I couldn’t believe my eyes as the Pro Medicus Limited (ASX: PME) share price charged to more than $29 today.

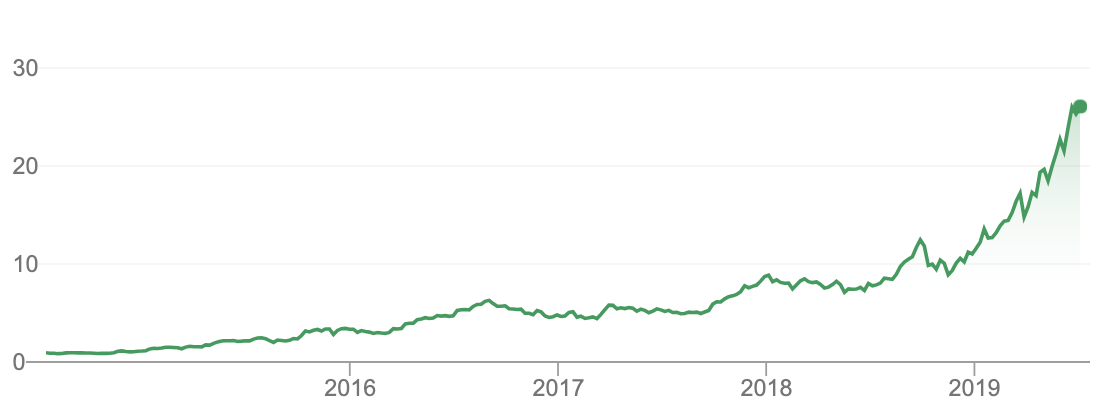

Over the past year, the Pro Medicus share price has risen from less than $8. We recommended it for Rask Invest below $8. Here’s the five-year chart of Pro Medicus shares:

What Does Pro Medicus Do?

https://youtu.be/0SWl9xBsRNw

As I explain in the presentation above (filmed way back in 2018), Pro Medicus is a Melbourne-headquarted radiology software developer with offices in the USA and Europe (Germany). The business is broken into two primary products.

The first product, and arguably less impressive of the two, is the Radiology Information System or Visage ‘RIS’. RIS is an all-in-one radiology practice software package handling everything from appointments to client files.

The second product is more commonly known as Visage and includes Visage Ease (for mobile) and Visage 7 (for hospitals). What does it do? Imagine being able to send a huge medical image (X-Ray, CT, etc.) from a hospital to a radiologist’s iPhone… in seconds. The radiologist can inspect the image to diagnose the patient.

Impressive image rendering and processing is just the start of what Visage offers some of the world’s leading hospitals and their doctors. Visage is currently being rolled out at prestigious institutions across the USA.

Sounds Good, Right?

Pro Medicus was the first ASX company we tipped for our Rask Invest service because its offering is first class, disruptive, capital light, sticky and recurring. It’s pretty much everything an investor could hope for in a company’s product.

Looking at the company as a whole and Pro Medicus has a strong balance sheet and exceptional cash flow. Its management team is talented, passionate and very well aligned with a huge ownership stake in the company they run.

Finally, the addressable market opportunity keeps you licking your lips. Improvements in imaging software, cloud-based infrastructure and favourable regulatory change keep pushing Pro Medicus further into a market worth as much as $US2 billion per year. Then there are many other lucrative verticals.

What’s Wrong With Pro Medicus shares?

A little thing called valuation.

I’m definitely not the only one who thinks the current share price, which implies a forward price-earnings ratio of 170 times, is a little bonkers.

Sure, you might argue ‘if Pro Medicus captures 50% of the market, its current $3 billion market capitalisation looks cheap’.

However, consider that such a momentous achievement is likely still years away and it faces some intense competition. Ultimately, it may never happen. For context in May 2019, Pro Medicus said it had $160 million of revenue to be earned over the next five years, assuming key contracts were renewed.

What Now?

Having bought shares for the Rask Invest model portfolio below $8 per share, we’re happy to be holding some Pro Medicus shares with a view to the long run (5+ years). However, I’d be very — very — cautious about buying at current levels because the valuation appears extremely stretched to me.

To give you a sense of where I’d start to be tempted, all things being equal, I’d consider adding more Pro Medicus shares to my portfolio if they were closer to $10. This is not me trying to predict or ‘time the market’ per se — they may never get to such a valuation — it’s more-so just a rational observation that patience won’t lose me money.

We’ve provided our original Rask Invest analysis of Pro Medicus free and in full — click here if you want to access it.

[ls_content_block id=”18457″ para=”paragraphs”]

Important Disclosure: At the time of publishing, Owen Raszkiewicz owns shares of Pro Medicus. Pro Medicus shares have a ‘Hold’ rating inside Rask Invest.