TPG Telecom Ltd (ASX: TPM), the $5.7 billion telco behind names like TPG and iiNet, released its half year report to the ASX this morning.

TPG is Australia’s second-largest ASX-listed telecommunications business behind Telstra Corporation Ltd (ASX: TLS). TPG competes with Telstra, Optus and Vocus Group Ltd’s (ASX: VOC) Dodo and Primus on the NBN and mobile, it is also expanding internationally.

Here are the key news stories from TPG’s HY report to 31 January 2018:

- Revenue was up 1% at $1.25 billion

- Profit fell 11% to $200 million

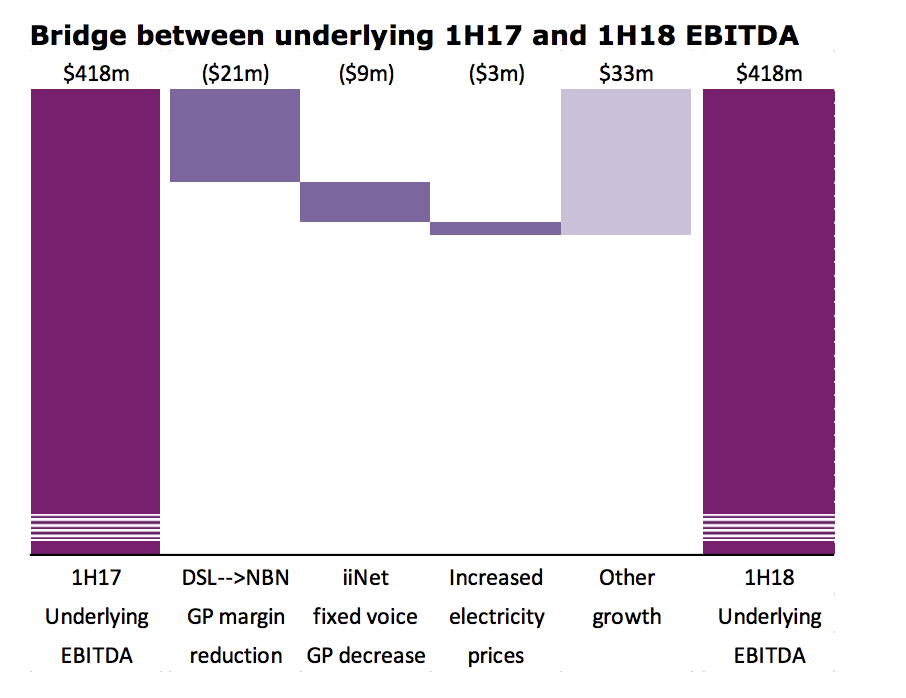

- EBITDA was down 12% to $418 million (click here to learn what EBITDA means)

- A dividend of 2 cents per share, fully franked, was declared

- Underlying EBITDA guidance was upgraded from between $800m to $815m to between $825m and $830 million

TPG pointed to falling profit margins, a worse result from iiNet’s fixed voice services and increased electricity prices.

TPG reports its results in two ‘segments’ being Corporate, which includes services to big businesses, governments and wholesale customers; and Consumer, which includes telecommunication connections to individuals, homes and small business.

During the half year, TPG’s Consumer segment reported a slight fall in profit despite a rise in revenue. “The gross profit decline is driven by broadband gross margin erosion and loss of home phone voice revenue, both due to the NBN rollout,” the company said.

TPG, like Australia’s other telco companies, is dealing with the ongoing rollout of the National Broadband Network, which was designed to improve speed and reliability for consumers and to increase competition.

TPG’s Corporate lines of business upped profit marginally. However, it said, “. . . although reported 1H18 EBITDA for the Corporate Segment is only $1.7m higher than 1H17, the comparable EBITDA growth for the segment was in fact $5.2m.”

“This EBITDA growth has been driven by continued strong data and internet sales offsetting ongoing declines in voice revenues.”

TPG said it delivered another “strong cashflow result” during its first half, with $417 million of cash from operations before tax. This allowed the company to invest in its mobile spectrum locally and continue its Singaporean expansion.

Looking ahead, TPG upgraded its underlying EBITDA guidance from between $800 million and $815 million to between $825 million and $830 million.

Takeaway

According to The Wall Street Journal

, analysts expect TPG to report full-year profit per share of 42 cents. During the half, it achieved 21.5 cents in per-share profit and pointed to a robust second half.

Did you know it’s free to join The Rask Group’s Investor Club Newsletter? It’s a regular (usually weekly) news and educational update on financial markets, investing and unique strategies. Join today and get ready to laugh and learn.

Click here to join The Rask Group’s Investor Club Newsletter Today

Hey, you, read this disclaimer: This article contains information only. It is not financial advice. It is no substitute for trusted and licensed financial advice and should not be relied upon. By using our website you agree to our Code of Ethics, Disclaimer & Terms of Use and

Privacy Policy. Also, don’t forget, past performance is not a reliable indicator of future performance.