Will Apple Inc. (NASDAQ: AAPL) shares continue powering higher, or will the entire thing lose its charge — like its phone batteries after a few years?

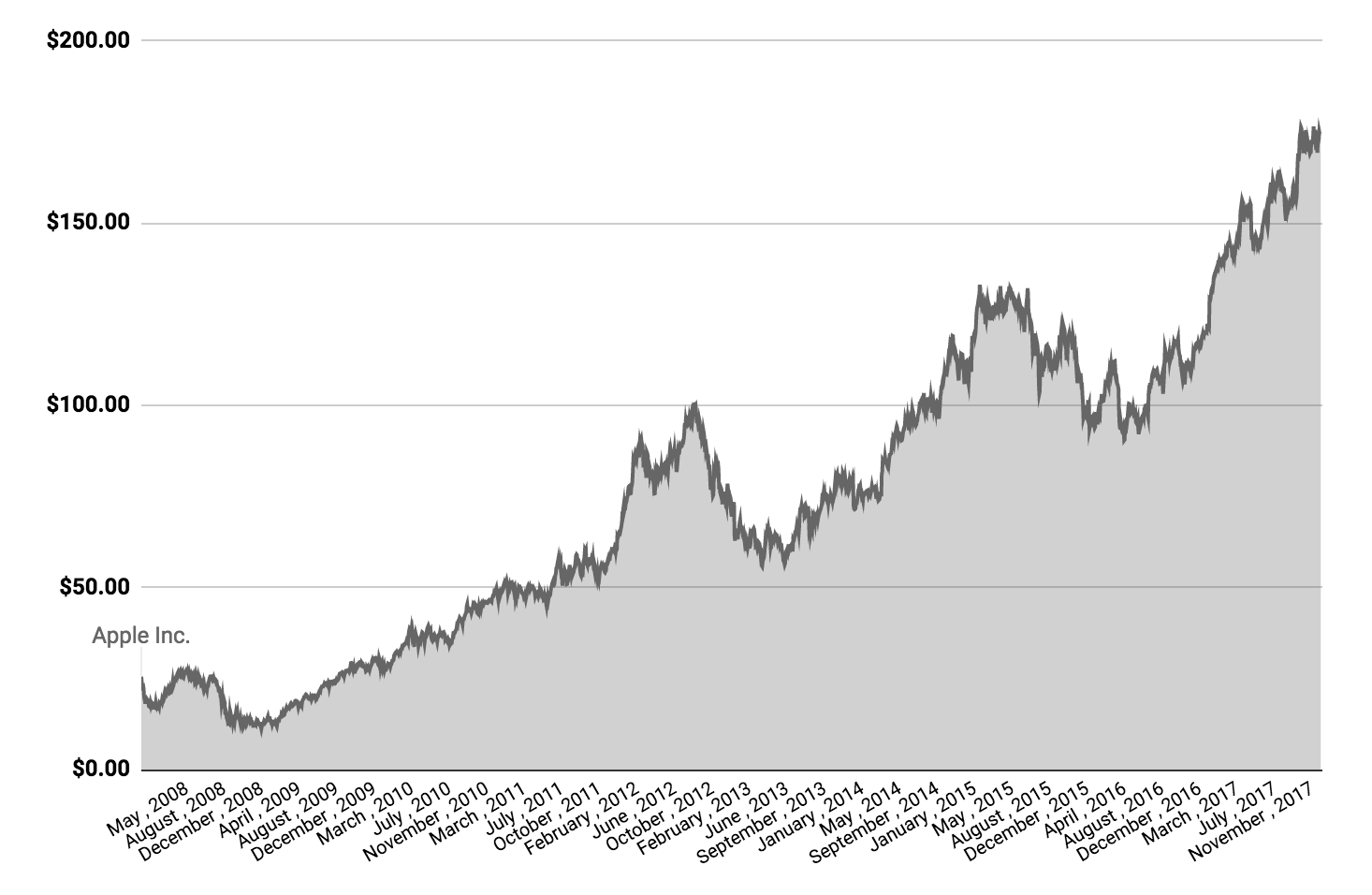

Apple Inc Shares

Since the release of the first iPhone in 2007, coupled with the rising popularity of iPads, Macs, iTunes and more, Apple shares have risen strongly, as can be seen in the chart above.

According to Google Finance, Apple’s market capitalisation, which is the total number of shares multiplied by the share price, is $US 896 billion.

That’s $1.14 trillion in Australian dollars — equivalent to eight Commonwealth Bank of Australia’s (ASX: CBA).

With the current number of shares outstanding (around 5.13 billion), Apple’s share price would need to reach around $195 per share. Yesterday, Apple shares closed at $174.29. Meaning, it would need to rise another 12% from here.

Analysts Are Bullish

According to The Wall Street Journal, analysts are bullish on Apple. Of the 38 analysts surveyed, 31 rate Apple shares as “Overweight” or “Buy” with just five analysts having a neutral or “Hold” rating.

The average price target is $191.84. A ‘price target’ is their estimate of the fair value, however, price targets are often wrong.

