The Tyro Payments Ltd (ASX: TYR) share price has dropped by 10% in the last six months. Does today’s investor presentation reveal signs of recovery for the Tyro share price?

Tyro is Australia’s 5th largest merchant bank that provides credit, debit and EFTPOS card acquiring, Medicare and private health fund claiming and rebating services to Aussie businesses.

The bank takes money on deposit and offered unsecured cash-flow based lending to Aussie EFTPOS merchants.

TYR share price

Key metrics

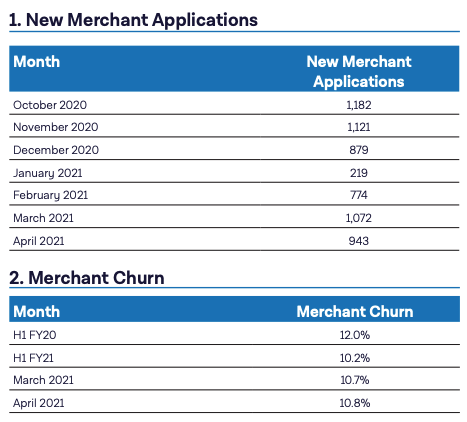

The below key metrics indicate that Tyro managed to fare reasonably well from its mini catastrophe in January when there was an outage and Viceroy Research released its short report.

Evidently, Tyro was punished severely in January with a record low number of new merchant applications. However, despite the bad publicity, it still managed to rebound to pre-January levels.

Also, churn for March and April remained relatively consistent and lower than H1 FY20. This is a bit surprising given EFTPOS terminal outages can have a severe impact on businesses.

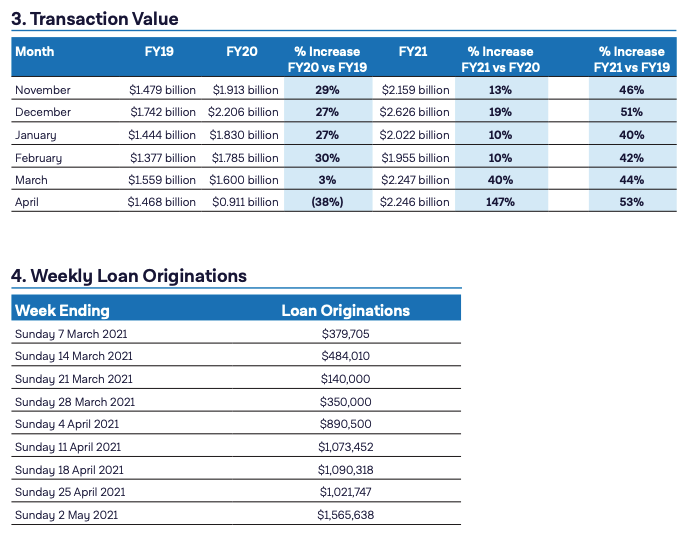

Further, total transaction value continues to remain strong and total loan originations is rapidly rising.

Tyro invests in me&u

Tyro has taken a ~16% equity stake in me&u ($3.5 million), providing rights to be an exclusive in-app payment provider.

Me&u provides tap, order and pay functionality for the hospitality industry, essentially removing the need to order at the counter or from waitstaff.

The me&u app is on the Tyro Connect platform and Tyro expects to become an in-app payment provider in June 2021.

Future financial outcomes

Tyro indicates it will require $19.9 million in one-off project costs and permanent operating personnel costs of $6.7 million per year.

The additional permanent personnel is expected to commence in Q4 FY21.

The bank is aiming to process $5 billion in transaction value and achieve a gross profit share of around $19 million in FY22.

The gross profit share is after accounting for gross profit share to Bendigo and Adelaide Bank Ltd (ASX: BEN) and before operating costs.

My thoughts on Tyro

I think Tyro has recovered quite well since the debacle in January especially with strong competition from the likes of Smartpay Holdings Ltd (ASX: SMP) and Square (NYSE: SQ).

The rebound in the growth of new merchant applications indicates businesses value Tyro’s product offering.

It’s encouraging to see Tyro finding ways to differentiate itself by investing in new technology like me&u. I think this is a sound investment given it presents cost and operating efficiency for restaurants.

If waitstaff spend less time on taking orders, they can channel their energy towards cleaning or the restaurant can hire more chefs to roll through more customers.

I think this is a worthwhile business to monitor since it operates in a structurally growing industry.

If you are interested in other ASX growth shares, I suggest getting a Rask account and accessing our full stock reports. Click this link to join for free.