Telematics provider EROAD Ltd (ASX: ERD) shares are in a trading halt while the company undertakes a capital raising to fund the acquisition of New Zealand based Coretex Limited for NZ$157.7 million.

The purchase will be partly funded by an underwritten conditional placement of NZ$$64.4 million and a NZ$16.1 million share purchase plan. Additionally, Coretex will be issued NZ$96.0 million in EROAD shares and $11.8 million in cash.

Coretex is also eligible for an additional $30.6 million payment pending operating performance in FY23.

The acquisition is expected to be completed in the second half of FY22 and subject to shareholder and regulatory approvals.

ERD share price

Growth accelerated by two years

Coretex is a telematics provider focused on growth verticals rated less than a truckload including refrigerated transport, construction, and waste & recycling.

Similar to EROAD, the company has operations in New Zealand, Australia and the United States.

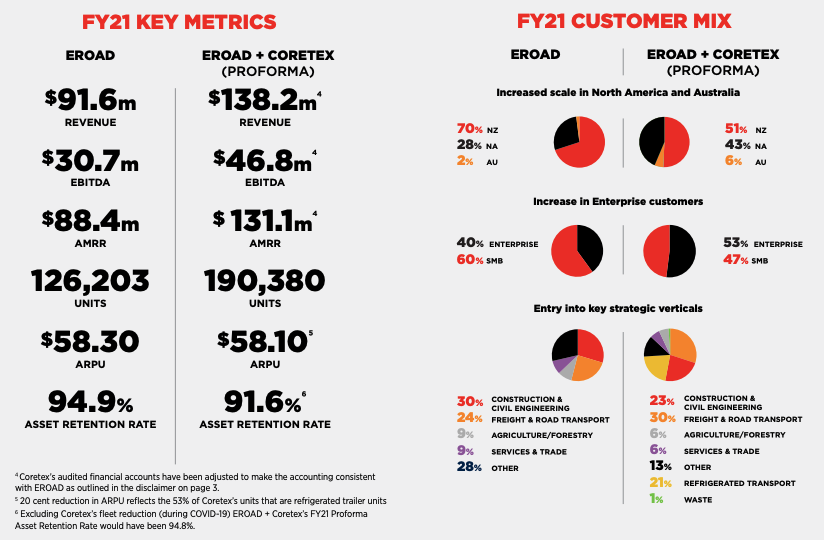

The acquisition of Coretex will more than double EROAD’s connected units in Australia and United States. This will significantly lift EROAD’s market position in its two key growth markets and expand the business into adjacent verticals increasing the total addressable market.

EROAD will also be able to leverage Coretex’s enterprise client base to cross-sell the EROAD platform and products.

The Coretex next-generation platform along with complementary technologies, development teams and customer solutions will be migrated to EROAD.

The addition of Coretex will add annualised monthly recurring revenue between $50-$53 million and EBITDA of $7-$9 million to EROAD in FY22.

The drop off of EBITDA in FY22 is attributed to the normalisation of costs (which were cut in FY21 due to COVID-19) and future investment in growth.

Selwyn Pellett, CEO of Coretex, will join EROAD’s Board as an Executive Director. She will remain an advisor to EROAD CEO Steven Newman during the integration period.

Directors Graham

Stuart, Susan Paterson and Tony Gibson in addition to Newman will participate in the capital raise.

Q1 Trading Update

EROAD also provided a first-quarter trading update. For context, EROAD reports on a March 31 financial year date.

The company sold 4,152 contracted units during the quarter, increasing its total unit base by 3.29% to 130,355.

216 customers renewed their contracts in New Zealand representing 7,845 units. EROADs asset retention remains strong at 95.5%.

Notwithstanding slow sales traction as the economy reopens, the company has two enterprise customers in pilot and a pipeline of additional pilots launching in the United States.

Management reiterated FY22 guidance of 13% revenue growth and research and development costs of 24%-27%. EBITDA margin guidance was revised down to a range of 28%-31% due to one-off integration costs as a result of the acquisition.

Guidance does not include any financial contribution from Coretex.

For more information on EROAD, check out three reasons I like the company.