In this deep-dive on Rask Media, Patrick Melville takes a look at Smartpay Holdings Ltd (ASX: SMP) shares, and asks what’s driving the SMP share price forward.

Smartpay: A push on digital payments

Digital payments and a COVID-19 accelerated push towards a cashless society have both been popular thematics that investors have continued to shift their focus towards.

Up until recently, the Australian payments system was structured in a way that prevented non-bank companies from processing card payments on behalf of merchants.

The rules have since changed though, which has given rise to the emergence of some new and innovative companies trying to have a crack at the lucrative EFTPOS terminal market here in Australia.

Here’s a deep dive into New Zealand-based Smartpay Holdings Limited (ASX: SMP), a fast-growing disruptor that’s been winning market share that I think has been relatively unappreciated by the market.

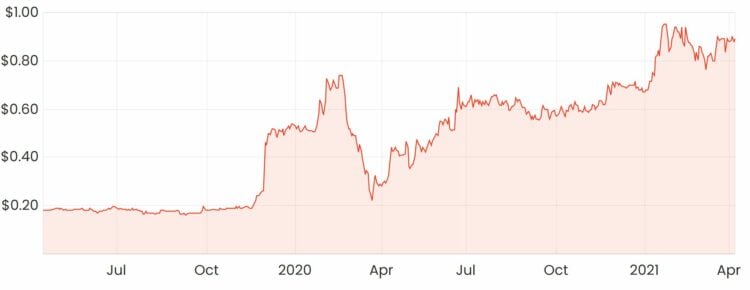

Smartpay – SMP share price

Smartpay’s story

Smartpay is a dual-listed New-Zealand-based EFTPOS machine provider to over 25,000 merchants across Australia and New Zealand.

Between the two countries, however, the service offering that Smartpay provides is slightly different.

New Zealand is Smartpay’s mature business segment and it’s currently the market leader as an EFTPOS machine provider with over 30,000 terminals — a 30% market share.

The revenue model in New Zealand is straight forward. Smartpay rents out its terminals to merchants and collects an average monthly fee of $48 per terminal. Each terminal has a payback period between 6-8 months and merchants are on contracts between 3-5 years.

