Here are the headlines from the S&P/ASX 200 (INDEXASX: XJO)(ASX: XJO) and Australian finance circles on Wednesday morning.

But first, here are the data points:

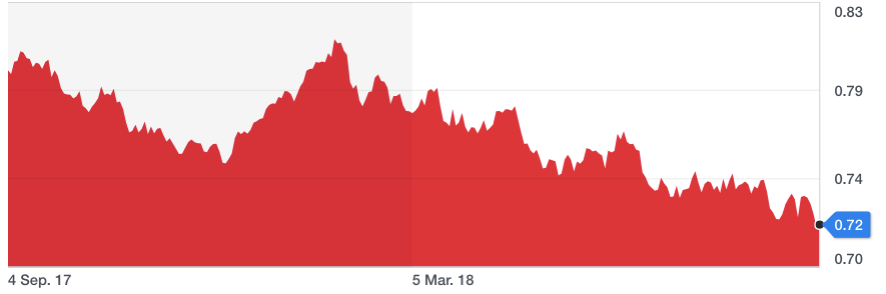

Australian Dollar ($A) (AUDUSD): 72 US cents

Dow Jones (DJI): flat

Oil (WTI): $US69.40 per barrel

Gold: $US1,197 per ounce

Australian Investing News

Investors have kept a keen eye on the Australian Dollar (AUDUSD) in recent weeks, as continued weakness in economic data dampens the outlook for the local economy.

Yesterday’s decision by the RBA to keep interest rates flat at 1.5%, and the commentary that followed, appears to have done little to ease the downward pressure on the Aussie dollar.

Today, Australia’s second-quarter GDP result is due to be released, plus we’ll have some data from abroad, including the latest US trade balance.

In company-specific news, Westpac Banking Corp (ASX: WBC) will face the news again today after the bank admitted it had breached its lending obligations and will pay a $35 million civil penalty.

“The litigation related to Westpac’s home loan assessment process during the period December 2011 and March 2015, during which approximately 260,000 home loans were approved by Westpac’s automated decision system,” the financial watchdog, ASIC, said in a media release.

Westpac approved 100,000 of these loans using either incorrect expense estimates or without assessing the loan applicant’s ability to service the loan at the end of the interest-only period.

“Of these approximately 100,000 loans, Westpac should not have automatically approved approximately 10,500 loans,” ASIC stated.

Read more: Westpac Has Been A Very Naughty Bank

National Veterinary Care Ltd (ASX: NVL) announced Tuesday afternoon that it would acquire a clinic in New South Wales, which will add an estimated $1.6 million in annual revenue to the company.

Toll roads business Transurban Group (ASX: TCL) announced the successful completion of the institutional component of its $4.2 billion capital raising.

“The acquisition of a 51% equity stake in WestConnex is a milestone for Transurban and its consortium partners. We thank our investors for supporting this transaction and look forward to working with the NSW Government as our partner for WestConnex,” Transurban CEO, Scott Charlton said.

Transurban will now undertake the retail shareholder offer. Click here to learn what an entitlement offer means.

Australia’s Best* Investors Podcast

The Rask Group’s Australian Investors Podcast is fast becoming Australia’s #1 podcast for serious investors. It provides unique insights from Australia’s best investors, entrepreneurs, authors and financial thinkers. Download the latest episode free on iTunes, Castbox, YouTube or wherever you choose to listen. Here’s a timeless interview with leading stockbroker, Charlie Aitken.

*as voted by us