The RBA says that home loan arrears are rising and this is an important issue.

The Reserve Bank of Australia is Australia’s central bank. One of its biggest roles is to decide Australia’s interest rate, taking into account economic conditions including unemployment, inflation and the housing market. The RBA interest rate has a ripple effect across the whole economy.

RBA On Home Loan Arrears

The RBA’s Head of Financial Stability Department, Jonathan Kearns, gave a speech to the Property Leaders’ Summit in Canberra today.

He pointed out that rising house loan arrears are important on several fronts. It points to rising risk in the financial system because housing loans are 40% of banks’ assets and falling house prices could lead to increasing losses in the loan is higher than the property value.

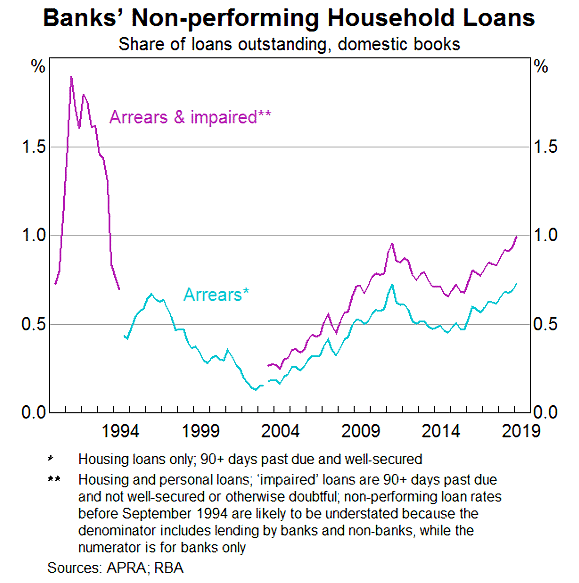

The below graph shows how arrears have been steadily rising since 2014.

Obviously we don’t want an Australian repeat of the GFC where banks have many loans go underwater because that could lead to a market crash.

Whilst Mr Kearns acknowledged that there will always be some people falling into arrears due to becoming unemployed, a relationship breakdown and so on, it is weak economic conditions that can lead to income falls and the rising arrears.

Should We Worry?

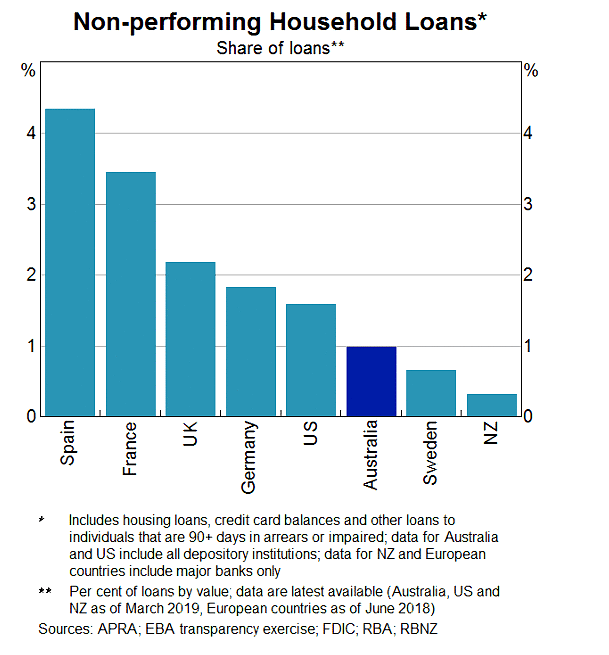

Australia’s non-performing home loans are still much lower than many other European countries as well as the US, as we can see on the graph below.

One of the main points that Mr Kearns made in his speech is that bank lending standards can have an important impact on arrears. If lending standards are good then the borrower should be able to cope even in a downturn. However, if lending standards haven’t been good then if prices stop rising it can lead to rising arrears, which is what we’re seeing now.

That’s why it’s important that National Australia Bank Ltd (ASX: NAB), Australia and New Zealand Banking Group (ASX: ANZ), Westpac Banking Corp (ASX: WBC) and Commonwealth Bank of Australia (ASX: CBA) all maintain a high level of lending standards throughout the entire economic cycle.

But he also pointed out that banks recently increased interest rates on interest-only loans which would have made it harder to afford and these borrowers also seem to have difficulty rolling onto another interest only loan because of the higher lending standards.

RBA Conclusion

To conclude, Mr Kearns said: “Summing up, housing arrears have risen but by no means to a level that poses a risk to financial stability. Several factors have been interacting to drive the rise in housing arrears. Economic conditions are undoubtedly part of the story.

“Weak income growth, housing price falls and rising unemployment in some areas have all contributed. But they have not acted alone, interacting with earlier weaker lending standards, and the more recent tightening in lending standards.”

Therefore, he seems to be saying that as long as the situation does not continue to deteriorate then Australian can cope with the current economic climate. But if it doesn’t? Well, I’d want to make sure that a good portion of my portfolio was full of reliable ASX shares like the ones in the free report below.

[ls_content_block id=”14945″ para=”paragraphs”]

[ls_content_block id=”18380″ para=”paragraphs”]