Bank shares such as Westpac Banking Corp (ASX: WBC) and Macquarie Group Ltd (ASX: MQG) helped the ALL ORDINARIES (INDEXASX: XAO)(ASX: XAO) index finish higher on Friday.

All Ordinaries: up 0.5% at 6,229.8 points

ASX 200: up 0.5% at 6,121 points

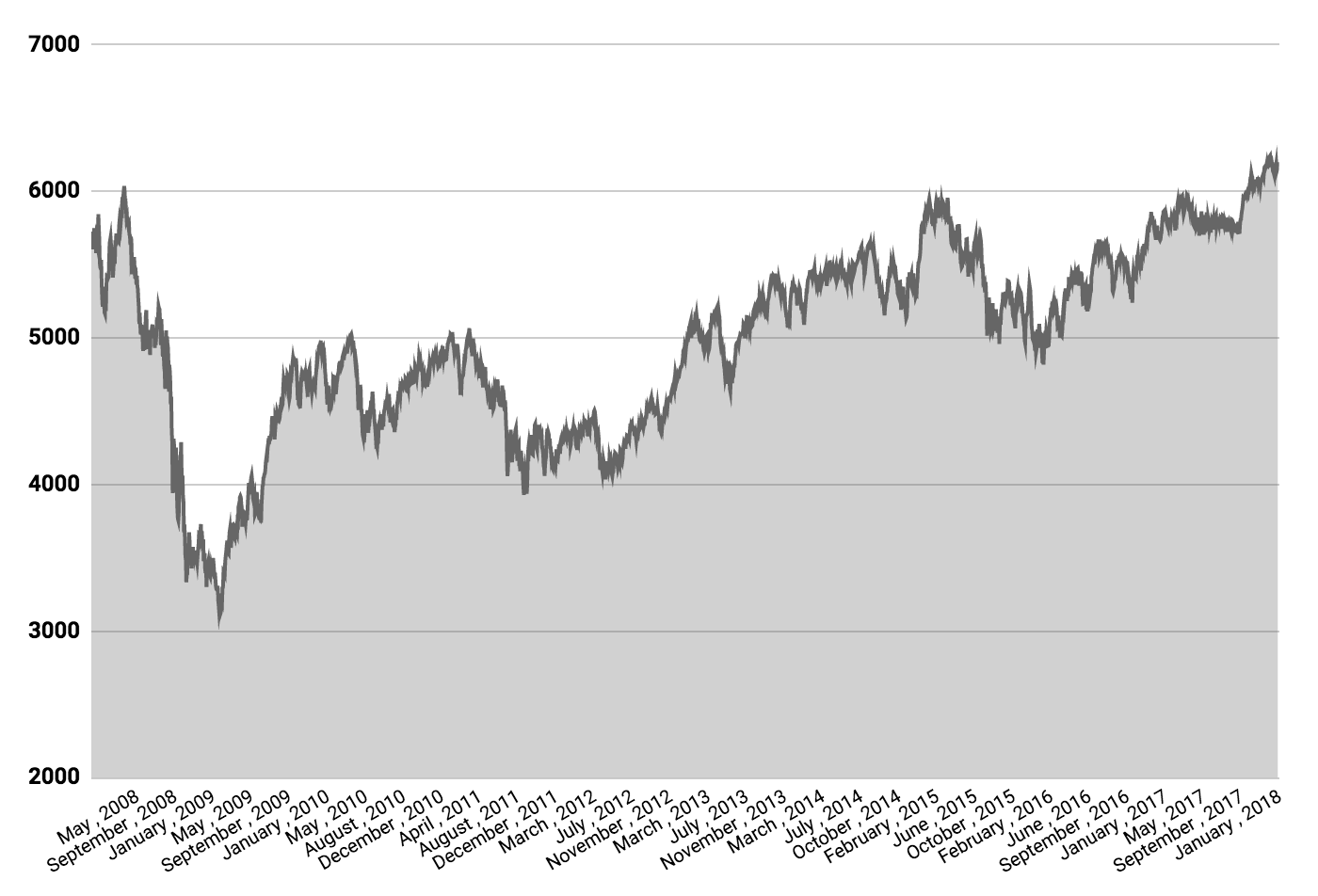

At today’s prices, the Aussie share market is less than 1% away from its 10-year high.

All Ords

Here are the shares which moved the market today.

Biggest Gainers

- Nextdc Ltd (ASX: NXT) – up 9.8%

- Vocus Group Ltd (ASX: VOC) – up 4.5%

- James Hardie Industries plc (ASX: JHX) – up 6.8%

Biggest Losers

- Medibank Private Ltd (ASX: MPL) – down 3.3%

- Galaxy Resources Ltd (ASX: GXY) – down 5.6%

- Xero Limited (ASX: XRO) – down 3.7%

Shares of the Big Four banks ended firmly higher today, with Westpac and Macquarie climbing 0.9% and 1.2%, respectively, despite no news being released.

Shares of data centre operator Nextdc was the ASX’s top performer despite no material news being released by the tech company. However, News Corp reports that Nextdc could be a takeover target of US-based private equity fund, Blackstone.

Shares of building products company James Hardie Industries jumped following the release of its third-quarter report. For its financial year to date, James Hardie Industries reported net sales up 7% at US$1.53 billion and a net profit of $US203.7 million, down 12%. Read more here.

Vocus Group, the owner of Dodo, Primus and other telecommunications brands, jumped following the appointment of Julie Fahey as Non-Executive Director. Ms Fahey has leadership experience from KPMG and previously held high-level positions at Holden and SAP Australia.

Finally, Commonwealth Bank of Australia (ASX: CBA) shares ended the week marginally higher following the appointment of Matt Comyn as its new CEO.

Want To Join An Investor Club Newsletter?

You can join Rask’s FREE investor’s club newsletter today for all of the latest analysis and education on investing. Join today – it doesn’t cost a thing.

Keep Reading

- The Best Investors Are Dead or Female

- Why Is Xero Teaming Up With NAB?

- Telstra Gets Slapped With $273m Charged

Disclaimer: This article contains general information only. It is no substitute for licenced financial advice and should not be relied upon. By using our website you agree to our Disclaimer & Terms of Use and Privacy Policy.