 50% per year thanks to a combination of new money added (“inflows”) and the returns of the investments themselves.

ETF Risks

While ETFs sound great — and they are — there are risks.

That’s right, even though our company has a $99 ETF investing research service called Rask Invest ETFs, and even though we’ve launched a popular ETF news website called Best ETFs Australia…

I want to make something very clear:

ETFs are risky!

Indeed, while I believe it’s fair to say ETFs are a net positive for investors, just like any type of investment they have risks.

Moreover, there are no guarantees ETFs will perform as well in the future as they have in the past.

Should I Get Out Of ETFs Now?

I think ETFs are risky. But, that does not mean I think you should get out now.

Far from it.

In fact I own ETFs for the Rask Invest model portfolio and I reckon I will continue to do so for many years to come.

The reason I’m saying ETFs are risky is that I think is it’s vital everyone understand the risks they’re taking when they invest in an ETF.

‘ETFs Are Like CDOs In The GFC’

In the past month, the famed investor behind The Big Short

(Michael Burry — played by Christian Bale in the movie) has called out the risks of ETFs.

One quote in particular from Burry caught my attention:

“This is very much like the bubble in synthetic asset-backed CDOs before the Great Financial Crisis in that price-setting in that market was not done by fundamental security-level analysis, but by massive capital flows based on Nobel-approved models of risk that proved to be untrue.”

What Burry is saying here is far more profound than what most TV ‘experts’ say when they appeal to popular opinion to justify their poor performance.

You see, a normal index fund ETF simply buys everything inside the index. For example, Commonwealth Bank (ASX: CBA) shares often make up the biggest part of most Australian share ETFs simply because it’s the biggest company.

But does being the biggest also mean they are the best?

Absolutely not.

What’s increasingly happening in share and bond markets is akin to going to an auction of a property and an investor, let’s call her “Ms. ETF”, buying the house for whatever the price is.

The problem is sooner or later Ms. ETF will be asking ‘WTF happened to my investments?’ when she discovers that her purchase price made no sense whatsoever.

The bigger concern for investors, Burry says, is that there are hundreds of Ms. ETFs all around the world buying up more and more assets (shares, bonds, etc.) every day and few people truly understand the risk of investing this way.

For one, this type of buying behaviour will lead to strong momentum and swings in prices — both up and down.

Again, imagine Ms. ETF when she discovers she’s overpaid for her properties. She’ll be auctioning a new property every day just to get out of her investment. And in doing so, she’s going to drive down the prices of other properties nearby even if she only wants ‘the market price’.

In my opinion, the biggest threat ETFs pose to markets is not specific to ETFs at all — it’s a lack of understanding of the risks involved.

Indeed, I do not believe ETFs will be the cause of a market crash or correction, but they could accentuate the declines because investors don’t know what’s going on.

I think part of the problem is that ETFs are being sold as ‘lower risk’ investments and people have taken that to mean ‘low risk’ which is just not true. Low-er risk does not mean ‘low risk’.

Here’s what I’m talking about:

