They’ve been around for quite a while now but, for some, they still elicit a fearful response. We take a closer look at ETFs and try to dispel, debunk and decipher this misunderstood product.

ETFs have changed the way we invest. In days gone by to put some money in a managed fund we filled out a form, wrote a cheque and mailed it in to the fund manager. The fund manager used our money to buy some physical assets like shares or bonds and we received our share of capital gains or losses plus any income distributions the fund paid out. It was easy to understand the transaction flow from our bank account to the fund manager and back again. We owned units in an investment trust and could see the value of those units change at the end of every day when the fund’s NAV was calculated. To get our money back we filled out a form again and received our money a few days later. Money in, units bought. Units sold, money out.

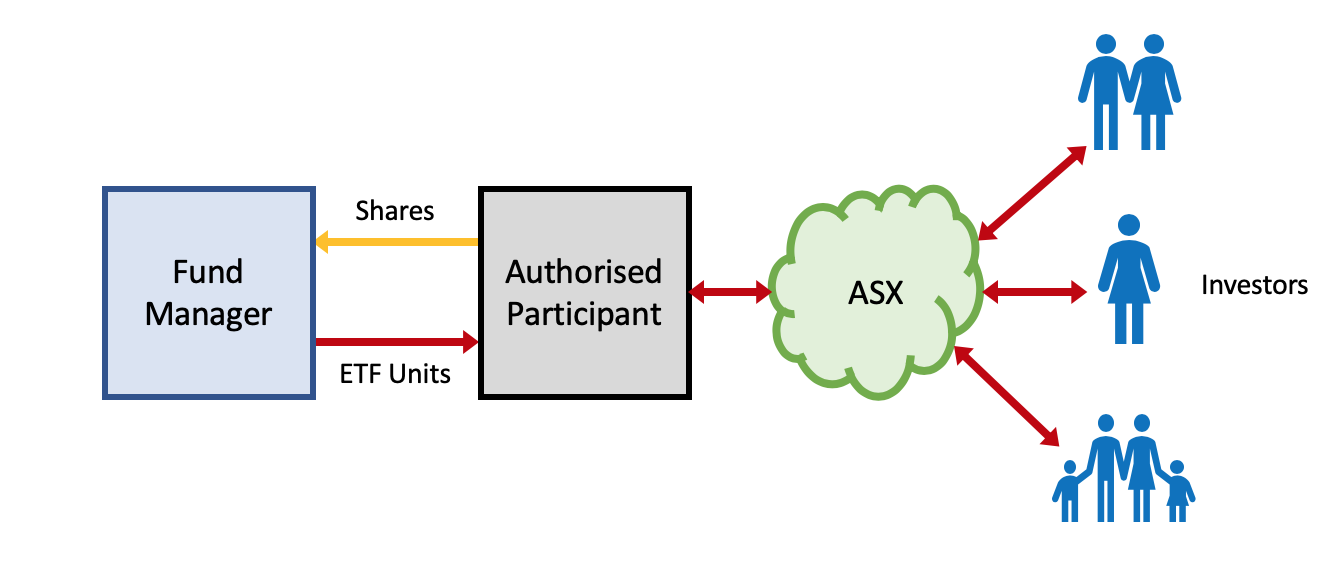

The advent of ETFs has changed this interaction. ETFs are traded on a stock exchange, just like shares. The investor doesn’t interact directly with the manager of the investments and, to some, this is troubling. But the ETF process makes things easier for investors. Here’s how.

It’s still the same, just different

One thing to be clear about is that an ETF unit is the same as a unit in a managed fund. It’s still a claim on a proportion of the assets in a pool of investments. The value of an ETF unit goes up and down just like the value of a unit in a managed fund. It pays distributions and may have some franking attached to it. The only difference is how you acquire it. Being exchange-traded means there are regulations about how the units are bought and sold, as well as disclosure requirements and other legal protections to ensure that investors can have confidence in their investment.

The big difference is the fee you pay

Fund managers like ETFs because client management is not required. This allows them to lower their fee. ETF management fees are small compared to the fee charged on an equivalent managed fund, which means investors keep more of their own money. There are brokerage fees to consider but these aren’t charged by the manager.

How did the units get on the stock exchange?

To fully understand how ETF units are created let’s look at this diagram.

Between the manager and the investor, we have a new player: the Authorised Participant. The Authorised Participant (“AP” in the jargon) has a non-exclusive arrangement with the fund manager to be the intermediary between the stock exchange —the market for units — and the fund manager. To create new, tradeable units of the managed fund the AP trades directly with the manager. The AP buys units in the fund from the manager but instead of paying in cash the AP gives the manager a portfolio of shares which are equal in value to the units received. The manager decides which shares will be accepted based on the composition of the fund. The reverse applies if the AP is redeeming units. It’s this creation/redemption process which keeps the market price of the ETF very close to its fair value.

