Telstra Corporation Ltd (ASX: TLS) shares barely budged an inch on Friday despite announcing a $273 million impairment charge.

Telstra is Australia’s largest telecommunications company, with 17.4 million mobile customers and 3.5 million broadband services. The $42 billion Telstra also owns part of Foxtel, Belong and other small technology companies.

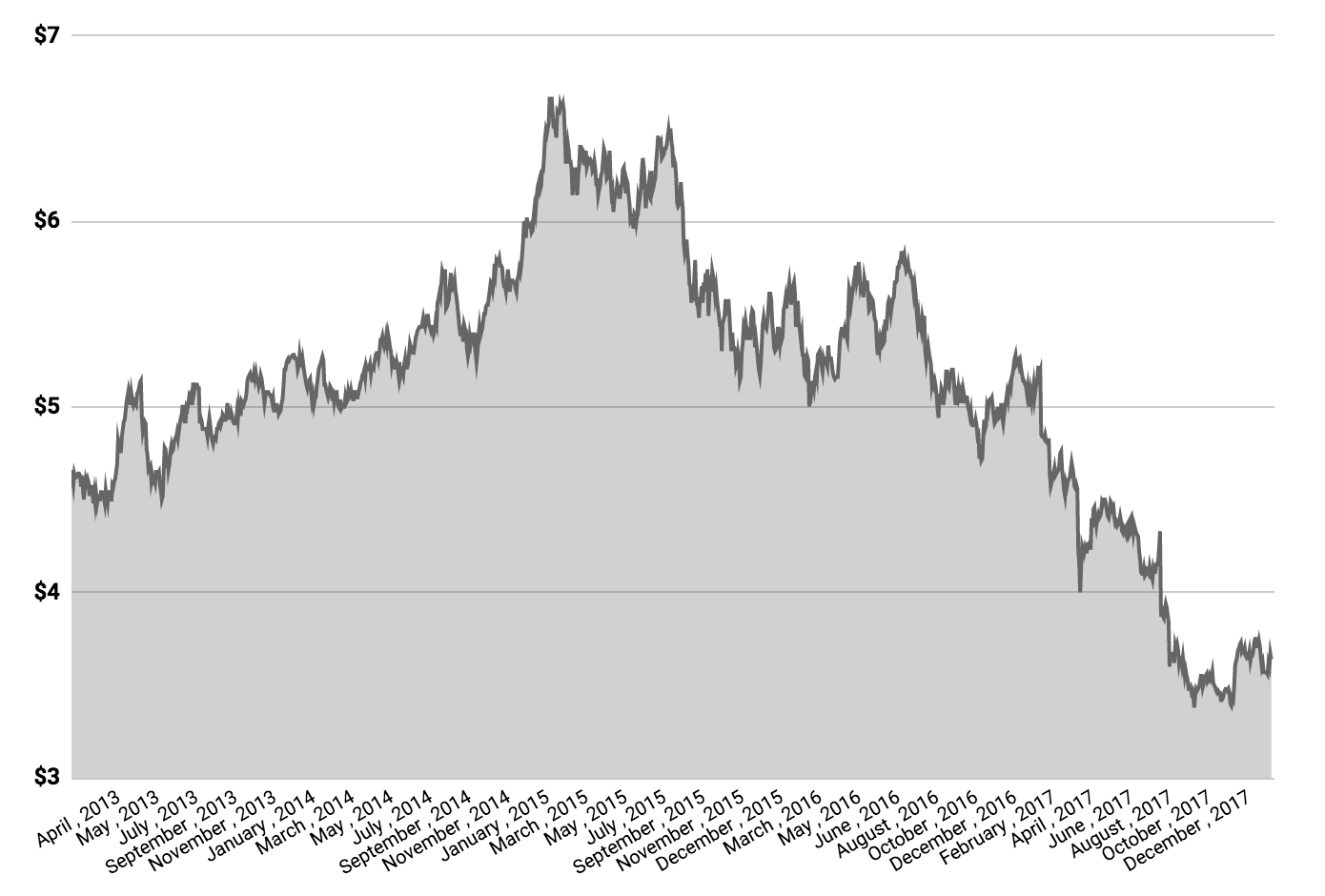

Telstra Share Price

This morning, Telstra announced that it would incur an impairment charge of $273 million to the value of its Ooyala business, a US-based video service. The value of Ooyala will now be zero.

That means, Telstra’s accountants assessed what they believed Ooyala was worth and came back with nothing. This impairment is not a cash outflow. It’s simply an accounting entry which will affect the official profits when Telstra next reports its results.

Telstra first got involved with Ooyala in 2012 and discovered problems with the company about 18 months ago.

“This was a business that Telstra purchased when the market dynamics were very different,” Telstra’s Executive of Technology, Innovation and Strategy, Stephen Elop, said. Mr Elop is also Chairman of Ooyala.

“When we announced the initial impairment 18 months ago we indicated that we would be working closely with the team to turn around the performance,” Elop added. “We believed Ooyala remained a young and exciting company with leading offerings in intelligent video which were continuing to evolve and scale.”

Mr Elop said although the market had changed Telstra remained optimistic about some parts of the Ooyala business, such as its video player and workflow management system. “From here we will sharpen Ooyala’s focus by exiting ad tech and focusing on the underlying video platform and continuing to serve our customers.”

“We will increase emphasis on our differentiated Flex media logistics product and we will drive operational efficiencies and leverage our go to market partnerships with companies such as Microsoft.”

Telstra, like other telcos such as TPG Telecom Ltd (ASX: TPM) and Dodo owner Vocus Group Ltd (ASX: VOC) have felt the pinch from a lack of investor enthusiasm. Shares in the three telcos have fallen more than 35% since the beginning of 2016.

The Government’s NBN Co is creating a level playing field for the telcos which are vying for ways to de-risk their broadband businesses and fend off pricing pressure in mobiles.

Telstra shares were trading 0.3% lower at $3.63 on Friday.

Want To Join An Investor’s Club Newsletter?

You can join Rask’s FREE investor’s club newsletter today for all of the latest analysis and education on investing. Join today – it doesn’t cost a thing.

Keep Reading

- The Best Investors Are Dead or Female

- Points of Reference & Investing

- Why Is Xero Teaming Up With NAB?

Disclaimer: This article contains general information only. It is no substitute for licenced financial advice and should not be relied upon. By using our website you agree to our Disclaimer & Terms of Use and Privacy Policy.