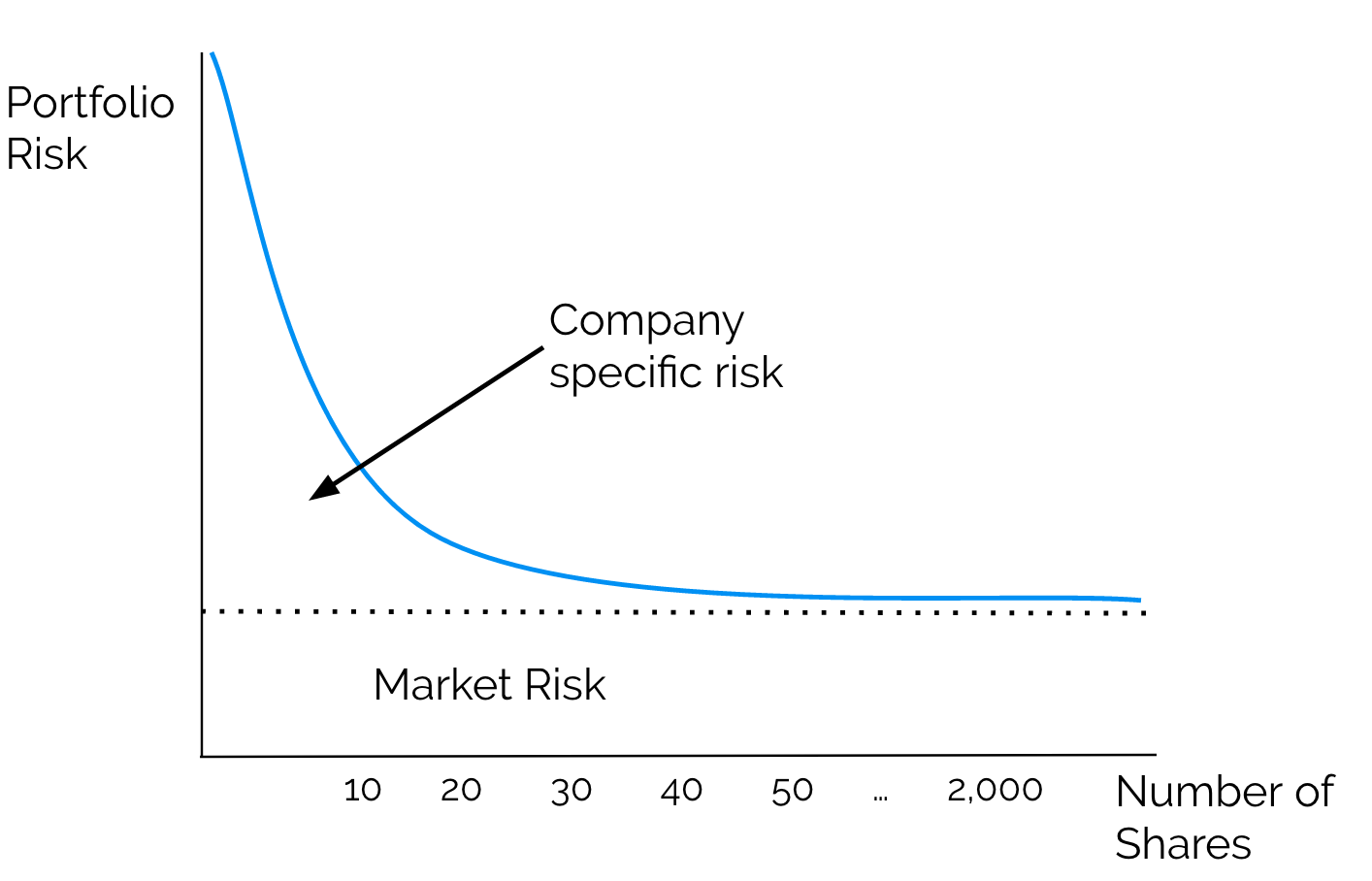

When an investor spreads their eggs across dozens or even hundreds of investments like shares (as some ETFs do), it’s true he or she is minimising the “specific risk” shown in the chart above.

However, investors will still be left with the “market risk”. The market risk represents all of the risks generally associated with the stock market as a whole. The small day-to-day ups and downs that can’t be avoided, as well the big ups and downs that go on for months or even years (e.g. the GFC).

The simple fact is investing involves risk. That’s as true of ETFs as it is of any other investment.

What Now?

Last week I shared a story about 5 unusual ways to control investing risk. Go back and read that if you haven’t already.

As always, my belief is that all we can do is prepare for the worst and hope for the best. Invest for long-term gains but avoid being wiped out in the short term.

To do that, consider more than just one way to invest, invest in more than one type of investment (local and global shares, property, local and global bonds, etc.) and — perhaps most importantly — consider how well you are diversified in your overall financial life (e.g. are your debts paid down and is your job secure?).

If you ask me, ETFs will continue to be a great way to invest for the long run but they are not risk-free.

Here’s to preparing for the worst but hoping for the best!

Owen

[ls_content_block id=”14947″ para=”paragraphs”]

Disclosure: At the time of publishing, Owen does not have a financial interest in any of companies mentioned.