Warren Buffett and Charlie Munger’s four-part investing checklist goes as follows… they buy shares in businesses:

- They can understand

- Which are run by people with integrity and talent

- That has a competitive advantage (aka a “moat”), and

- Can be purchased for a reasonable price

So far, readers of our free Investor Club email have stepped through 3 of the 4 requirements — but in reverse order.

For those of you who have been reading and watching our content for a while, you will know that I produced a free video series on investment valuation; then we discovered how competitive advantages and moats can play a big part in investing success; and, why it is vital to invest with and alongside great CEOs and managers (I even showed you exactly what I look for).

So what’s left from Buffett and Munger’s checklist?

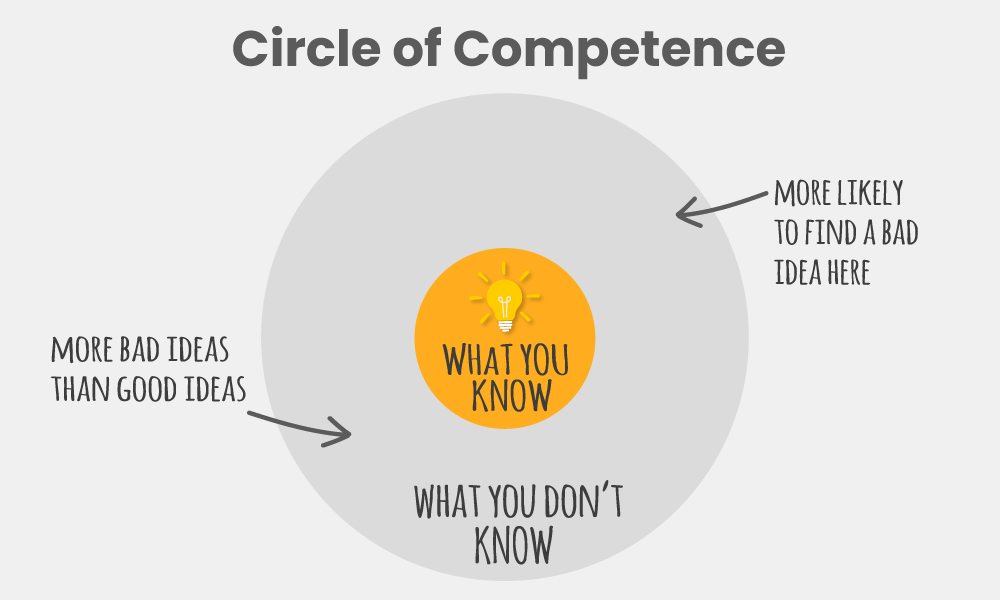

The Circle of Competence

If you have read anything from the great investors you will know that they often talk about this thing called a ‘circle of competence‘.

Believe me, I know, it sounds like a test you did in fifth grade after your teacher saw you eating purple crayons.

My teacher would have said, “To be quite honest, Mrs Raszkiewicz, I was concerned before Owen put the crayon up his nose.”

All jokes aside, a circle of competence is just another phrase for being self-aware. It’s knowing what you do and do not understand. It’s about not being afraid to say “I don’t know”.

As I’ve mentioned before, everyone has a different set of skills and experience which can give him or her an ‘edge’ in business and investing.

For example, a mechanic might be better at understanding the car parts industry than me.

And a doctor would know how to interpret clinical trial results better than a taxi driver.

I believe knowing what your skills are — and are not — is one of the secrets to investing successfully.

Just imagine if an investment you own falls 10%, 30% or even 60% in price.

If you don’t understand what the company does and why you bought it, you will have no idea if the share price fall is justified, or if it is a buying opportunity.

Ultimately, before you invest, understanding your circle of competence is a trick to help you avoid doing something dumb in the future. For example, buying Bitcoin at $US20k (too soon?).

So how do we stop ourselves from doing something silly?

The ‘Better Half’ Investing Test

I’ve found one of the easiest ways to test my own knowledge and make better financial decisions is to speak to someone.

Not just anyone — my wife.

She’s my BS filter.

Me: “I would like to buy shares in an African gold miner that also does biotechnology.”

Wife: “Hmm, let’s see. No!“

She’s not a finance person but she knows me. And — most importantly — she will tell me if the Emperor (me) has no clothes on.

She’ll tell me straight.

My better half: “I don’t care how charismatic the CEO was, we’re not buying part of a business we don’t understand.”

It’s safe to say, she’s helped me dodge many bad investment ideas.

How It Works

I’ve developed a little investing/money checklist to take to my wife each time I want to make an investment.

She will ask me the following questions and I must answer them without batting an eyelid.

In order:

- What does the company do?

- How does it make money?

- Why will it go wrong?

- Who are the competitors?

- Why is now the time to buy?

They might sound like simple questions to you and me.

But I continue to be surprised at just how many investors couldn’t answer those questions without saying “umm” or “argh” at the beginning of each sentence.

My ‘Better Half’ investing checklist is similar to Peter Lynch’s famous ‘fifth-grader test’.

“If you’re prepared to invest in a company, then you ought to be able to explain why in simple language that a fifth grader could understand, and quickly enough so the fifth grader won’t get bored.” – Peter Lynch

But before you think that I’m regressing back to chucking crayons up my schnozz, you should know that my ‘Better Half’ checklist goes a lot deeper than primary school shenanigans.

Why It Can Work

Explaining your thoughts to someone else is very, very powerful.

Not only does it challenge your logic, educating someone is known to be an effective way to supercharge your own learning.

It’s called the Feynman Technique, named after the Nobel Prize-winning physicist Richard Feynman.

“The first principle is that you must not fool yourself and you are the easiest person to fool.” – Feynman

If you’ve ever found yourself explaining something to someone only to find out that you are the one discovering a new way to think about the idea — that’s what the Feynman technique exposes.

It’s a powerful technique and applies incredibly well to my investing process.

Firstly, do the research on the investment.

Second, educate someone else about it.

Next, identify gaps in your knowledge and go back to researching.

Finally, review and simplify.

Summary

Repeat the Better Half investing checklist until you and your significant other are satisfied with your answers. Over time you’ll find that your circle of competence grows wider and your investing ideas drift inwards towards your core competencies.

Inside your circle of competence is where the good ideas are found — it’s where you have an ‘edge’ over other investors.

Indeed, by using this strategy an investor will pass up ‘the next hot thing’ (that they don’t understand) and stick with tried and tested investments they can explain.

In other words, they’ll avoid many more bad investment ideas and focus on the few that fit within their circle of competence.

Staying within your circle of competence is a key to surviving in investing over many years. If you have ever heard someone say, “shares are like gambling” it’s because they didn’t understand what they were doing and (most likely) lost money.

Bringing It All Together

If we can stick within our circle of competence and apply the ideas on moats, valuation, and identifying people with integrity, energy and talent, I would hope that we’ll all be on our way to achieving better results over the long run.

Cheers to our financial futures!

Owen Raszkiewicz

Twitter: @owenrask

[ls_content_block id=”14945″ para=”paragraphs”]