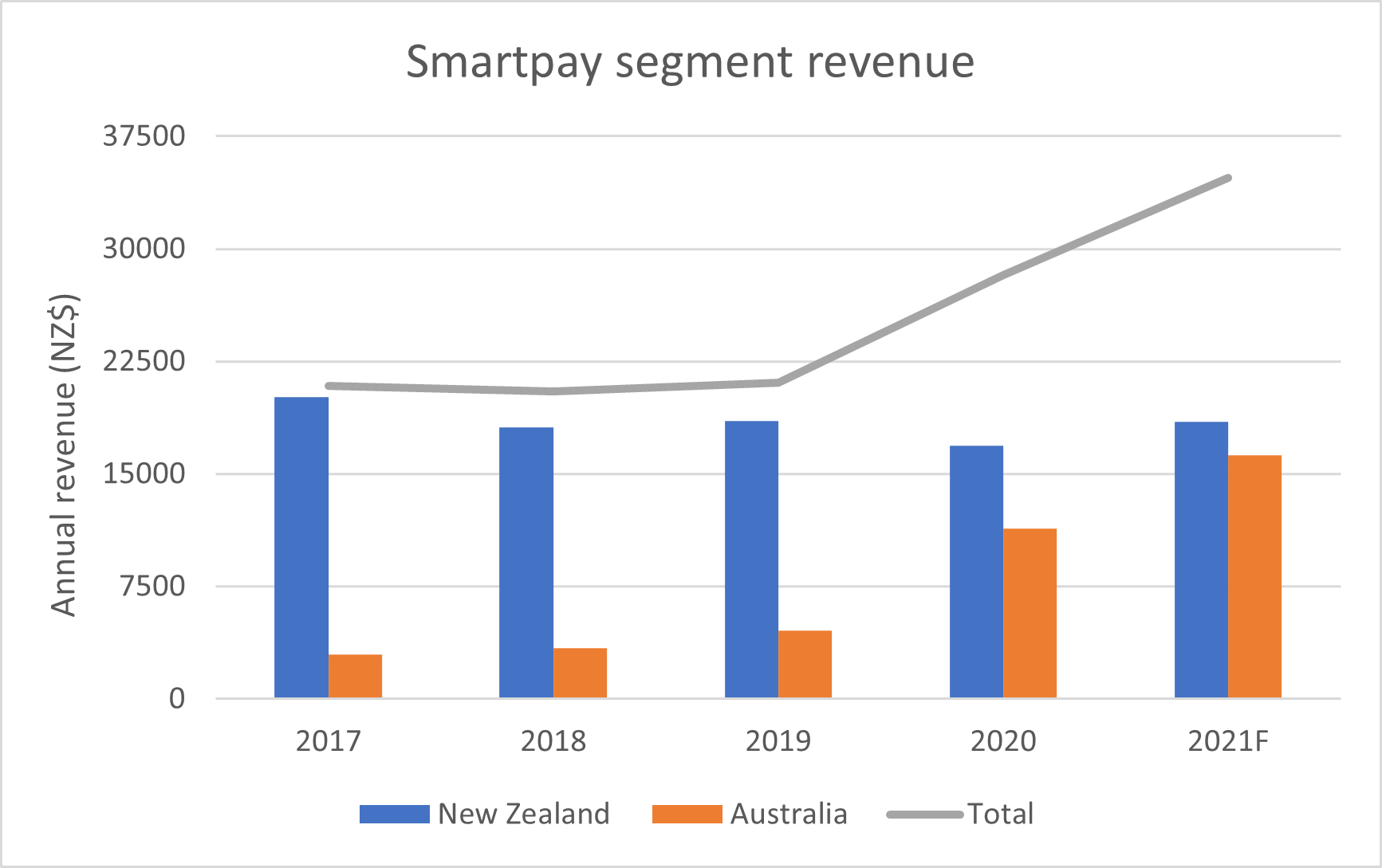

Revenue from this segment has been stagnant at around $20 million per year for the last several years.

