The gold price is surging, but chasing it with borrowed conviction is how investors get their timing wrong.

We’re in the middle of a modern-day gold rush!

The precious metal has had a helluva run. The gold price rally has outpaced many equity indexes, and the debasement trade has helped push the ‘pet rock’ to record highs. According to the World Gold Council, the commodity hit 53 new all-time highs during 2025 and 95 since 2024. When an asset feels as though it’s making fresh highs daily and every chart looks like an elevator to the moon, the temptation is to close your eyes and buy. Join the party. Buying is the easy part; it’s buying for the wrong reason that is the issue.

This isn’t a call on where the gold price goes next. Forecasting commodities or macro cycles is notoriously difficult, and certainty is usually an illusion.

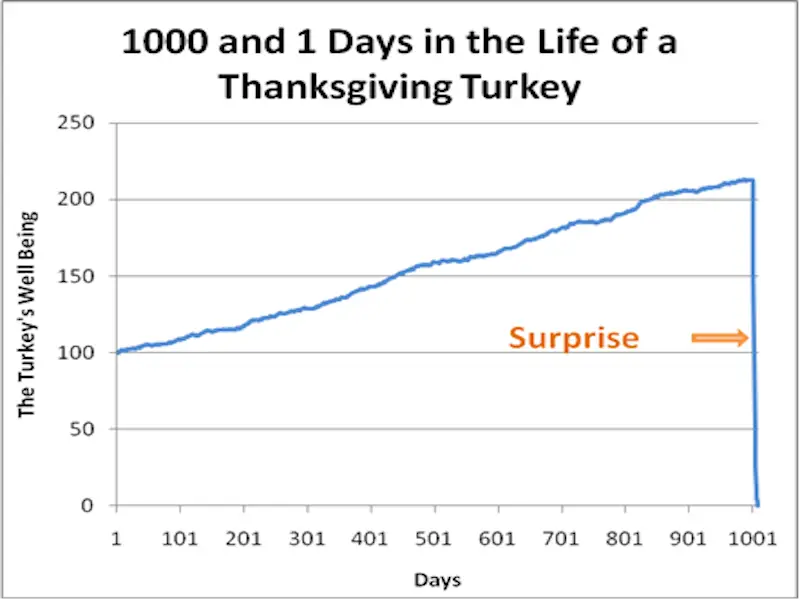

But speaking from past experience, FOMO’ing into a hot sector is a fragile form of ownership. It rewards bad processes and is void of your own conviction. Like the classic Nassim Taleb Black Swan/Thanksgiving turkey reference, it’s a good idea until it isn’t.

The hidden cost of borrowed conviction

The gold price may continue to rise. It may not. The honest answer is that nobody knows.

Most late-cycle decisions are really social decisions. A mate made money. A newsletter sounds confident. A fund manager went on TV. So you “borrow” their conviction and hit the buy button.

The fatal flaw of borrowed conviction is the lack of an exit plan.

When you don’t know why you bought something, you also don’t know what would prove you wrong. So every dip feels like panic, and every rally feels like relief. You either sell too early (“I can’t lose this profit”) or too late (“It’ll come back”) because you’re reacting to price, not your thesis.

Don’t confuse conviction with stubbornness. It means you have a clear set of reasons you can explain in plain language, plus a clear set of conditions that would make you sell. Writing out a thesis as to why you own or pass on a position is an investing cheat code.

Yes, you can get lucky

Dangerously (or fortunately?) sometimes FOMO works.

You buy late. The price keeps rising. You feel smart. No matter how good you are at investing, even the best benefit from luck. It’s important to recognise the difference between luck and skill. Because without this, bad habits can become permanent.

The market occasionally rewards weak process. But it doesn’t do it consistently. Over time, the penalty manifests as whipsaws, overtrading, and a single big drawdown that erases 10 small wins.

Build conviction before you buy

If you’re going to join the gold price rally, or anything that’s “running hard”, it’s crucial to write down three things before you press buy:

- Your thesis: what’s driving gold, in your words?

- Your time horizon: weeks, months, or years?

- Your sell rules: what conditions would make you exit (or trim)?

That’s the difference between investing and punting.

That framework is the difference between investing and speculation.

Gold may continue higher. But buying without a thesis is buying blind. Emotion is powerful, persuasive, and always mean-reverting.