2020 has been an exciting year for anyone following the Pointerra Ltd

(ASX: 3DP) share price.

Although the company has seen significant growth in the value of its contracts, the majority of the growth I am referring to is, of course, its valuation.

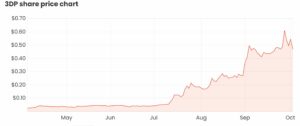

From July, Pointerra shares have risen more than 1000% and are currently trading at $0.47 at the time of writing.

What does Pointerra do?

Pointerra allows its customers to work with large 3D datasets in a cloud-based environment. Its customers include surveyors, drone operators, regulators and pretty much anyone who captures large amounts of 3D data and needs this data to be analysed and managed.

The company’s competitive advantage lies within its intellectual property, which allows for the manipulation of this 3D data to be efficiently turned into useable 3D models.

Pointerra collects revenue in a few different ways. Firstly, it charges a fee to process and analyse the data that is then managed. It also charges its customers based on the amount of data that is hosted on its platform. The company also allows its users to sell their 3D data to buyers, with a revenue share agreement between the seller and Pointerra.

Rendering huge amounts of 3D data typically uses large amounts of computing power. Pointerra’s cloud-based servers allow its customers to view huge 3D data sets remotely without having to possess the necessary computing power.

What’s caused the hype in the Pointerra share price?

In July, tech entrepreneur Bevan Slattery, who also founded NextDC Ltd (ASX: NXT), Megaport Ltd (ASX: MP1) and Superloop Ltd (ASX: SLC), bought $2.5 million worth of Pointerra shares at $0.05 each.

This announcement has been the major catalyst which has seen shares in Pointerra go in a one-way direction since.

Concerns about Pointerra shares

Pointerra has only just recently reached a cashflow inflection point and breaks even on an annualised contract value (ACV) basis. Like many companies that are in an early stage of their lifecycle, the Pointerra share price reflects the market’s expectations of future earnings potential.

While I do think Pointerra operates in an exciting new space, my biggest concern is that the market has gotten ahead of itself and priced in levels of growth that are extremely optimistic.

If this is the case, there is the possibility that this could shape up to be a very asymmetric return. If Pointerra can achieve growth rates that are in line with the market’s expectations, the current share price will then be justified.

But if the opposite happens and Pointerra can’t achieve this level of growth, you can guess what will most likely happen to the share price. The point is, at current valuations, I think the downside risk is greater than the upside gain.

I do hold Pointerra shares, but I don’t know if I would be buying more at current levels. This one will have to play out over the long-term and is entirely dependent on how management can successfully execute its growth strategy.

If you would like some more insight into Pointerra, check out the following podcast with Rask founder Owen Raszkiewicz and Strawman.com founder Andrew Page.

If you’re looking for a tech stock that is less of a punt, I’d prefer Integrated Research Limited (ASX: IRI). It’s gone through a pretty significant pull-back recently and I think it could be in the buy zone. Here’s an article I wrote recently about why I think Integrated Research could be a further wealth winner.