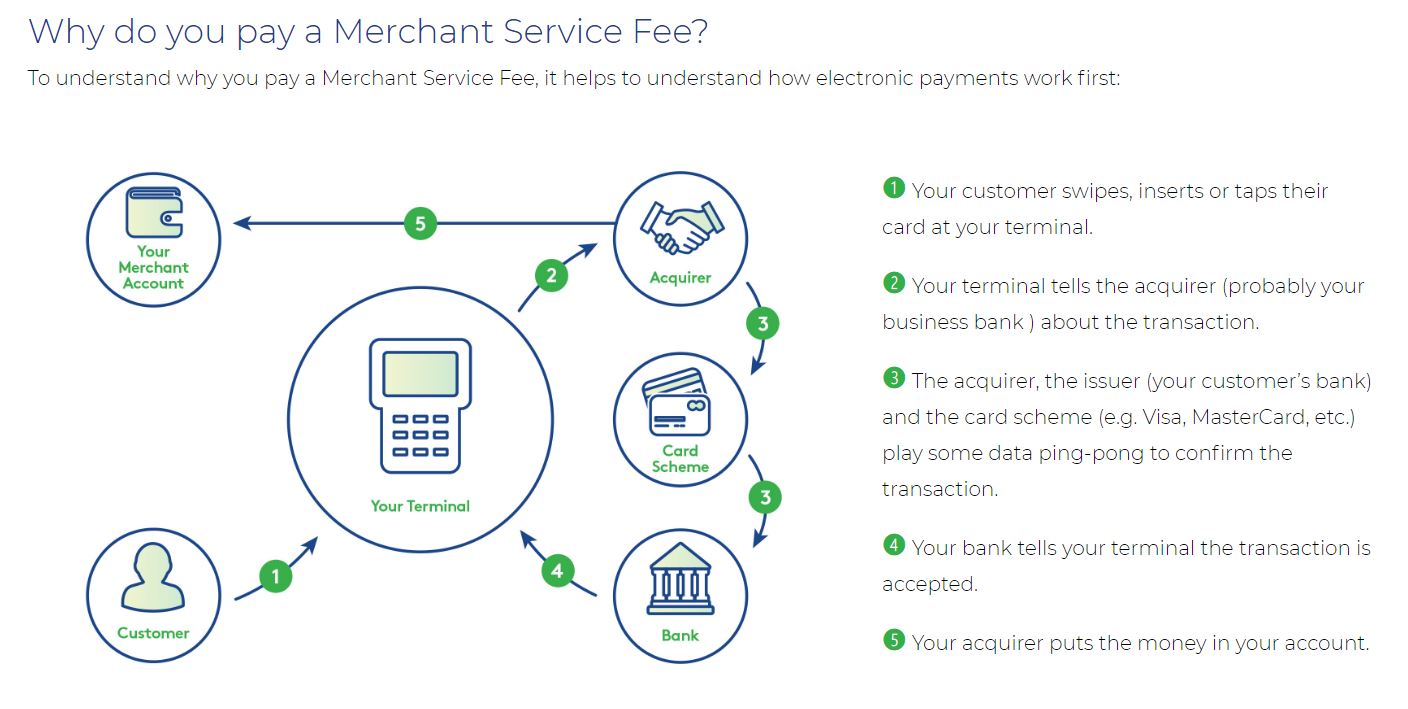

Smartpay’s Australian business is an evolving growth story that started in late 2017. Rather than just collecting rental income, Smartpay performs what’s known as the “acquiring service”, where it essentially performs the functions of a merchant bank by processing card payments.

Smartpay isn’t a bank.

