The Blue Sky Alternative Access Fund Ltd (ASX: BAF) is an ASX Listed Investment Company or LIC.

Note that it is quite different to Blue Sky Alternative Investments Ltd (ASX: BLA), which was suspended from ASX trading in May. The latter is the funds management company that has dominated the news in recent times for all the wrong reasons.

A quick google news search finds many alarming issues regarding BLA. You will read about inflated AUMs, fund managers shorting the stock and questionable valuations. The founder managed to cash out near the top and in May the company went into voluntary administration.

Nearly all the headlines, however, do not relate directly to BAF (the LIC). Plenty of caution is needed still though when trusting the valuations inside of this LIC.

The LIC Can Soon Get Rid Of The Blue Sky Name

The Blue Sky LIC (BAF), is in quite a different situation to BLA. It does not rely on unsustainable funds management fee revenue to pay expensive staff and other costs to survive.

It holds a variety of “alternative” investments that are managed by the Blue Sky funds management company. Thus far in this LICs history, it has had a long term investment management agreement (IMA) to pay high management fees to Blue Sky funds management. In the event of BLA appointing a voluntary administrator or receiver, the LIC can then be freed from this IMA. Despite all the negative press about Blue Sky, this fact may turn out to be positive for the LIC.

What Does The LIC Own?

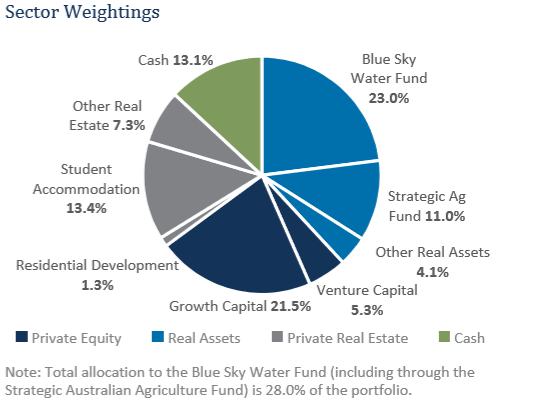

Below is a recent snapshot of the sector allocations within BAF.

The portfolio totals approximately $225 million of assets, which equates to an approximate NTA per share of $1.13. Why then did the share price fall below 66 cents in May?

Investors quite rightly have concerns over the valuations of the above assets. We are not dealing with a LIC here that is holding listed liquid securities.

Questionable Valuations?

The collapse of the BLA share price came after a highly publicised short-seller’s research piece was released around April 2018.

Fortunately, the board of directors of the LIC now has a fresh look, with new Independent directors having been added since then. There’s also been an acceleration of independent valuation reviews.

Unfortunately, this still doesn’t give me complete confidence as the value of a portfolio like this is quite subjective. Cash at least still represents a significant part of BAF’s net assets (NTA). I would be most concerned about the Growth and Venture Capital buckets shown in the chart above, this is where investments can be high risk and uncertain.

Quite a lot of the fund’s exposure is in student accommodation and other real estate, as well as water/agriculture assets.

How wrong could the valuations be?

When the shares recently plunged below 66 cents whilst the NTA was above $1.10, this represented a discount of more than 40%. For the shares to remain this low I suspect some of the above valuations need to be horribly wrong.

Those in the accelerated independent valuation process would have been fully aware of the level of publicity around Blue Sky. Hopefully, for shareholders of this LIC, that means they won’t make huge mistakes in regard to valuing certain asset types.

Management late last year reported they had interest from a buyer of their stake in the Blue Sky Water Fund. It was stated the buyer was prepared to bid at the most recent book value at that time.

The student accommodation portfolio recently received an upbeat report from management for June 30.

Who manages the portfolio in the future?

Late last year the BAF LIC received proposals from Pinnacle Investment Management (ASX: PNI) and Wilson Asset Management (WAM). They both expressed interest in taking over the management rights from Blue Sky. This year it has just been WAM that has continued with talks. The developments of the Blue Sky funds management business has complicated matters.

An announcement in May, however, notes that the board still wishes to let shareholders vote on WAM becoming the new investment manager. WAM is well regarded with a good performance record across a range of products. It has also got some of its LICs to trade at premiums to NTA.

However, this week we then learned that Blue Sky’s Real Asset business (water and agriculture funds) will now be overseen by a subsidiary of Oaktree Capital Management. This is a large component of the BAF portfolio and provides some certainty for shareholders. Does it indicate they are more confident in the valuations within this sector going forward?

This subsidiary is majority-owned by Kim Morison, who was previously managing the real assets section of the portfolio.

Can shareholders also win from a wind-up?

Another option is to wind up the BAF LIC and return capital to shareholders. Even if we apply a hefty haircut to the reported NTA, shareholders could still return far more than the current share price.

What Now?

It may well turn out that the recent fall below 70 cents a share with BAF marks a major low. Then to be followed by a sustainable rise in the share price no matter which future path the LIC takes from here.

The good buying opportunity may have passed us now with the recent climb above 80 cents. For existing shareholders though I think it may well still be worth holding for further upside from current levels.

[ls_content_block id=”14948″ para=”paragraphs”]

Disclosure: At the time of publishing, Steve Green owns shares in Blue Sky Alternatives Access Fund but does not own shares in the Blue Sky Alternatives Investments Limited.