The Catapult Group International Ltd (ASX: CAT) share price traded 7% higher today following the release of its annual report.

For context, the broader Australian share market or S&P/ASX 200 (ASX: XJO) was trading at 6107.5, down 0.97%.

Catapult International is a sports technology business probably best-known for the GPS trackers that sit on the back of the shirts of professional sportspeople at teams like Richmond in the AFL or Real Madrid in European soccer.

Catapult technology allows coaches and staff to monitor player performance and improve gameplay. The company has also branched out to provide services for media organisations and for semi-pro sportspeople.

Featured video: how to read an annual report quickly

In the video above, Rask Invest analyst Owen explains how analysts read an annual report quickly, including the 7 pieces of information to look for. You can take one of Owen’s free finance courses by clicking here.

page.

CAT’s key results

| This period | Change | |

| Revenue | $100.7 million | +6% |

| Subscription revenue | $77.6 million | +21% |

| Free cash flow | $8 million | N/A |

| Average customer duration | 6.5 years | Down from 6.7 years |

Source: Catapult Group International Ltd announcements; author calculations, AUD millions unless otherwise stated.

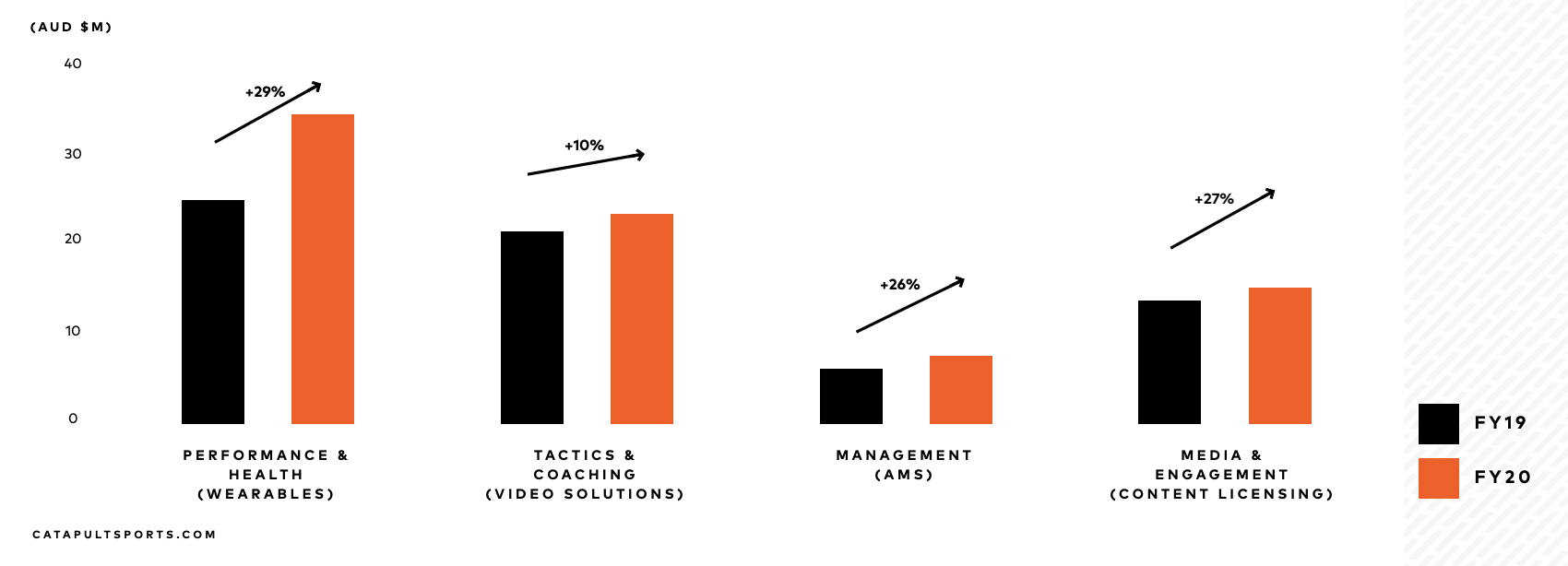

Across each of Catapult’s solutions and services, subscription revenue increased. This came despite a fall in capital or one-off sales which are obviously not recurring.

After years of running with cash burn, the recently appointed CEO Will Lopes said this result is a reflection of the lower costs and inherent operating leverage within the business.

“This positive cash flow inflection points means we are a great SaaS business that is well-positioned to scale while delivering great service to our customers and value to our shareholders,” Lopes said.

The company will look to keep reinvesting in its core business of Pro athlete software, management and media, while also staying cash flow positive.

What now?

Catapult is moving into FY21 and will change the way it reports. For example, it will change the timing of its financial year, resulting in a nine-month financial year in FY21, and begin to report results in USD. The company said this better aligns with its customers’ sales cycles and the fact that 70% of revenue comes from the Americas.

Catapult Group International shares were last seen trading at $2.21, giving the company a market capitalisation more than $400 million.