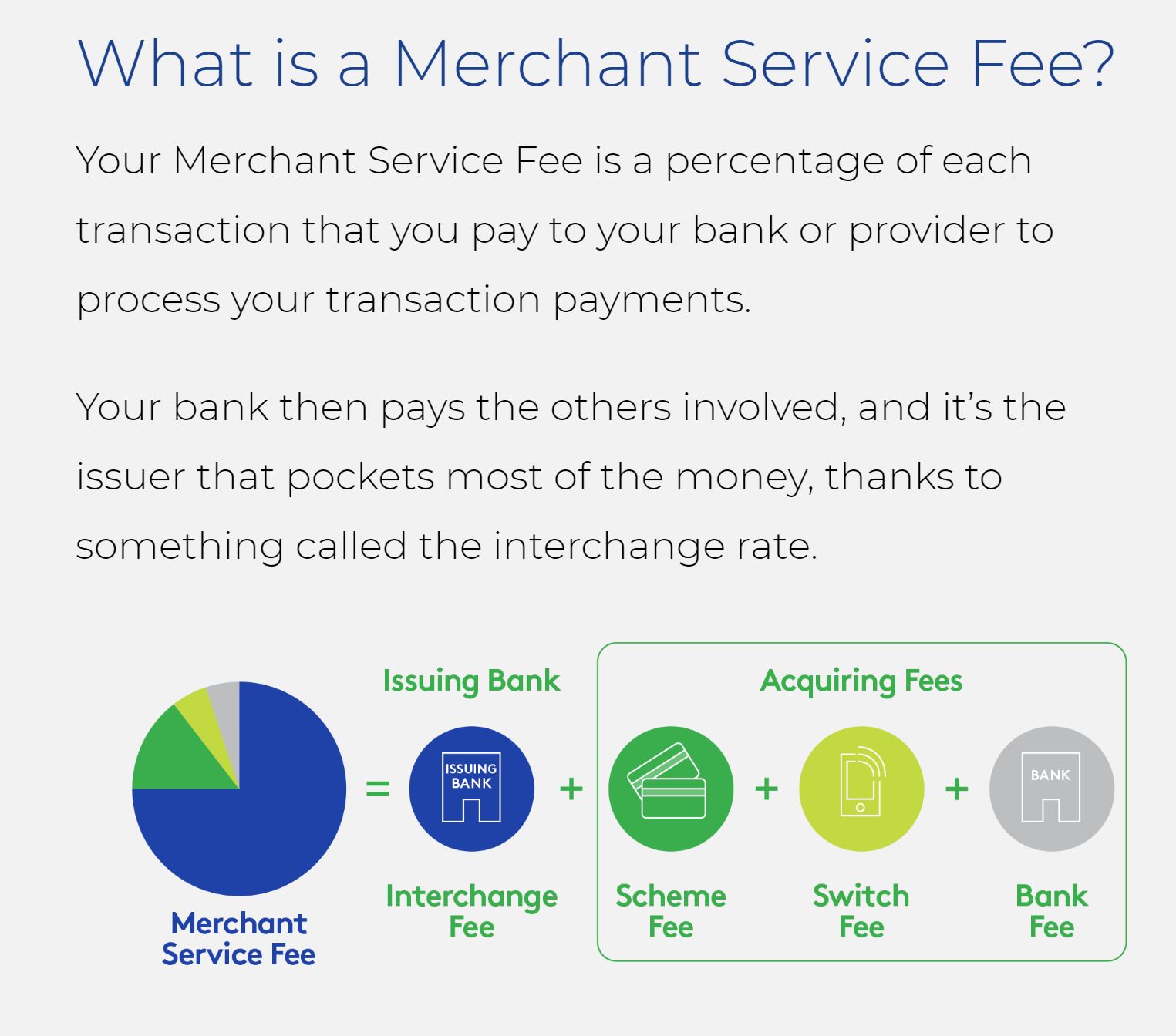

Smartpay earns revenue by collecting a share of the merchant service fee, with the rest split between the issuing bank (the bank that issued the card being used in a transaction), and the card scheme (eg Mastercard/Visa etc).

As you can see from the below image, the bank that issues the card, such as Commonwealth Bank of Australia (ASX: CBA), used in a transaction takes home the biggest slice of the pie with the interchange rate. Smartpay collects a much smaller percentage of the overall merchant service fee, which is a share of the acquiring fee earned by its bank partner, Bendigo.

Competitive landscape

The EFTPOS terminal market in Australia is a growing industry with close to 1 million active terminals that’s likely to expand through the acceleration of contactless payments resulting from COVID-19.

Out of the million terminals in Australia, it’s estimated the incumbent banks have around 93% of the market share.

Aside from the big 4 banks, Tyro Payments Ltd (ASX: TYR) is the largest of the independent providers, with just over 68,000 terminals as of December 2020 (that’s before its recent terminal issues).

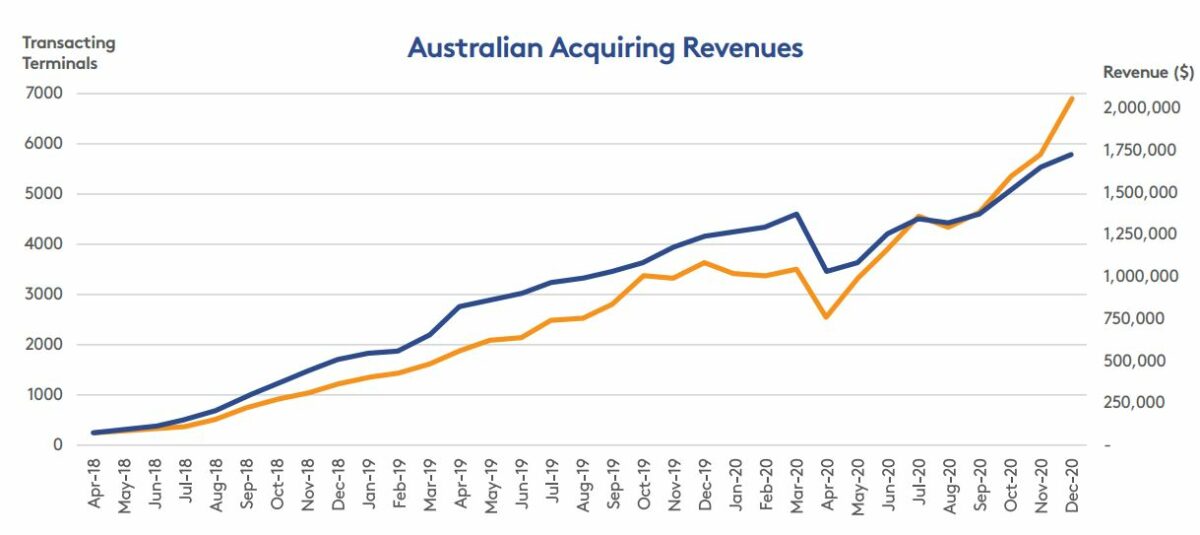

Smartpay had 5,775 transacting terminals as of 31 December 2020, which was up 35% on the prior quarter. Acquiring revenue (Smartpay’s share of the merchant fee) has grown in line with the number of terminals in use and has recovered strongly out of COVID-19.

There are a handful of other competitors including the recent emergence of Square Inc (NYSE: SQ), which has also been growing rapidly over the last 12 months.

