Over the past week, month and year, the Australian dollar (AUD) has continued to fall.

Fast.

Meanwhile, the Apple Inc (NASDAQ: AAPL) stock price has continued to rise.

For Australian investors like me — and Rask members who follow my Rask Invest model portfolio — it’s been music to our ears.

Not only has Apple stock performed well but it earns

US dollars, so a stronger US dollar makes our investment from Australia even better.

Most Australian investors think investing overseas is risky because the currency can go this way and that. And that’s fair enough. I think predicting short-term moves in currencies is a mug’s game.

However, I say it’s risky to avoid overseas markets.

Why?

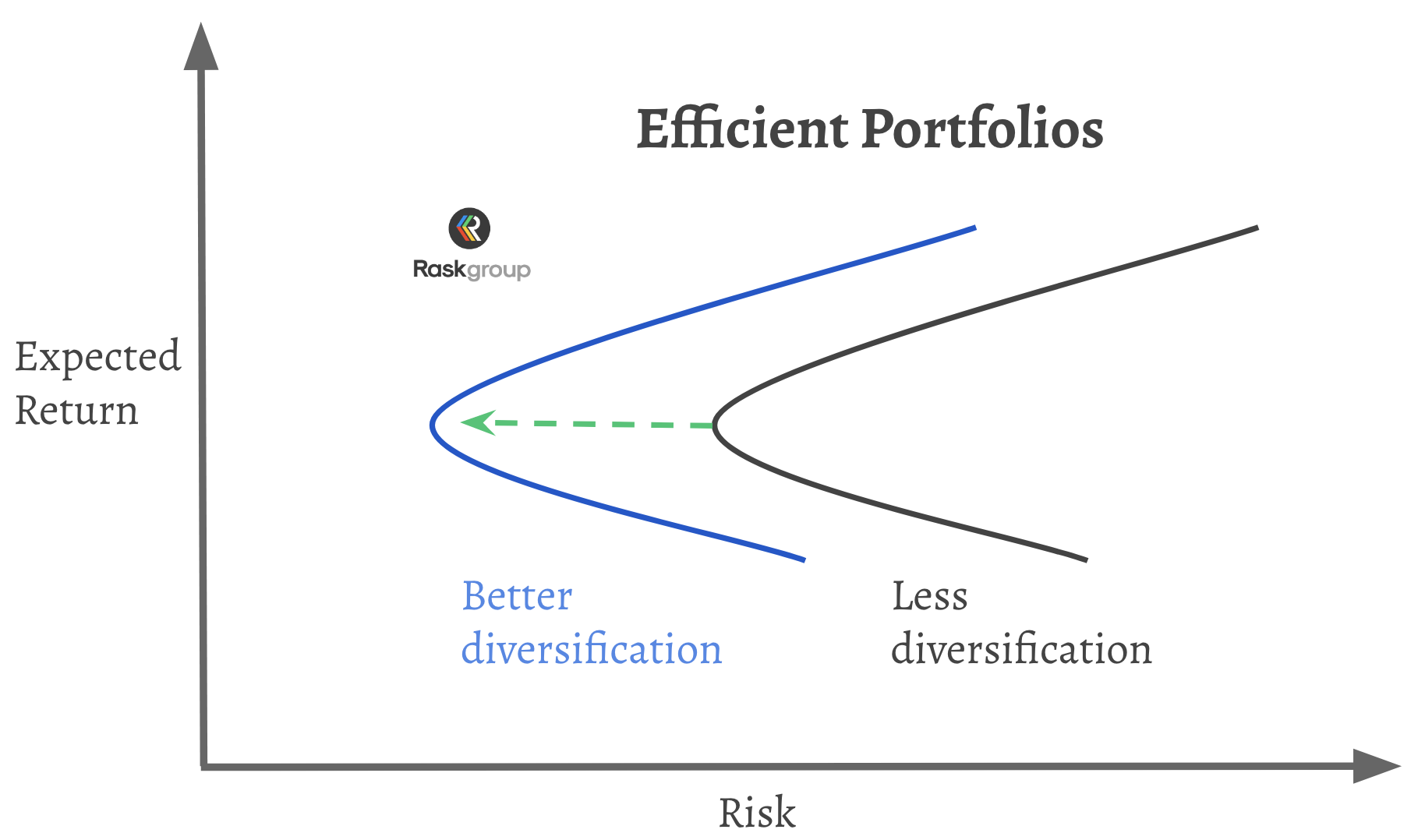

Firstly, investing globally has been shown to improve the risk-return profile of investors portfolio. In other words, it might look something like this:

For example, if you could get a 10% return from a new investment in Australia (where your existing investments are located) or the same return from an investment overseas, you should consider the overseas option. Why? Because you’re getting the same return but the risks associated with putting ‘all of your eggs in one Australian basket’ will be reduced. In simple terms, same return with a better risk profile. Click here to listen to our podcast episode on diversification:

The second reason to invest in global companies is that around 97% of the world’s stocks are found outside Australia. Put another way, there are 30-times more opportunities outside the ASX.

