According to some analysts, Telstra Corporation Ltd (ASX: TLS) shareholders could see their dividends cut in 2019.

Telstra – (was) A Dividend Stalwart?

Since selling its shares to ASX investors in the late ’90s, Telstra’s nationwide 100-year-old copper cable network and ducts system gave it a strong competitive advantage against rivals like Optus, which had to pay to access Telstra’s phone lines.

This defensive ‘moat’, which was gifted to Telstra shareholders by the Government when it privatised, ultimately enabled the telco to earn reliable streams of cashflow to support its dividend.

Moat No More?

With the rollout of the National Broadband Network (NBN), owned by the NBN Co, Telstra no longer owns ‘the digital rails’ that connect Australians to broadband/fibre internet. Instead, like the other retailers, it is now more akin to a simple ‘carriage’ which rides on the backbone network.

As a result of this transition, Telstra’s crown jewel will continue to be its wireless/mobile network.

As of this year, Telstra provides more than 17 million retail mobile services, nearly 5 million retail fixed voice services (e.g. home phones) and 3.6 million broadband services. It is most dominant in mobiles.

However, while Telstra earns generous and consistent profit margins on its mobile plans, it is facing stiff competition from the likes of TPG Telecom Ltd (ASX: TPM), Vodafone Australia or Hutchison Telecommunications Ltd (ASX: HTA), Optus and Vocus Group Ltd (ASX: VOC). Therefore, it must compete on price to maintain its leading position.

And against a backdrop of rising capital expenditure costs to develop new networks, capable of handling the surge in data, the high costs of developing new mobile capabilities may not bode well for outsized shareholder returns. In my view, profit margins could be expected to fall.

Dividend Cut?

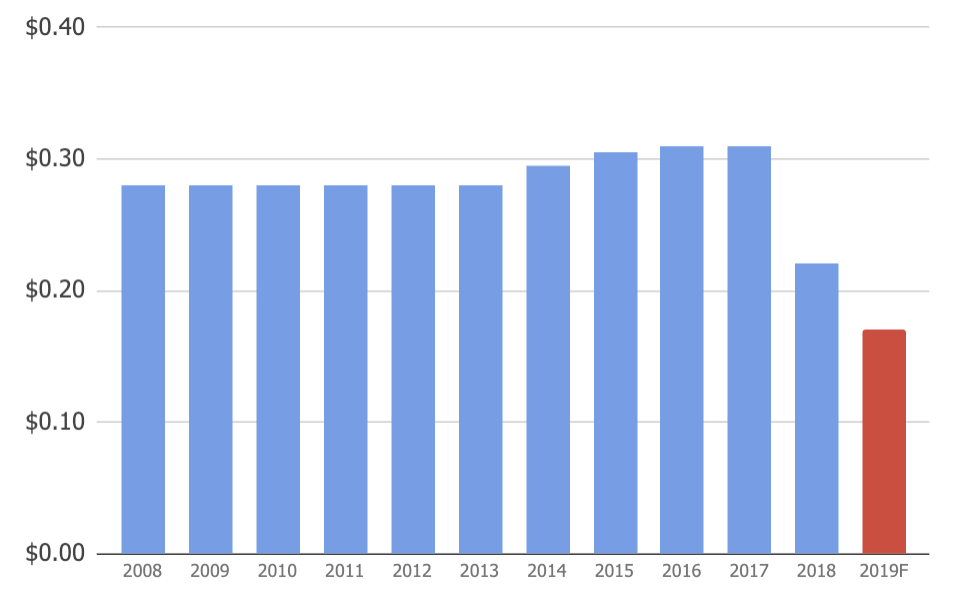

As can be seen above, Telstra has trimmed its ordinary dividend in recent years. According to data from Morningstar, analysts are currently predicting dividends for 2019 in the 15-20 cents per share range.

While it’s little consolation for current shareholders, even at a conservative forecast of 15 cents per share, the recent fall in Telstra’s share price means the estimated dividend yield is around 5.4% — fully franked, for now. That’s a handy return in a low interest rate environment.

Buy, Hold or Sell

I’m not buying Telstra shares at this time or price. As I outlined here, it’s not because they are overvalued but simply because I believe there are far better opportunities for investors who care about making better-than-average returns over the long run.

Put another way, Telstra could execute on its T22 plan, pay down debt and return excess cash to shareholders via dividends — while fending off the intense competition — but I’m not convinced it’s worth the bet.

If you’re stuck for ideas in 2019, I recently unearthed 2 fast-growing ASX small caps that are at the top of my 2019 watchlist…

[ls_content_block id=”14947″ para=”paragraphs”]