Something important to note is the significant barrier to entry. It takes around six months to connect a new “switch” – essentially integrating a new provider to the back-end bank infrastructure. Therefore, switch providers would be less incentivised to connect much smaller players.

Setting the scene

Up until recently, incumbent banks have had the dominant position in the market due to extremely favourable regulations that have previously prevented non-bank institutions from performing the acquiring service. In other words, you had to be an authorised deposit-taking institution (ADI/bank) in order to process card payments.

Additionally, the RBA has made changes in recent years that have required Visa Inc (NYSE: V), and Mastercard Inc (NYSE: MA) to cap their interchange fees at a maximum of 0.80%. In a transaction, the interchange fee is collected by the issuing bank (the cardholder’s bank) and is partly used to fund reward programs.

This is partly why the banks have previously been in such a monopolistic position. Cards that have rewards programs charge the merchant (e.g. cafe) a significantly higher fee on the transaction value compared to cheaper schemes like EFTPOS or Visa/Mastercard. But because the customer expects to be able to pay with that card, the merchant effectively has no choice but to accept the card and pay the higher fee, meaning interchange rates could be raised with merchants having little say in the matter.

According to data from the RBA, the cap on the interchange rate has caused a decline in average fees paid by merchants in Visa and Mastercard debit schemes since the change in 2017. However, their research also indicates that despite this, smaller businesses are still typically facing higher payment costs than large businesses due to a variety of reasons.

This industry is clearly ripe for disruption as banks have previously had the ability to dictate merchant service fees.

Given that Smartpay is targeting small and medium-sized enterprises (SMEs) which have been disadvantaged by the current payment system, the potential growth opportunity appears to be significant.

Smartpay’s offering

Smartpay’s value proposition concerns its competitive pricing as well as an enhanced software platform that goes beyond the normal transaction processing service.

Its SmartCharge plan offers merchants zero merchant service fees by automatically applying an appropriate surcharge to the transaction value, effectively passing on the merchant service fee to the customer. Additionally, if a terminal has a monthly turnover of over $10,000 per month, the $30 per month terminal rental fee is waived.

Alternatively offered is a simple flat-rate plan, which doesn’t use a surcharge but has one flat rate for Visa, Mastercard, Wechat Pay and Alipay. As mentioned earlier, many merchants have to cough up a higher merchant fee when a customer uses a rewards card such as a frequent flyer card, however, this isn’t the case using Smartpay’s simple flat-rate plan.

For comparison, most of the big four banks offer plans where merchants are expected to forecast their monthly sales. If sales come in under forecast, they end up paying for transactions they don’t use. If they go over, they must pay more. Either way, the banks win.

Surcharging is an option for merchants with the big four, but it’s a little bit more complicated and time-consuming due to it not being an automatic adjustment to the transaction value.

SMP – Payments or tech company?

In addition to competitive pricing, Smartpay’s tech offering involves a software component that enhances the functionality of the terminals.

SmartConnect is the name of its cloud integration system that pairs the point of sale (POS) system with the terminal.

This removes the need to manually enter the transaction amount into the terminal and allows the merchant to access real-time transaction information, which is a feature the banks don’t have.

Additionally, SmartConnect is able to pair any POS system running on any device to its terminals, meaning devices running on PC, Mac, tablet or mobile phones are able to be connected seamlessly.

Smartpay’s software is further enhanced through its open API architecture which allows its app ecosystem, driven by third-party developers, to expand and add value.

As an example, if a new payment method was created similar to Alipay or WeChat Pay, a developer could easily integrate their app into the existing payment terminal provided by Smartpay, adding further value and creating a bigger incentive for merchants to use Smartpay’s terminals.

The bigger players have caught on and have started to accept Alipay in recent years, but Smartpay appears to be the only player that accepts WeChat Pay at this time.

Investment thesis

- A growing industry with structural tailwinds

As mentioned above, the EFTPOS market in Australia represents around 1 million active terminals. Smartpay is a fairly small player with 5,775 active terminals, or ~0.5% of the total addressable market (TAM).

The recent acceleration towards cashless payments resulting from COVID-19 is likely to be a sustainable tailwind for companies such as Smartpay in multiple ways.

Firstly, the total amount of terminals in Australia is likely to grow as merchants that previously only accepted cash are continuing to now accept debit and credit cards.

