First flagged in 2019, Woolworths Group Ltd (ASX: WOW) recently announced the separation of Endeavour Group from Woolworths Group.

If you’re not keen on the 228-page demerger booklet, read on below to gain a better understanding of the Woolworths Group demerger of Endeavour Group.

Who and what is Endeavour Group?

Before delving into the intricacies of the demerger, let us understand who is Endeavour Group and how it came about.

Woolworths Group is a $54 billion conglomerate with activities in retail, drinks, accommodation and gaming. The company owns and operates a number of businesses including:

- Woolworths and Countdown supermarket stores

- Big W retail stores

- Endeavour Drinks – BWS, Dan Murphy’s, Cellarmasters stores, Pinnacle Drinks, EndeavourX

- ALH Group – hospitality venues, hotels, accommodation and gaming assets

- Digital – Cartology, Quantium, WooliesX

- Everyday Rewards Program

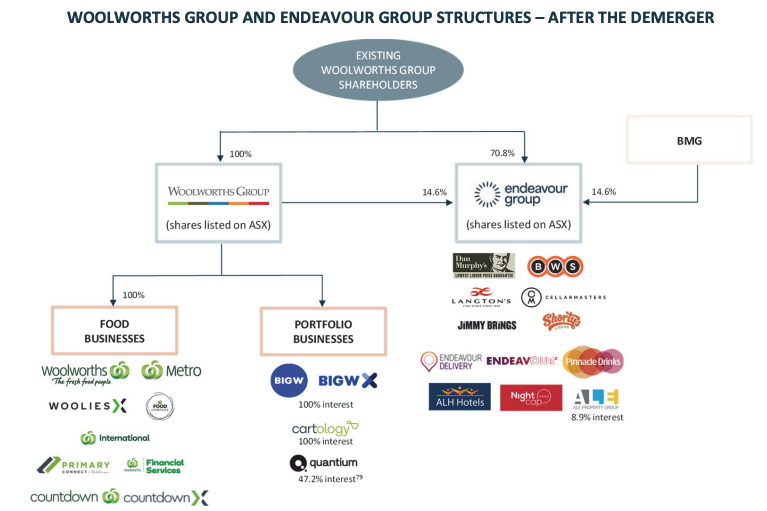

Endeavour Group is a result of Endeavour Drinks and ALH Group merging into one entity under the Woolworths Group umbrella.

Demerger overview

In summary, Woolworths Group is being split into two separate and independently managed ASX-listed companies:

- Woolworths Group (ASX: WOW) – Australia and New Zealand’s leading food and everyday needs business. Operating businesses include Woolworths, Big W, Everyday Rewards Program, WooliesX, Quantium, Countdown and Cartology.

- Endeavour Group (ticker TBC) – the leading retail drinks and hospitality business in Australia. Operating businesses include Dan Murphy’s, BWS, ALH Hotels, Pinnacle Drinks, EndeavourX, Cellardoors and gaming assets. Endeavour Group will house a store network of 1,630, in addition to 332 hotels, 1,775 liquor licenses venues with 12,364 pokie machines and 290 TABs and KENO outlets. It will also acquire the My Dan’s loyalty program, which has 5.1 million members. Woolworths Group will retain a 14.6% interest (down from 85.4%).

Strategic partnership

It’s a difficult task demerging any company, let alone one that shares utilities, rent, staff, delivery orders and inventory. For illustration, a majority of Woolworths supermarkets are accompanied by a BWS next door.

In order to alleviate the burden of shared costs, Woolworths and Endeavour Group will enter into long-term partnership agreements. The agreements cover five key business areas; Supply Chain & Stores, Loyalty & Fintech, Digital & Media, Business Support and International.

Each year, Endeavour will pay Woolworths $564 million for access to the aforementioned business areas. Two-thirds of the payment will be for Supply Chain & Stores, with the remainder across the remaining four areas.

The numbers

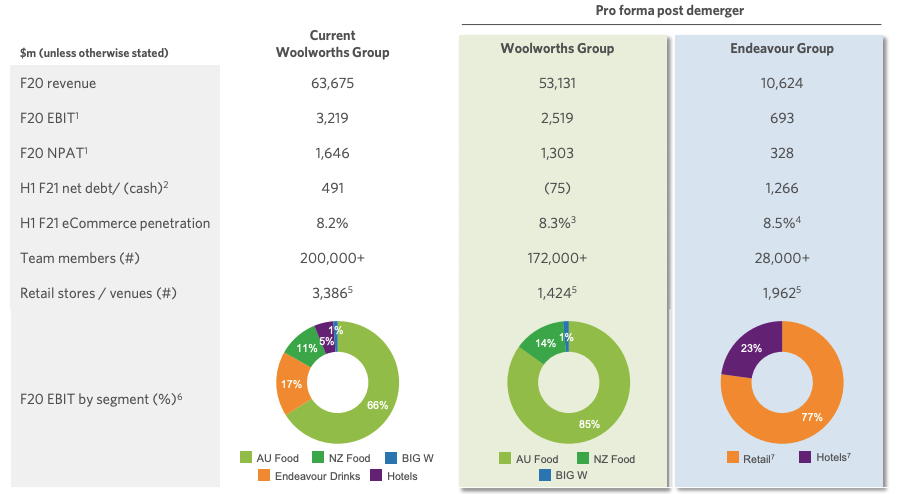

Endeavour Group reported FY20 sales of $10.6 billion and EBIT of $693 million. The group recorded $1.4 billion in operating cash flow before finance costs and tax.

