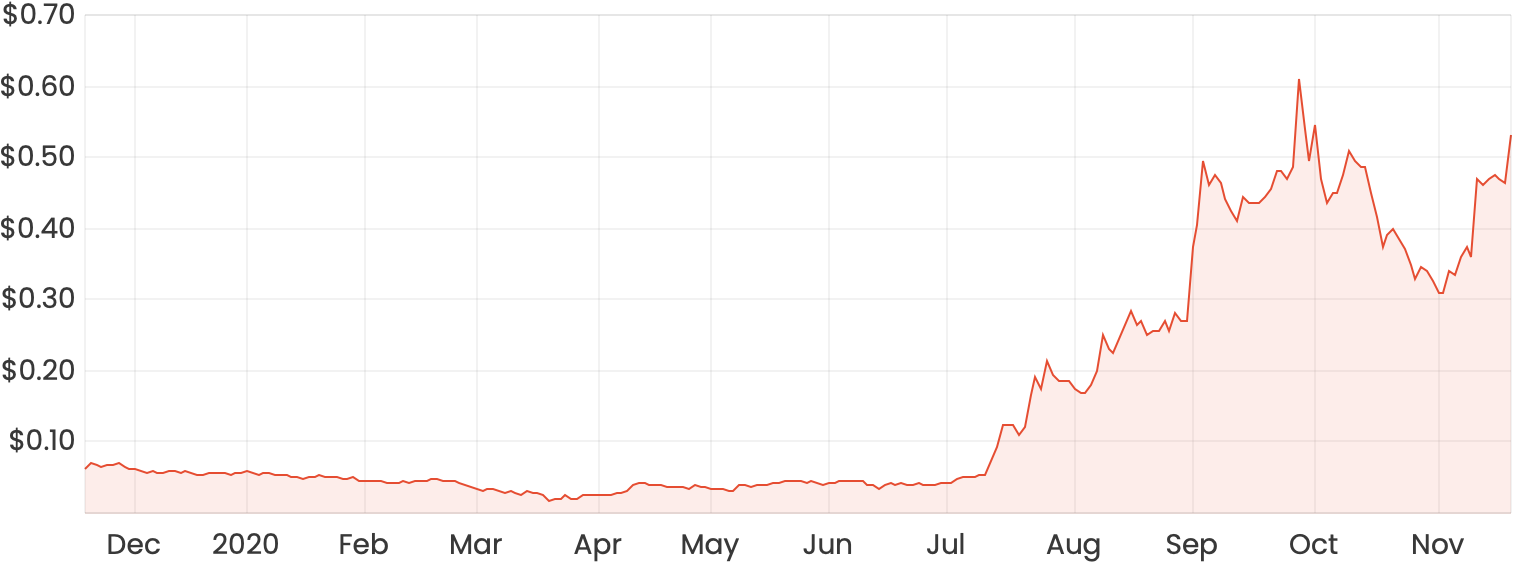

Shares in geospatial technology company Pointerra Ltd (ASX: 3DP) have been highly sought after this week after a fairly significant sell-off over these last couple of months.

The Pointerra share price shot up more than 30% in just one day last week, and currently sits at $0.51 at the time of writing.

3DP share price

What does Pointerra do?

Pointerra allows its customers to work with large 3D datasets in a cloud-based environment. Its customers include surveyors, drone operators, regulators and pretty much anyone who captures large amounts of 3D data and needs this data to be analysed and managed. It essentially works by taking raw 3D data and manipulating it into usable models.

My latest thoughts on Pointerra shares

I was a shareholder of Pointerra last time I wrote about the company, but I’m not anymore. However, this wasn’t in relation to my underlying sentiment towards the company.

My only criticism of Pointerra was regarding the valuation aspect. From that point a few months ago, not much has changed since.

If you were to try and come to a valuation today based on Pointerra’s current financials, the valuation is still looking quite stretched with shares trading at just over 51x the company’s annualised contract value (ACV).

Featured video: SaaS valuation explained

Recent developments

If the market is prepared to put such a high price tag on Pointerra shares, it must be expecting some big things to come. Here are a couple of things that stand out to me so far.

Just a few days ago through the company’s LinkedIn account, Pointerra shared that it would be presenting at US-based event Tech-Palooza – an event hosted by the Army Research Office, Emerging Technology Institute, and Practical Scientific Solutions. Pointerra will demonstrate its 3D data analytic capabilities for mission planning and execution to the US Army and other special operations agencies.

Pointerra stated in its most recent quarterly that the feedback received from the US defence sector has been positive and that it’s received multiple invites for additional demonstrations from different agencies.

The US utilities sector remains as the primary growth driver for Pointerra, however, the US defence sector is looking promising.

Buy, hold or sell?

In my books, the Pointerra share price remains a hold. I would personally need to do a lot more research into these emerging sectors to get a better idea of the size of this opportunity.

I know there are many people out there who have done this research and have spoken to management and customers of Pointerra with nothing but positive remarks. To them, I’m sure $0.50 per share looks attractive considering their perceived growth potential of the company.

As I have not, it would just seem slightly too speculative for me personally to buy right now at these levels.

For more share ideas, you can read about a couple of my favourite ASX tech shares in this article: 2 ASX tech shares I’d happily buy today