Moreover, it’s likely that Smartpay’s average revenue per terminal will increase as customers continue to move away from cash payments and preference other forms of payment.

The recent change in regulation that’s allowed non-ADI companies to accept payments has been an additional tailwind that’s catapulted much of Smartpay’s recent success.

Under the rental model that’s currently operating in New Zealand, each terminal earns on average around $48 per month on a fixed term of 2-3 years.

Since being able to perform the acquiring service in Australia, monthly revenue has jumped over 300% to around $200 per terminal as of FY20.

I think this number is likely to continue to rise as Smartpay continues to target higher value transactions, customers move away from cash, and transaction values gradually rise in line with the cost of living.

It’s a possibility that the market may be partly overlooking this growth due to the larger and mature New Zealand segment which has experienced a slight decline in revenue while the Australian business has simultaneously been growing behind the scenes.

- An attractive business model with a compelling product offering

As a small business, choosing the appropriate EFTPOS provider is likely to be influenced by a few major considerations; such as price, functionality and customer service.

Even small businesses with fairly low turnover can end up paying thousands of dollars per year in merchant fees. Due to the complexity and opaque nature behind pricing structures and interchange fees, I think this could have prevented small business owners from shopping around to find the best possible payment service provider.

Currently, Smartpay is the only player that can offer merchants zero fees through its Smartcharge plan, automatically adjusting the transaction amount with the appropriate surcharge.

As previously mentioned, the RBA suggests that small businesses continue to be disadvantaged through the current payment system and pay higher fees than larger businesses relative to their turnover.

Based on this, I think Smartpay has a clear value proposition relevant to its target market which is likely to attract more merchants to its current network.

Compared to the incumbent banks, I also think that smaller players such as Smartpay have a unique advantage in that they can specialise in payments technology rather than traditional banking services.

Smartpay’s cloud-based terminal integration system and the acceptance of Chinese payment schemes such as Alipay and WeChat Pay is a testament to its ability to adopt new technology and offer products with enhanced functionality.

It’s important to remember that Smartpay was operating profitability prior to entering the Australian market. Increased investment into the business and the non-cash revaluation of a convertible note has led to a widening net loss in recent years.

Ignoring non-cash items and focusing on underlying figures, Smartpay has an attractive business model that is currently generating positive free cash flow beneath the surface.

The New Zealand rental model is similar to an annuity-style income stream where Smartpay incurs costs involved in acquiring a new customer. After a short initial payback period of 6-8 months, the subsequent monthly revenue is recurring due to customers being on fixed-term contracts between 3-5 years.

The Australian plans do not have lock-in contracts, but growing merchant numbers and positive reviews would indicate that these cashflows could also be viewed as a similar annuity-style income stream with close to a 100% EBITDA margin.

I think it’s a possibility that as the Australian segment matures out and fewer terminals are added to its fleet, Smartpay’s largest costs of depreciation and costs of sales will decrease accordingly resulting in expanding margins and increased profitability.

Valuation

Even after Smartpay’s shares have rallied around 50% over the last six months, I still think the current valuation is reasonably fair based on my own estimates of Smartpay’s intrinsic value.

The major catalyst which caused it SMP shares to rerate towards the end of 2019 was the announcement that Verifone would acquire the New Zealand business and its assets for the sum of $70 million, which was more than double the market capitalisation of the entirety of Smartpay at the time.

However, the transaction was terminated due to certain conditions not being met before a cut-off date. No plans or new offers have been made for the NZ business and as such, my valuation assumes that this segment will remain as well.

