Yesterday the BHP Group Ltd (ASX: BHP) share price dropped 4% after shares in the mining powerhouse went ‘ex-dividend’.

BHP is a world-leading resources company, extracting and processing minerals (like iron ore and copper), oil and gas, and has more than 62,000 employees and contractors, primarily in Australia and the Americas. BHP has shares listed on both the ASX and London Stock Exchange as BHP Billiton Plc (LON: BLT).

Why Did BHP Shares Fall on Thursday?

As we detailed in this article, “Is BHP A Buy For Dividend Income“, when shares go ‘ex-dividend’, it means they no longer include the right to receive the most recently announced dividends. BHP will pay $US1.02 per share in dividends to its shareholders who owned shares before the ex-dividend date.

With the miner announcing a big special dividend following the sale of its US oil and gas business, investors are left questioning if there are more juicy dividends in store.

We recently took a look at BHP’s balance sheet in this article and suggested a good value to pay for its shares, based on its dividend payments. Now let’s take a look at what analysts and other investors expect the miner to do.

BHP Dividends Rising

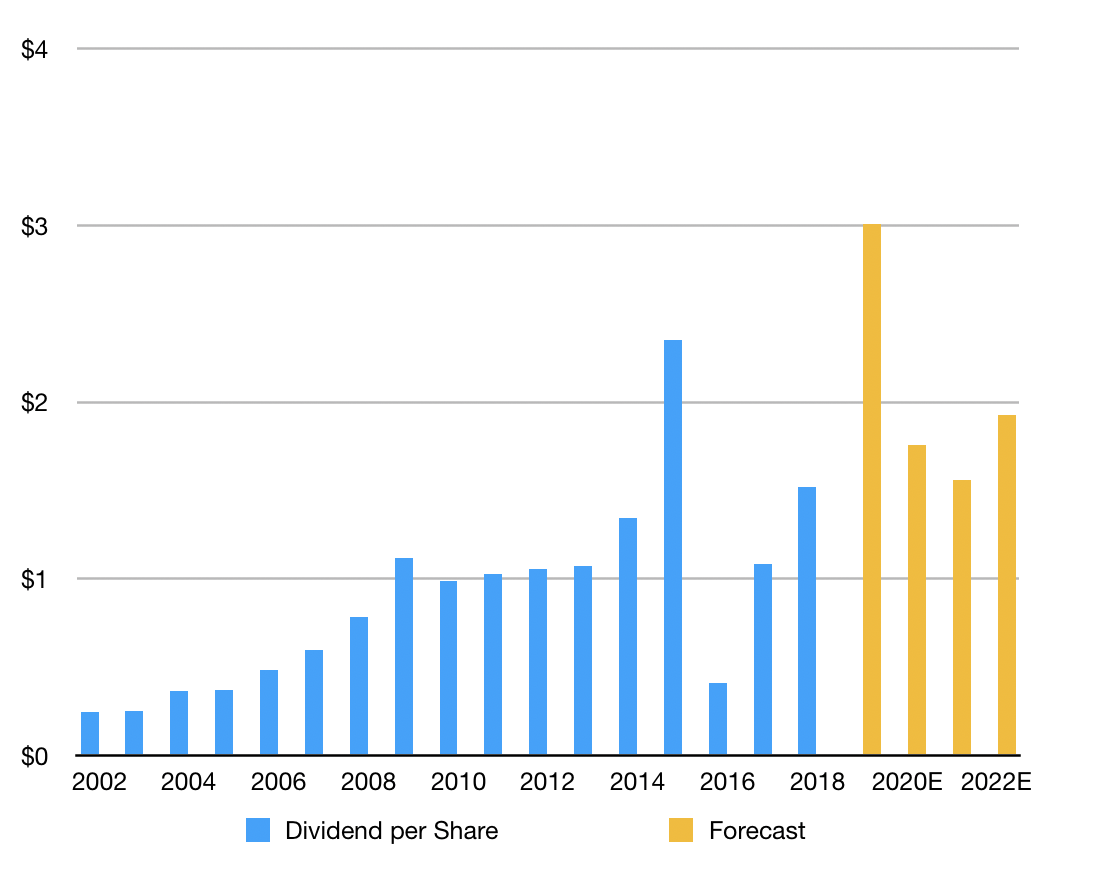

Data source: Sentieo

As you can see above, BHP’s dividend track record is superb. There was one year (2016) when its payments were cut. This happened because the prices of oil, iron ore, coal and aluminium were being beaten down.

