This morning, audio and video networking chip manufacturer Audinate Group Ltd (ASX: AD8) released its results for the first half of FY 2021. For the half-year, Audinate recorded revenue of $15.4 million, down 4.8% on the first half last year. Audinate made a loss of $1.2m over H1 FY2021, and this would have been more like $2m but for the $0.8m in covid related government grants received.

The Audinate share price of $8.55 at the time of writing gives the company a market capitalisation of about $650 million, putting the company on about 21 times revenue based on annualising the first half. This is a fairly full multiple for a software company, and indicates a return of optimism about Audinate, which has seen its share price rebound to pre-covid levels.

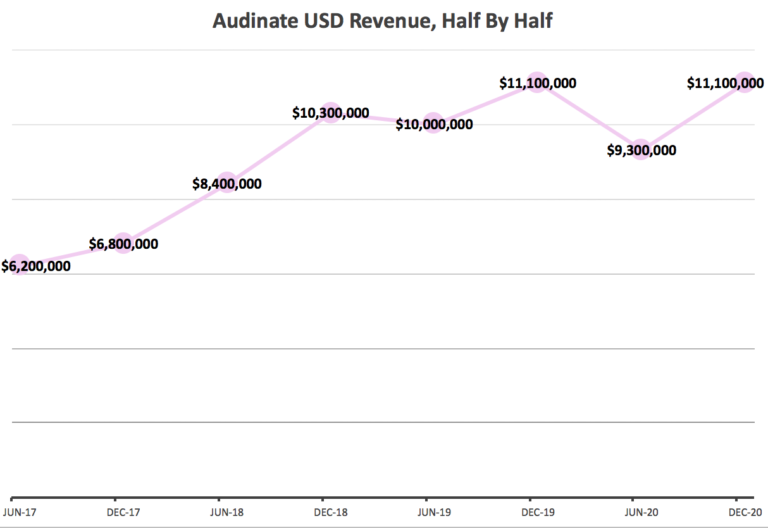

We like to track Audinate’s revenue in US dollars, since that gives us a better view of its underlying business. As you can see below, these results signal the return of revenue to pre-pandemic levels. That’s good to see.

Arguably, shareholders should be expecting record revenue next half, given the company touted “good demand for Dante products heading into the second half”, during the conference call.

Audinate Removing Upfront Fees, Increases Design Wins

Previously, Audinate would require upfront fees when it won a design brief from a company. More recently, the company has offered a different model where they remove the upfront fees and instead “charge an annual licence fee which is for the Dante tech.” This has helped boost design wins.

Arguably, the best news in the Audinate first half 2021 results is that the company achieved 51 design wins during the period. This record result implies a good pick up in new products containing Dante products, in future periods.

Audinate Network Effect Business Model

As we have discussed before, Audinate has an adaptive, enabling business model that allows it to grow when its customers grow. Not only that, but the business model takes advantage of network effects that mean its Dante protocol becomes more attractive as it is adopted by more different original equipment manufacturer customers, because all end users value interoperability.

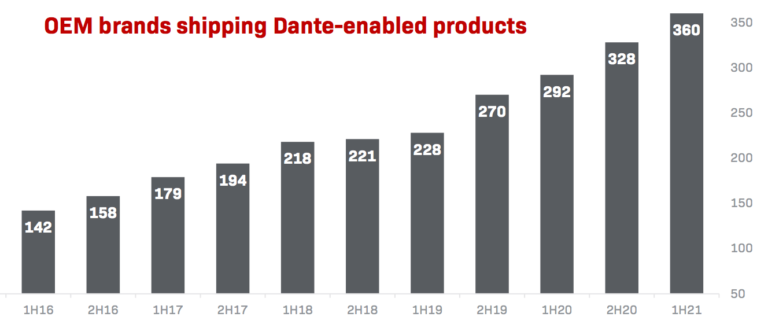

Happily for shareholders, the pandemic has not slowed the improvement in business quality, even though revenue did take a hit. Still, it is simply a fact that the company continued to grow its numbers of original equipment manufacturer customers, and that this is good to see. The image from their recent presentation, below, sets the recent growth in context.

While one would expect fewer new products shipped during a pandemic, Audinate has still managed to grow the number of products containing its technology. This implies that it has a resilient business model.

Audinate Moving From Audio Only To Audio Visual

One of the biggest developments in this report is the announcement of a new development team focussed on video products, based in Cambridge. Most of the hiring for this initiative took place in the second half, so the first half results do not reflect the increased spending on employee expenses.

Strategically, the decision to hire a team to accelerate video product development looks inspired. On the conference call the company said that when Synaptics completed its acquisition of DisplayLink, it “rationalised their headcount laying off 50% of staff.”

Given that Audinate already had “a preexisting relationship with team leads in that group, in Cambridge,” the company acted quickly to hire some newly available individual researchers and build a new video technology team. While it is far from certain that the increased R&D spend will succeed, it certainly makes sense to go for it, as expansion into AV has “the potential to double our audio networking business, in time” according to management. And they are not betting the company on it.