The Nearmap Ltd (ASX: NEA) share price is up almost 10% this morning, after the company presented relatively strong half year results for the first half of FY 2021. Revenue was up 18% to $54.7 million for the half year, while the half-year loss was reduced to $9.4 million.

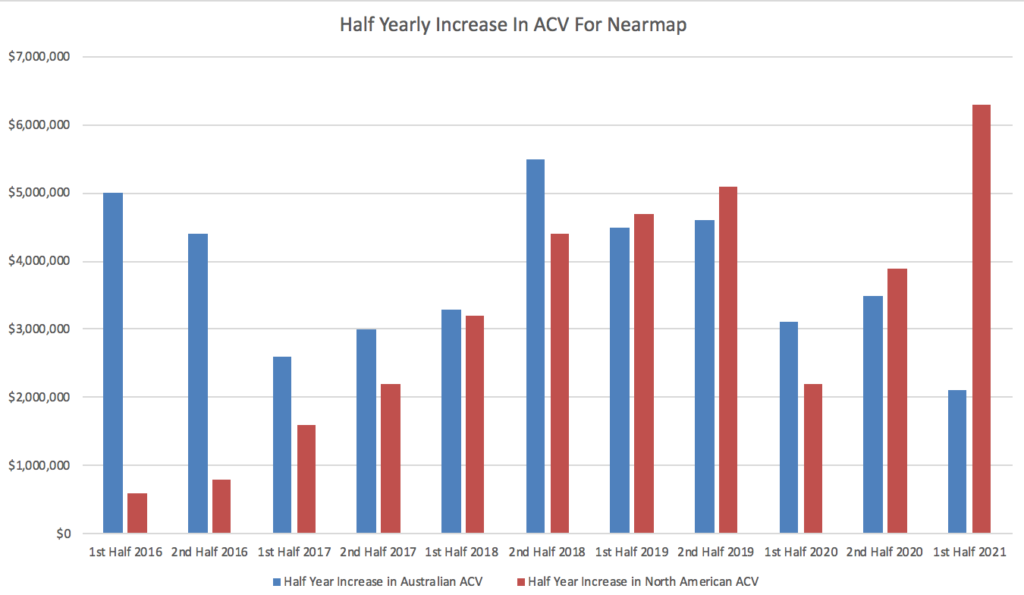

As a company, Nearmap tends to focus on its annualised contract value (ACV). While this does have some flaws as a metric, in the half year to December 2020, the company had a great deal of success increasing revenue from existing clients. This drove a strong increase in ACV, as you can see in the chart below.

As is so often the case with Nearmap, the devil is in the detail. In this case, the amount of ACV contributed by new customers was down 43% to just $4.9 million, with the entire North America market signing just $2.6m worth of new customer contracts. To spell it out, this means that future growth by upsell will be harder.

Our research indicates that Nearmap does drive through price increases on a regular basis, and while this shows the utility of their services, it also opens the door for higher churn if they are too relentless with price rises. The CFO admitted that the reason for the low new customer contract revenue was because “we didn’t have any material new customer wins in North America, this half.” One is inclined to look past this given covid has genuinely disrupted the whole of the North American society.

Nearmap Results Highlights For H1 FY2021

The best part of Nearmap’s results from a superficial perspective is that the company actually generated a little bit of free cashflow this half. However, this was only achieved because the company paid many employees 20% of their salary in shares during the year, as a response to covid. In reality, it seems the business is well and truly still burning through cash. On the upside, having raised $95 million in September 2020, Nearmap is well capitalised to continue its cash incineration with over $125 million in the bank.

Ultimately, this business may be of lower quality than the market thinks, simply because competition is more serious in North America than people realise. Potential Nearmap competitors in the US include: Google Maps Platform, Maxar Technologies, Planet.com, Hexagon, Eagleview, Mapbox, Vexcel Imaging, and Sanborn.

To read the full version of this article, please visit A Rich Life.