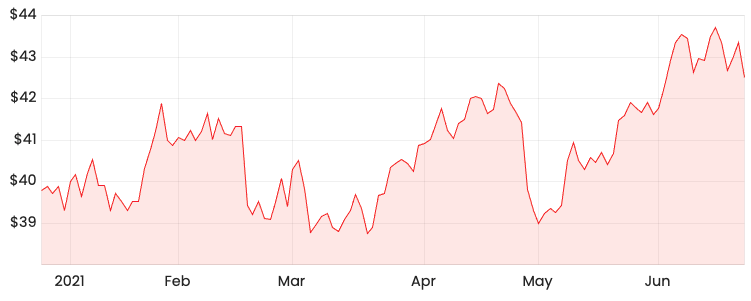

The Woolworths Group Ltd (ASX: WOW) share price has bucketed down by as much as 13% but it’s justified.

As reported by my colleague, Lachlan Buur-Jensen, Endeavour Group Ltd

(ASX: EDV) has begun its trading journey today.

It’s not a break-up

Investors should note Woolworths still holds a 14.6% shareholding in Endeavour Group, down from an 85.4% stake. Hence why the Woolworths share price has been falling. But sometimes, less means more over the long run.

This demerger will enable Endeavour Group to channel all its energy towards improving its hotel division.

As reported in the Sydney Morning Herald, Endeavour’s new CEO, Steve Donohue

is looking to expand its hotel network in a disciplined manner.

The plan is to also include more pokies and wagering services in newer sites.

Given the Woolworths’ board has faced scrutiny over its environmental, social and corporate governance (ESG) credentials, it’s no wonder why it’s trying to distance itself from Endeavour.

Stain-free future for Woolworths?

This move provides Woolworths with the best of both worlds. On one side, Woolworths is able to appease funds regarding ESG concerns. And on the other side, Endeavour can still sail with Woolworths support.

Donohue acknowledged the ESG concerns surrounding alcohol and gambling but also noted that Endeavour aims to support shoppers who “enjoy responsibly”. He raises a valid point.

Given the constraints on both entities, I think the demerger is a sound play for shareholders.

For more details about the demerger, I recommend reading Lachlan Buur-Jensen’s deep dive.

Worried about Woolies? Want a better company to invest in right now? We’ve set up a free analyst report — featuring our top medical technology company on the ASX. Click here now to get the report on this #1 stock.