The new company will have $3.2 billion in net assets including $2.0 billion in liquor, gaming and other licenses and $592 million in land, warehouse and retail property. Cash on hand is $566 million against lease liabilities of $3.7 billion and $1.8 billion in borrowings.

Endeavour Group intends to follow Woolworths Group’s established dividend policy, which is initially expected to deliver a payout ratio of 70% to 75% of profit after tax. The company will have $600 million in franking credits available for future dividends.

Why is Woolworths demerging Endeavour?

The primary reason for demerging Endeavour Group from the broader Woolworths portfolio is to increase shareholder value.

The board believes separating the two groups will enable a greater focus on each business’ core customer offering. Rather than one conglomerate, the two groups will be more agile and better positioned to respond to changes in consumer preferences. Endeavour and Woolworths Group will have distinct strategies, consistent with each other’s respective strengths and capabilities.

In years gone past, management has focused on where returns could be best achieved – mainly growing supermarket network and to a lesser extent liquor stores. Furthermore, Woolworth’s Group has been reluctant to invest in gaming and gambling operations over environmental, social and governance (ESG) concerns. As a result, underinvestment occurred within the Endeavour Group portfolio. Spinning off the group enables its own capital allocation plan to drive future growth.

Turning back to ESG concerns, institutional investors such as superannuation and pension funds have been reluctant to invest in Woolworths Group due to the group’s exposure to alcohol and gambling. The demerger of Endeavour group enables Woolworths Group to gain exposure to a new shareholder base, possibly rerating its market multiple upwards.

Moreover, the demerger enables Woolworths Group to focus on growing its digital arms. Focusing on WooliesX, Cartology media, Quantiam data analytics will yield future efficiencies and drive customer engagement, which Endeavour Group will be able to leverage off.

Management did consider selling to a third party and an initial public offering (IPO) for Endeavour Group. Both were not recommended due to tax consequences, unrealised value in the Endeavour Group business, additional costs relating to an IPO and the material overlap in existing shareholders.

Grant Samuel, an Independent Expert appointed by Woolworths to review the proposed demerger, concluded it is in the best interests of shareholders. Additionally, the Woolworths Board has unanimously recommended the proposal.

What does this mean for Woolworths shareholders?

Let us assume you hold 10,000 Woolworths shares. Post the demerger you will hold:

- 10,000 Woolworths Group shares – your original investment

- 10,000 Endeavour Group shares

This all seems pretty straightforward. However, the price of each share will change post the announcement. Since Woolworths Group no longer owns Endeavour Group (except for a 14.6% stake), the share price will likely fall to reflect the new value of Woolworths Group shares. Conversely, the Endeavour Group shares you have acquired will increase in price, as the market values the new stand-alone Endeavour Group company.

For example, Woolworths Group shares are currently trading at $42.88. In the latest half-year result, Endeavour Group accounted for approximately 25% of Earnings Before Interest Tax (EBIT).

Assuming Endeavour Group and Woolworths Group both trade on the same EBIT multiple, Woolworths Group shares would fall to $32.16 (75%) and Endeavour Group would begin trading at $10.72 (25%).

The above example is purely for illustration purposes and most likely won’t eventuate, as the market will assign different growth prospects and market multiples to each company.

My take

Demergers have a history of success in Australia. A Morgan Stanley study of 20 demergers found the combined entities outperform the benchmark S&P/ASX 200 by 6% in the first year. More impressively, the outperformance increased to an average of 17% over two years.

Wesfarmers Ltd (ASX: WES) spinning off Coles Group Ltd (ASX: COL) in 2018 is a case in point. Since the demerger, the Wesfarmers share price has risen 72% while the Coles share price has increased 30%. Both have outperformed the benchmark performance of 27%.

The fact that Woolworths Group is retaining a 14.6% stake in Endeavour Group shows alignment with new shareholders. Two separate management teams focused on independent strategies allows both Woolworths and Endeavour Group to flourish.

An added bonus for Woolworths shareholders is upon completion of the demerger, the board intends to return between $1.6 billion and $2 billion via a special dividend.

I’m optimistic about the demerger and believe it will unlock value for current Woolworths shareholders.