Looking ahead, analysts expect plenty more meaty dividends from BHP, as you can see in the yellow part of the graph above.

Based on a 2020 forecast dividend payment of $1.76 — which appears lower than 2019 because it excludes the effects of special dividend payments — BHP shares yield 5.3% fully franked. Click here to learn what franking means.

Under The Hood

Drooling over what analysts are forecasting is one thing, popping the hood and seeing the moving parts is another. It’s often overwhelming at first and it can be quite confusing.

Indeed, while on the surface BHP hints at having a durable moat or competitive advantage given its wide profit margins, I find it very difficult to forecast BHP’s business with sufficient certainty.

Of course, as we know BHP makes money by digging up and selling essential materials which move the world forward. These commodities are not easy to locate nor extract at an efficient cost, which is why most medium and small miners have terrible economics and go out of business when commodity prices fall.

BHP produces iron ore and coal for steelmaking; coal for energy; aluminium for cars, cans and alloys; and copper and minerals for electrical networks and everyday technologies. These things all seem fairly straightforward, right. I mean, everyone needs to drive on roads and live in solid houses, right?

It’s not until we (pardon the pun) dig a little deeper that we begin to realise understanding the global demand and supply for BHP’s commodities is incredibly difficult. Sure, BHP won’t go bust overnight — unlike some miners — but given the laws of supply and demand, can we predict BHP’s profit margins and cash flow with accuracy in one, two or five years?

On the demand side of the market, the elephant in the room is China:

- Is its apartment binge finally coming to an end?

- Will a rough transition to a consumer-led economy (rather than one being driven by infrastructure spending) hurt BHP’s operations? It would definitely hurt a business like Fortescue Metals Group (ASX: FMG).

These are questions I cannot answer with respectable certainty. I could try to answer them but it would be too much guesswork, even for me.

And to be more candid, I highly doubt many of the analysts who are forecasting BHP’s revenue to rise from $56 billion today to over $66 billion by 2023 really know what’s going on either.

You: “Is that just a cop-out?”

Of course, we invest in the face of uncertainty — not in its absence. And uncertainty or risk is the reason sharemarket investors become richer over many years relative to folks who prefer the safety of bonds or term deposits.

So maybe I’m being a little harsh? Maybe India, a country many forecasters believe could be primed to go through a massive transformation, will pick up the slack on demand? Maybe the recent commodity price falls put many of the weaker miners out of business, hence the higher prices?

So Is It Time To Buy BHP?

I’ve said it before but BHP is well outside of my circle of competence as an investor. It’s not so much that I couldn’t understand the business well enough to have a small allocation. It’s more-so about asking myself why I would invest in a company that I’m not 100% comfortable owning?

As I recently noted, while not risk-free by any stretch, shares in some Aussie bank shares like National Australia Bank Ltd (ASX: NAB) sport dividend yields north of 8%.

And even though I wouldn’t be surprised to see Telstra Corp (ASX: TLS) trim its dividend in time, I might be more comfortable owning the telco for dividend income — relative to BHP at least. Finally, a growth business like CSL Ltd (ASX: CSL) might be a better option for the long run.

Ultimately, BHP is probably the best mining stock on the ASX for reliable dividend income, but with nearly 200 exchange traded funds (ETFs) on the ASX, thousands of other shares on the ASX and internationally, there are other dividend + growth investments I’d prefer to make before BHP — 3 of which can be found in the free investing report below.

[ls_content_block id=”14945″ para=”paragraphs”]