The AP holds an inventory of ETF units and stands in the market as both buyer and seller. For his role as a market maker the AP has been able to acquire units of the fund at the fair value or NAV which are then offered on the market at a slightly higher price. The AP will also be a buyer at a slightly lower price. It’s akin to buying wholesale and selling retail. This is the AP’s “spread” and it represents a margin which should cover the AP’s costs.

To buy or sell ETF units it’s a simple matter of transacting on the exchange at the best available price, just as you’d do if investing in shares.

Am I getting the right price?

Traditional fund investment guarantees that an investor will transact at the NAV price of the fund, with the fund manager’s buy/sell spread added. When you buy an ETF, you get the current trading price; it’s a “live” market, so you’re getting the “real time NAV”. The ETF price fluctuates continually as the prices of the shares in the underlying fund change. The ETF units should always trade close to their fair value; the dynamics of the stock market and the creation/redemption process ensure it.

What about liquidity?

You can deposit a cheque of any size with a fund manager and it will be accepted at the NAV price. There are no issues with getting your funds invested or getting them back when you need them.

An ETF, as a listed security, relies on supply of and demand for units. For most retail-sized trades there will be ample liquidity in the market to allow any transaction to be completed almost immediately.

ETF sponsors will gladly assist with large trades to ensure that they happen at a fair price. If you wanted to purchase or sell an unusually large number of units you or your adviser could contact the sponsor and arrange what’s called a “block trade” at an agreed price. A large trade would not be constrained by the liquidity available in the market.

Generally speaking, the bigger ETFs will have greater liquidity. Daily trading volume statistics from the exchange will give a good indication of the turnover of an ETF.

What about liquidity in a crisis?

When markets are falling, selling at the right price is important. Having an AP in the market is likely to increase liquidity compared to a managed fund which, in a crisis, could close the fund to transactions. ETFs have survived three global crises – the worst being the GFC in 2008 – an emerged unscathed. In the GFC there was actually a global switch into ETFs at the expense of actively-managed funds.

Are ETFs getting too big?

ETFs have grown to a $50 billion market in Australia in just over 10 years. In the first six months of this year flows to ETFs were $5 billion. Some estimates have the ETF market reaching $100 billion by 2022. Even at that size there’s no reason to think that ETFs distort markets or affect pricing of securities. The size of the market is a testament to ETFs’ suitability to the majority of investors. Much of the negative commentary has been from active funds which are seeing their market share eroded by ETFs’ success.

Investors should also understand that the legal structure of ETFs ensures that assets are as safe as those held in managed funds. In the unlikely event that the sponsor of an ETF should fail, the assets are held in a legally-separate entity and the regulators will pass the management of those assets on to another manager. There would be very little disruption to investors.

Since they’re listed, should I trade them?

In short, no. The temptation to trade ETFs like a day trader is always there but high trading costs, tax and other slippages will make over-trading a poor strategy for long-term wealth creation.

What should I look out for?

Just because they’re listed on the exchange doesn’t mean all ETFs are equal. Potential investors should always do their due diligence. Choose an ETF with an underlying index that’s suitable for your own investment needs. Ensure that the sponsor of the ETF is a reputable name with a good track record in investment products.

Don’t fall into the trap of performance-chasing: many ETFs are launched when their asset class has had a positive return in the previous months but run out of puff after launch.

Most ETFs are backed by physical securities, meaning that the underlying fund invests in physical shares or bonds. Some others, particularly commodity ETFs such as gold and oil, use derivatives, often futures, to get their market exposures. From a risk-minimisation perspective a physical asset is a much safer exposure. Investors should be mindful of the underlying assets before investing.

And, as always, look for ETFs with low fees. As domestic cash rates approach zero the fees you pay are more important than ever to your investment performance.

What’s on offer?

There are almost 200 ETFs available on the ASX in a range of asset classes and sectors. From domestic to international equities, global bonds and commodities, as well as some “exotic” ETFs which include leverage, reverse-market performance or derivative exposures, investors have a wide choice of exposures available through ETFs. You are our advisor can select the most appropriate for your circumstances and objectives.

What’s pretty certain is that the broadly-diversified equity and bond ETFs will continue to dominate the market since they give investors a very low-cost way to attain the core-portfolio exposures they provide. As they grow in size their fees are sure to reduce even further. The lowest fees in US-listed ETFs are 0.03% and we’re not far away from that here.

Embrace the new

ETFs offer a low-cost entry into a well-diversified investment.

Equity ETFs follow broad market indices and give even small investors access to entire markets including Australia, Europe, US or the world. Fixed interest ETFs bring the diversification benefits of global and domestic government and corporate bonds within reach of ordinary investors. The cost savings, compared to managed funds, are an additional benefit, especially in today’s low-return environment. ETFs are a valuable tool available to everyone.

Don’t be afraid of them; embrace the new.

[ls_content_block id=”21919″ para=”paragraphs”]