CSL Limited (ASX: CSL) is Australia’s largest (and some might say best) healthcare company, specialising in biopharmaceuticals.

Founded in the late 1900s as the Commonwealth Serum Laboratories, CSL was sold by the Australian Government to Australian investors via the share market in 1994 at $2.30 per share, at which time it doubled its size through an international acquisition.

Today, CSL is a global leader in blood plasma vaccines (think: the flu) and antivenoms, providing relief for potentially life-threatening medical conditions.

Along with the likes of Commonwealth Bank of Australia (ASX: CBA) and BHP Group Ltd (ASX: BHP), CSL shares have been some of the best-performing over the past two decades.

While the growth of all companies slows eventually, here are two reasons why CSL shares might still be worth owning.

2 Reasons CSL Shares Could Be Worth Owning

1. Financial Engineering

One way to grow a great business is to scale the operations. The best businesses can add substantial amounts of revenue or sales with the same (or less) staff and overheads. For example, software companies selling a product to a consumer don’t need to employ 10 more staff just to sell another 1,000 versions of the software.

Another — and I think, less attractive — way to grow your business is to introduce financial leverage. Basically, add low-cost debt to the business as a source of funding. This way you can boost the dividends (effectively paid by either the business’ operations or by bank debt) while also sustaining the business. The following video explains how dividends work.

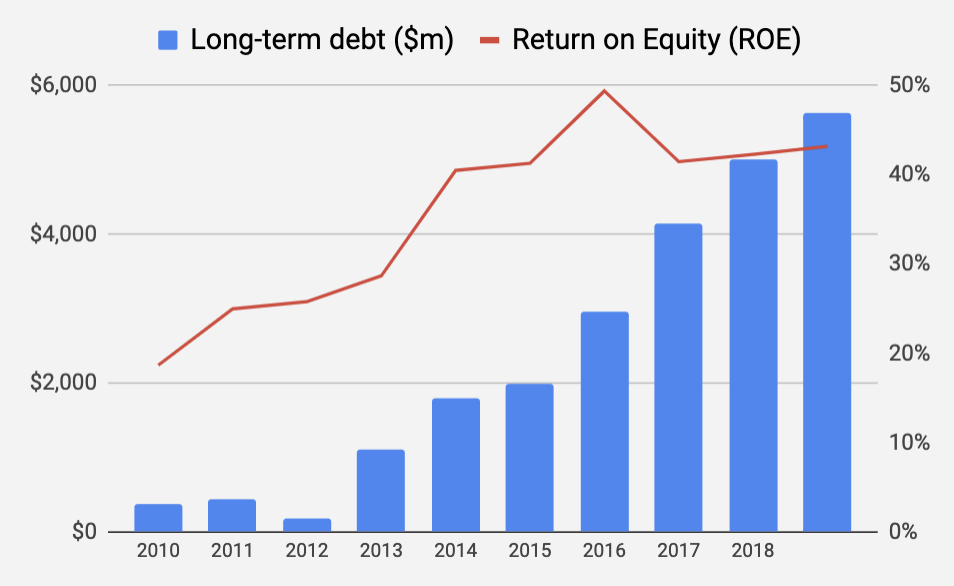

CSL has injected debt into its business which has given the impression that from a share investor perspective the business is more profitable. Meaning, return on equity does not capture how much debt is in the business. This is something most bank investors overlook when their CEOs tout how lovely their ROE was in the last half.

So long as CSL can keep chugging on debt, it should be able to keep returning excess capital to shareholders. Eventually, it’ll catch up with them and shareholders should be aware of the risk of leverage (I don’t like it). But here’s hoping that’s not for a while yet!

If you want a better way to gauge the company’s profitability than ROE, use the Return On Capital (ROC) measure.

2. Intellectual Property

CSL creates products (e.g. vaccines) that change lives or keep people alive. It’s a great business backed by some great products and research.

Basically, if you want or need CSL’s products — many of which are protected by intellectual property rights — you need to pay the company. There aren’t too many high-quality ASX blue chips with such protections around their business or services.

Buy, Hold Or Sell?

I’m not a buyer of CSL shares today but I’m also not a seller either (please note: I don’t own CSL, nor do we recommend it). However, if I did own shares from a much smaller base or a lesser price, then I’d probably just hang onto them but keep in mind that the company is using more debt to squeeze returns for shareholders.

Ultimately, it should be able to sustain some debt because it’s an extremely high quality business — and I’m not sure how much is too much for CSL. Personally though, I prefer to buy great businesses before they need to use financial leverage and even before they begin to scale operationally.

You’ll find an example of one company I own in the free investing report below.

[ls_content_block id=”18457″ para=”paragraphs”]

Disclosure: At the time of publishing, Owen does not have a financial interest in any of the companies mentioned.