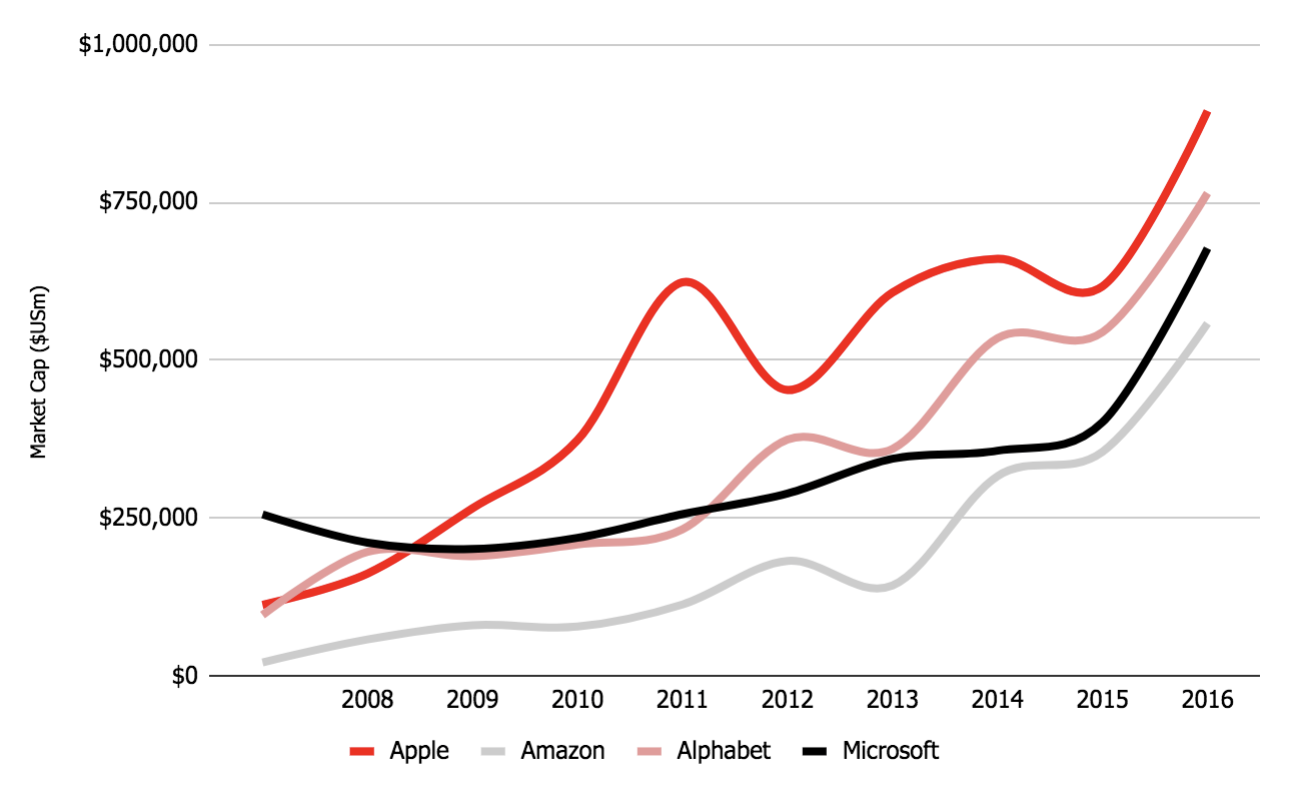

Is it a 4 Horse Race?

Apple isn’t the only giant tech company rapidly growing towards the elusive but otherwise unimportant level of $1 trillion.

As can be seen in the chart above, Amazon.Com Inc (NASDAQ: AMZN), Alphabet Inc (NASDAQ: GOOGL) and Microsoft Corporation (NASDAQ: MSFT) are nipping at its heels, according to data from Stockrow.

Analysts from Morgan Stanley wrote in a research report that they believe Amazon could be the first to reach $1 trillion, which would require a share price of around $US2,000.

These are the four largest companies in the world by market capitalization according to Forbes.

What’s most remarkable about them is the pace of the growth of all of them combined.

In just ten years the combined value of Apple, Alphabet, Microsoft and Amazon has risen from $US 488 billion to nearly $US 2.9 trillion ($3.75 trillion), or around 490%.

The entire Australian stock exchange, which includes more than 2,000 companies, was worth $US 1.4 trillion in November 2017, according to the World Federation of Exchanges.

Did you know it’s free to join The Rask Group’s Investor Club Newsletter? It’s a regular (usually weekly) news and educational update on financial markets, investing and unique strategies. Join today and get ready to laugh and learn.

Click here to join The Rask Group’s Investor Club Newsletter Today

Hey, you, read this disclaimer: This article contains information only. It is not financial advice. It is no substitute for trusted and licensed financial advice and should not be relied upon. By using our website you agree to our Code of Ethics, Disclaimer & Terms of Use and Privacy Policy. Also, don’t forget, past performance is not a reliable indicator of future performance.