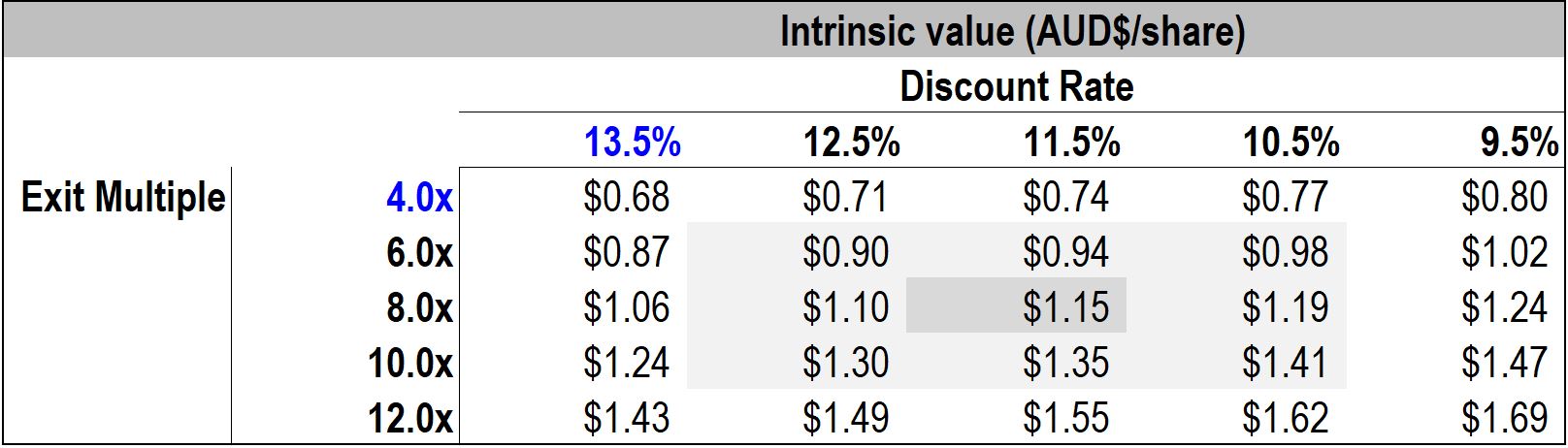

My discounted cash flow (DCF) model on SMP assumes that New Zealand revenue will remain constant and that Australian revenue is a function of the amount of transacting terminals which are assumed to increase by 2,500 terminals per year.

Even under some less-than-ideal assumptions regarding the discount rate and the terminal value, my estimate of intrinsic value gives a range of values that are relatively close to the current market price.

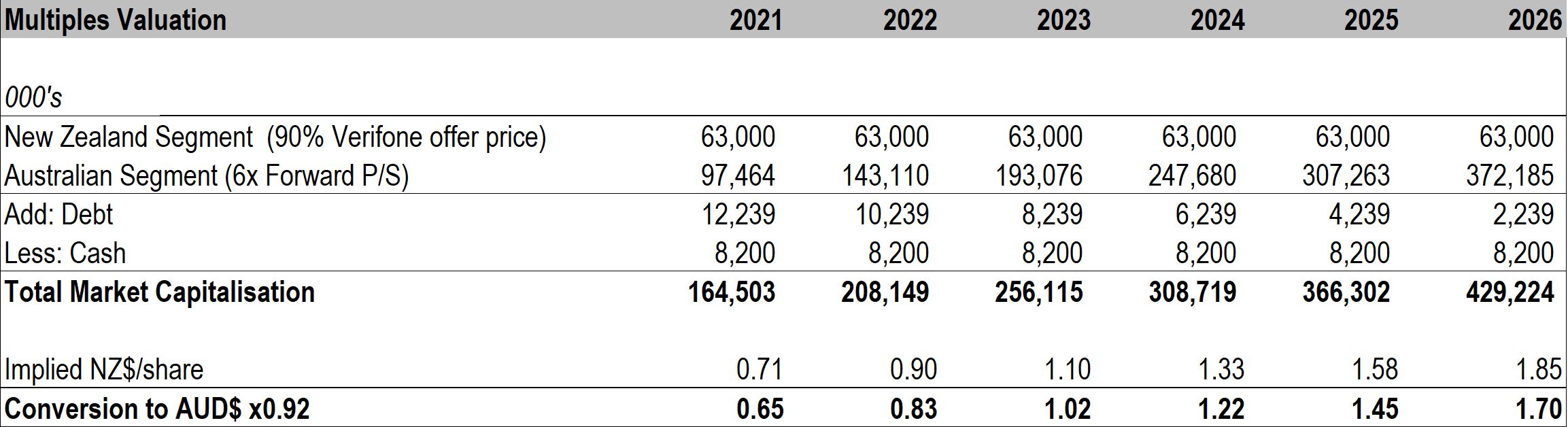

I’ve additionally used a multiples valuation method to estimate the value of SMP shares.

This SMP share price valuation assumes that the NZ business will continue to be valued at 90% of Verifone’s $70 million offer as a margin of safety. I assigned the high-growth Australian segment a 6x revenue multiple, adjusted for the debt and cash position, then converted to AUD$.

