This morning, Newcrest Mining Limited (ASX: NCM) released its December quarter production report to ASX investors, revealing gold production up 17% versus the prior period.

Newcrest Mining is Australia’s largest gold-focused mining company, with a total market capitalisation of around $17.6 billion.

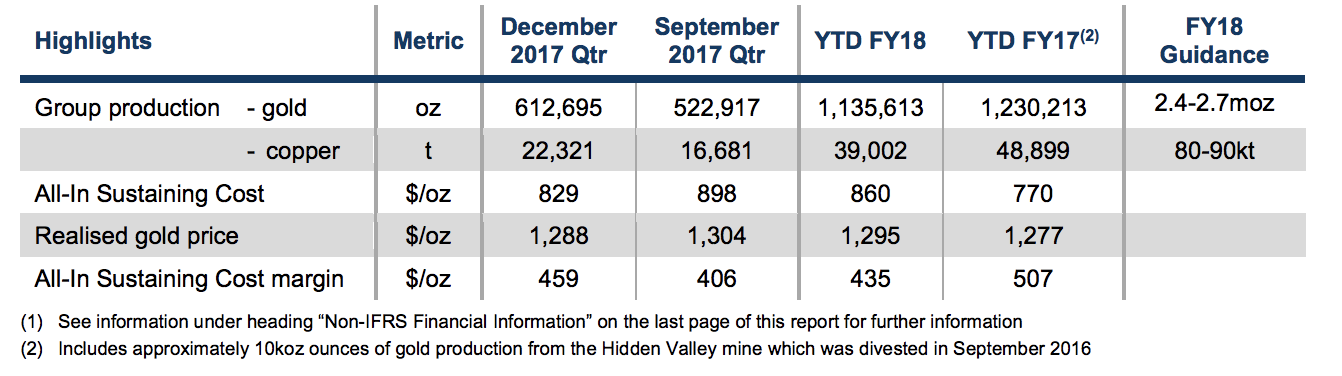

In its December quarter, Newcrest produced 613,000 ounces of gold, up 17% on the previous quarter. Production of copper, which is commonly mined alongside gold, was 22,000 tonnes and up 34%.

“Newcrest has delivered a significantly improved quarter with all but one of our operations producing more ounces than the previous quarter,” Newcrest CEO Sandeep Biswas said.

“I am particularly pleased with Cadia’s strong quarter-on-quarter production increase and record low quarterly AISC per ounce.”

Newcrest reported its all-in sustaining cost or “AISC” was $829 per ounce across the entire company. The AISC is an important number in gold mining because it includes all of the costs the company incurred to produce its gold.

Thanks in part to Newcrest’s AISC falling by $69 per ounce during the quarter, the company said its margin on each ounce of gold it produced rose by 13% to $459.

At Cadia, a Newcrest mine in New South Wales, the AISC was just $129 per ounce.

Looking ahead, Mr Sandeep said Newcrest expects to meet its production targets for its 2018 financial year and build on its momentum in the second half of the year.

“Newcrest remains on track for production from continuing operations to be stronger in the second half of FY18,” Sandeep added.

Alongside Newcrest, fellow ASX-listed gold and copper mining companies Evolution Mining Ltd (ASX: EVN) and Sandfire Resources Ltd (ASX: SFR) reported their quarterly production results today.

Want to Join An Investor’s Club Newsletter?

You can join Rask’s FREE investor’s club newsletter today for all of the latest analysis and education on investing. Join today – it doesn’t cost a thing.

Keep Reading

- Expert: Here’s 3 Signs The Australian Dollar ($A) Could Fall Below 80 Cents

- 75% of Big Bank Financial Planners Failed Best Interest Duty

- The Bank Royal Commission Wants YOU

Disclaimer: This article contains general information only. It is no substitute for licensed financial advice and should not be relied upon. By using our website you agree to our Disclaimer & Terms of Use and Privacy Policy

.