Harvey Norman Holdings Limited (ASX: HVN) shares slumped nearly 15% on Wednesday, according to Google Finance, following the release of its half year report

.

Harvey Norman Holdings is the corporate name behind the popular electrical, white goods and home furnishings retailer. Harvey Norman also has a large property business.

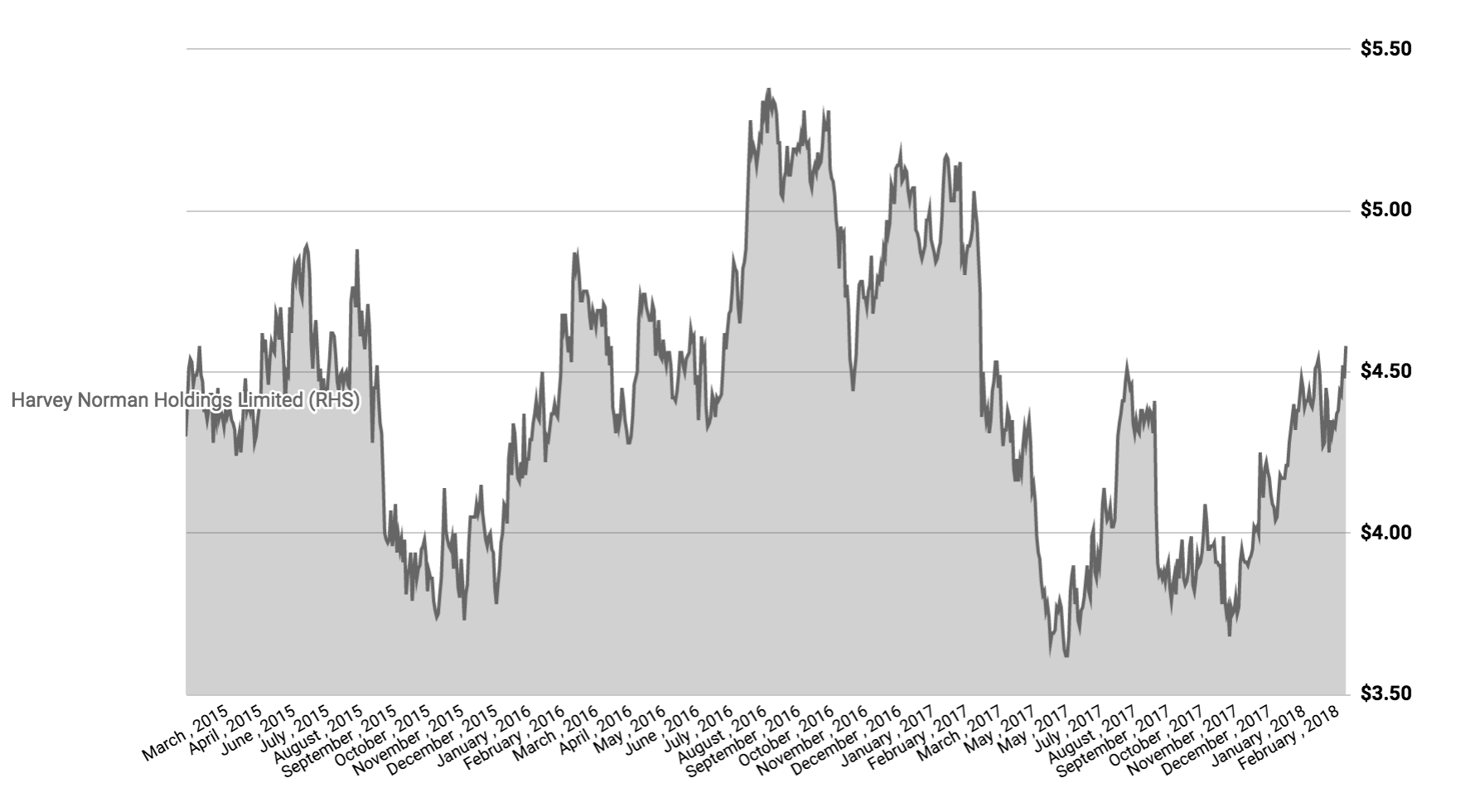

Harvey Norman Shares Over 3 Years

Here are the key headlines from Harvey Norman’s half year report:

- Revenue of $1.02 billion, up 4.7%

- Profit of $210 million, down 19%

- Fully franked dividends of 12 cents per share, down from 14 cents per share (what are franking credits?)

- Profit excluding significant items was up 0.8%

“The strength, stability and flexibility of our expansive, high-quality retail developments continue to be an integral point of difference, and this allows us to maximise the ability of our physical retail offerings to provide a complete interactive customer experience,” Harvey Norman Chairman Gerry Harvey said.

“We’re very much focused on raising the bar of our retail experience, and this period has seen a concerted focus towards completing our Flagship store strategy by the end of the 2018 financial year.” – Harvey

Harvey Norman’s property portfolio is valued at $2.81 billion, or 62% of the company’s total asset base, it said. The company said its balance sheet remains strong, with a robust working capital position, allowing the board to announce a fully franked dividend of 12 cents per share.

Harvey Norman’s share price fall follows the selloff of shares in rival JB Hi-Fi Limited (ASX: JBH) on the day of its results announcement. Indeed, despite reporting a 21% increase in profit the retailer’s share price was sold down by the market.

Some pundits and commentators expect the arrival of online e-commerce giant Amazon.com Inc (NASDAQ: AMZN) will begin to put pressure on incumbents such as Harvey Norman and JB HiFi.

However, late in 2017, Gerry Harvey dismissed some concerns over Amazon’s arrival. “It’s not a simple case of Amazon coming in and eating our lunch – we’ll be the most formidable competitor they’ve ever seen,” Fairfax quoted Harvey as saying. “If it gets rough we have a war chest much greater than any of our competitors in this space and we will be the last man standing.”

Harvey Norman shares were trading 14.6% lower at $3.91 on Wednesday.

Join Rask’s Investor Club Newsletter Today

You can join Rask’s FREE investor’s club newsletter today for all of the latest news and education on investing. Join today – it doesn’t cost a thing. BUT, you’ll need a good sense of humour and a willingness to learn.

Keep Reading

Disclaimer: This article contains general information only. It is no substitute for licensed financial advice and should not be relied upon. By using our website you agree to our Disclaimer & Terms of Use and Privacy Policy.