In such a high growth industry, it’s important to realise the limitations of valuation models and their sensitivity to growth rates and other assumptions.

Rather than trying to estimate an exact fair value, I’ve used these valuations as a rough sanity check. Taking an average between the two methods results in an estimate that’s more or less the same as the current market price of around $0.90.

Management

There’s a bit of interesting history behind Smartpay’s key management personnel over the last few years that somewhat weakens my overall conviction of the company moving forward.

The driving force behind the Australian growth story, Bradley Gerdis, resigned from his position of CEO in August 2020 after being with the company for around seven years. Bradley was formerly a founding executive of a successful ASX-listed ATM and payments company that grew from a start-up.

Bradley was assigned 15 million share options split into three tranches able to be exercised progressively at 30 cents, 40 cents and 60 cents between 2014 and 2018, all of which expired worthless with the share price at the time below the respective exercise price.

At the time, it seemed to me that Gerdis would have wanted to be compensated for the lost options, but the board was unwilling to come to any sort of agreement. While not explicitly stated, it seems to me that this was likely a contributing factor behind his resignation.

Gerdis was replaced last year by Marty Pomeroy, who was formerly the Chief Operating Officer within Smartpay. Although Marty has been heavily involved within the Australian and New Zealand business, there’s a limited track record of performance in his current position and not a significant amount of shareholder alignment in my view.

Marty’s share options also expired recently, which means there’s now no management options on issue, as well as any sort of long-term incentive plans. Short-term incentives are in place to encourage management, but all metrics are undisclosed making it difficult to judge the level of alignment this provides to shareholders.

CEO’s may leave a company for many reasons, but I think Bradley’s resignation came at such a pivotal time where Smartpay was only beginning to establish itself in the Australian market.

Please note that Marty and Bradley do still have skin in the game and hold around 3.3 million and 6.5 million shares, respectively.

Smartpay’s management isn’t a total thesis buster at this stage, but if either Marty or Bradley were to sell down their positions, it would likely further weaken the investment case.

Risks

Increased competition will be one of the most significant risks faced by Smartpay as it continues on its Australian expansion in my view.

On average, merchant service fees are around 1-1.5% of the transaction value, but Smartpay’s share of the bank acquiring fee is a fraction of this amount again. The RBA’s data suggests that businesses are paying less in merchant service fees since introducing the cap on interchange fees.

It’s a real possibility that rival EFTPOS providers could offer merchants even lower fees which Smartpay might have to match to remain competitive, putting further downwards pressure on margins.

That being said, merchants that use Smartpay’s automatic surcharging plan might not consider this too much as they’re effectively paying zero merchant fees anyway.

On that topic, I’m not sure what’s stopping other EFTPOS providers from introducing their own automatic surcharging plan which would level the playing field on price to an extent.

Tyro’s terminal connectivity issue which occurred at the start of this year highlights an additional risk that suggests to me that switching costs aren’t as high as I originally thought. For those unfamiliar, Tyro had an intermittent issue where terminals weren’t able to process card payments, resulting in lost revenue for small businesses and some very unhappy customers.

Some anecdotal stories I read at the time indicated that affected customers were prepared to switch EFTPOS providers after just one bad incident, something that could also potentially happen to Smartpay, especially considering it doesn’t have lock-in contracts in its Australian business.

Not only does this suggest to me that Smartpay’s switching costs aren’t very high, but I think it also highlights the need for the ongoing investment required to maintain and upgrade its terminal fleet.

Summary

Despite the potential risks, Smartpay appears to be executing well on its Australian expansion evidenced by its continued growth in active terminals and acquiring revenue. I think this upwards trajectory is likely to remain as small businesses continue to seek a lower cost EFTPOS solution with enhanced functionality.

In a disruptive industry such as this where incumbent players have previously had a monopoly, I’d much rather be backing a strong new entrant due to the potential upside rather than a larger player that must compete just to retain its market share.

Smartpay is a high-risk investment that’s success will mostly be contingent on the continued expansion into the Australian market. Provided It can continue to grow its terminal fleet, I think Smartpay is on track to reaching an inflection point on a profitability basis which is likely to experience further margin expansion through its capital-light business model and recurring revenues.