Is the Templeton Global Growth Fund Ltd (ASX: TGG) value investing style about to outperform? That’s the questions on investors’ minds in 2019.

Whether an investor is classified as having a “growth” or “value” investing style is often debatable. Warren Buffett has said that the two investing approaches are “joined at the hip”. With that being said, however, many investors associate a value investing approach with certain quantitative metrics. That could involve, for example, searching for companies with a low price to book or price to earnings ratio.

Templeton Global Growth Fund’s Value Investing Style

Templeton Global Growth Fund is renowned for sticking with a rigid value investing approach in terms of the valuation metrics I just mentioned. Despite the “growth” description in this LIC’s name, TGG likes to highlight various valuation measures of its portfolio. On metrics such as price to earnings, cash flow and book value, its portfolio appears far cheaper compared with the MSCI World Index.

Portfolios that were positioned this way just prior to the year 2000 enjoyed a great decade afterwards of relative outperformance. I can recall at the time many investors were asking if value investing was dead. This topic has also been heavily debated in recent times. If you are considering investing in TGG I think it is worthwhile considering where you stand on this debate before buying in.

Why Value Investing May Be Dead

Having a strong bias to low P/E or P/B shares over the last decade has kept plenty of investors out of great performers such as Facebook (NASDAQ: FB) and Google/Alphabet

(NASDAQ: GOOGL). They don’t hold so much in the way of tangible fixed assets such as physical property and equipment.

They also haven’t looked so cheap if one only looks at the prior year’s earnings numbers. Their value has been investing for growth in earnings well into the future. Value also lies within their powerful network effect rather than more quantifiable fixed assets on the balance sheet.

The value investing approach may also be suffering because over time active fund managers have exploited all the obvious opportunities. Too many were trying to do it, and all the easy outperformance may have been eaten away. Technology has made it easier now for fund managers to conduct stock screens and identify shares in which clear value exists.

Some investors believe global central banks have also provided so much liquidity over the last decade and this is structurally leading to a bias for growth shares.

Why Value Investing Still Works

A quote by Sir John Templeton, one of the most famous investors of all time, sums up why value investing may be due for a comeback: “The four most dangerous words in investing are this time it’s different”. Are these four words being used now write-off the value investing style?

As I mentioned above the current negative sentiment towards value investing strategies does feel a little bit like 1999. Older investors might also remember the “Nifty Fifty” boom that came to an end in the 1970s. Investors were fixated with around 50 or so larger stocks that had such fantastic growth prospects. This supposedly meant you could pay extremely high multiples of profit and hold for the long term and everything would work out okay. This did not end well when the bear market of 1973/74 hit.

Another argument might be that the surge in passive investing and Exchange Traded Funds (ETFs) over the last decade has created abnormally high valuations in the better-performing shares. Money that flows into passive ETFs will invest more into the leading companies in the regardless of valuations. This trend could easily reverse sharply in a bear market.

TGG’s Low Expenses

Back to TGG, it has greatly improved its corporate governance and fee structure in recent years. In 2016, there was a strong vote against the remuneration report after some dissatisfaction with regular capital raisings. Now the company is adding value to the NTA by regularly buying back shares on-market at a discount.

TGG’s fees have actually been lowered from the early days, which is rare to see. There is a 1% base management fee and no performance fees with TGG. Other costs are fairly lean as the LIC has quite a bit of scale with a healthy portfolio size of around $300 million.

Relative Performance Numbers Need to Turnaround

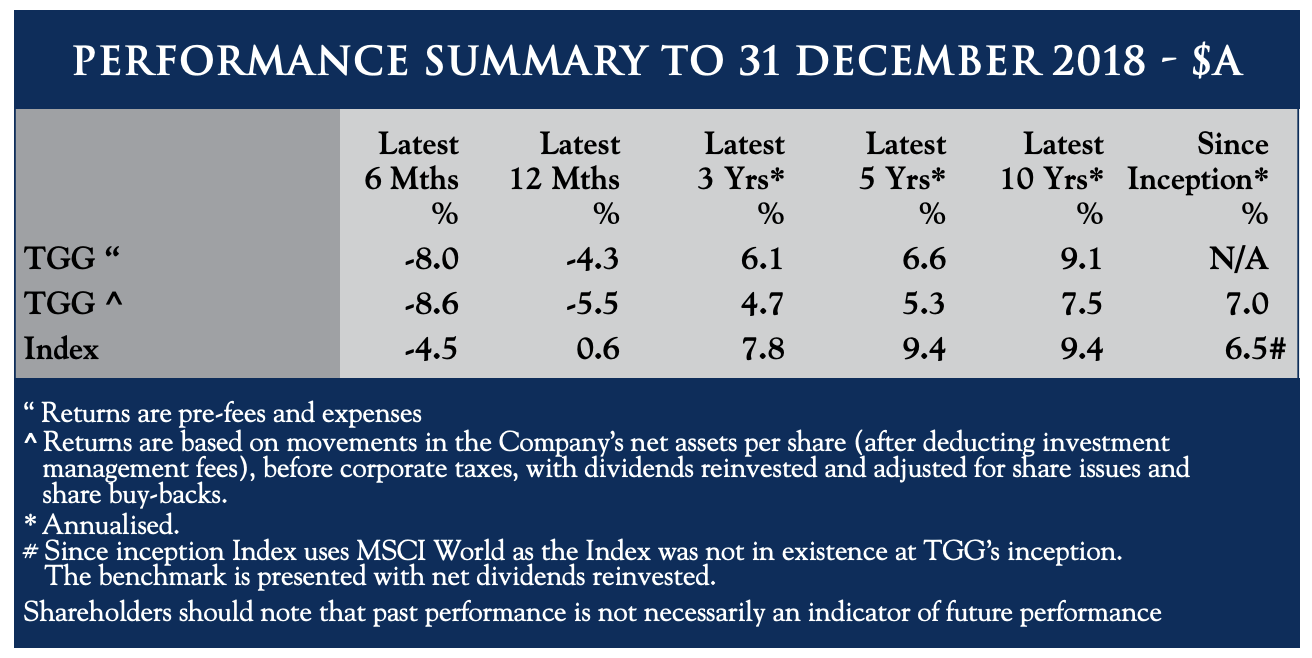

You wouldn’t invest in TGG if you extrapolated performance figures from the last decade into the future. Here is how they presented their performance numbers in the latest half-year report:

TGG is more likely to attract investors who believe that the performance of value versus growth investing often fluctuates over very long term cycles.

Buy, Hold or Sell

If you think value investing could be about to outperform, TGG is a suitable LIC to consider because its fee structure is lower than many of its competitors and it pays dividends annually worth 3% of the pre-tax NTA.

However, if the fund doesn’t improve its relative performance over the next few years its future could be in question. That could limit some of the downside associated with the discount to NTA widening — if a decision was made to return capital to investors.

[ls_content_block id=”14945″ para=”paragraphs”]

Disclosure: At the time of publishing, Steve Green owns shares in Templeton Global Growth Fund Limited.