The Apple That Keeps On Giving

Over the past year, I’ve written in this column before saying why I like — and currently own — Apple shares.

Between the regular dividends, currency changes and share prices (converted into Aussie dollars), our position in Apple has returned more than 20% — beating our international benchmark by 10%.

Now I know what you’re thinking…

While it sounds good to talk about positive past performance, we all know it’s not a reliable indicator of future performance.

So how do we think Apple shares might fair going forward and — the important question — are they still a Buy inside Rask Invest? Let’s take a brief look at the recent results…

Apple Beats

No, I’m not talking about Apple’s Beats headphones.

Overnight, Apple beat analysts’ quarterly profit forecasts and the shares are now expected to trade sharply higher when they return to trading in the US.

Firstly, it’s worth noting that Apple did not grow its revenue year-over-year in the third quarter because iPhone sales fell. That sounds pretty ominous, right? Please keep reading…

For years ‘peak iPhone sales’ is what the media and analysts fixated on as if no-one could see that coming or read the financial statements.

Indeed, if you ask me sales of Hardware (iPhone, Mac, iPad, etc.) drove Apple’s growth over the past decade or two but it’s Services (think: iTunes, App Store, iCloud, etc.) that will drive its next wave of growth.

Remember, we invest looking through the windshield, not the rear-view mirror. Here’s what I wrote to Rask Invest members early this morning:

“My position — Owen here — has always been that Apple’s transition to more Services revenue could be a lumpy one for shareholders to digest and today’s result was no exception.

However, as I have emphasised time and again to Rask Invest members, if Apple can execute on its vision to double Services revenue in coming years (relative to the 2016 financial year) it’ll be worth the occasional sinking feeling in our stomachs.

To wrap some numbers around this belief, during the quarter around 64 cents of every $1 earned in Services revenue dripped through the cost of sales line item. By contrast, for Products/Hardware, 30 cents of revenue makes it past the unavoidable costs (e.g. manufacturing, overheads, contractors, etc.).

In other words, right now $1 generated by the Apple Services business is more than twice as valuable as the sales generated from selling ‘products’. And let’s consider for a moment that this is before Apple turns the screw on prices and while it continues to incur high fixed costs relative to earnings (think adding servers, marketing, engineering, etc.) for a long-term return…

Myopic or near-sighted analysts, the media and investors are focused on the ‘peak in iPhone sales’ when what they really should be focused on is the huge and expected growth in the margin-thick Services revenue.”

Such is the nature of investment markets that what’s comfortable is almost never profitable. And investing in great businesses is best done over years, not months or quarters. They need time to compound. So if you like certainty or you’re eager for a quick buck, I wouldn’t consider Apple shares (or investing in shares).

Are Apple Shares Still A Buy?

Again, here’s what I told Rask Invest members this morning:

“Of course, risks remain in the form of a potential regulatory clampdown on its uber-profitable App Store, a break-up of services businesses from hardware, the China-USA trade war and more. But all things considered, for now, I’m very happy to keep Apple shares as a Buy for Rask Invest.

Tell me where else I can find a dividend-paying wide-moat US dollar-earner that I can buy for ~15x cash-adjusted profit and I’ll add it to my list.”

I encourage you to compare Apple to any technology or competitively-advantaged stock in your portfolio. I think you’ll find that Apple shares are surprisingly cheap on a cash-adjusted P/E ratio of 15x. And this is before we factor in meaningful revenue from Services like Apple Pay, Apple Cart (launching next month), iCloud, and Wearables.

Fun fact: 75% of people who buy an Apple Watch are buying one for the first time.

For me, what’s great to know is that Apple is yet another one of our ideas that have made a market-beating return since it was released to Rask Invest members.

And chances are, as you read this, I’m getting into the weeds and researching more ideas that will be sent exclusively to our members.

[ls_content_block id=”18457″ para=”paragraphs”]

Disclosure: At the time of publishing, Owen owns shares of Apple.