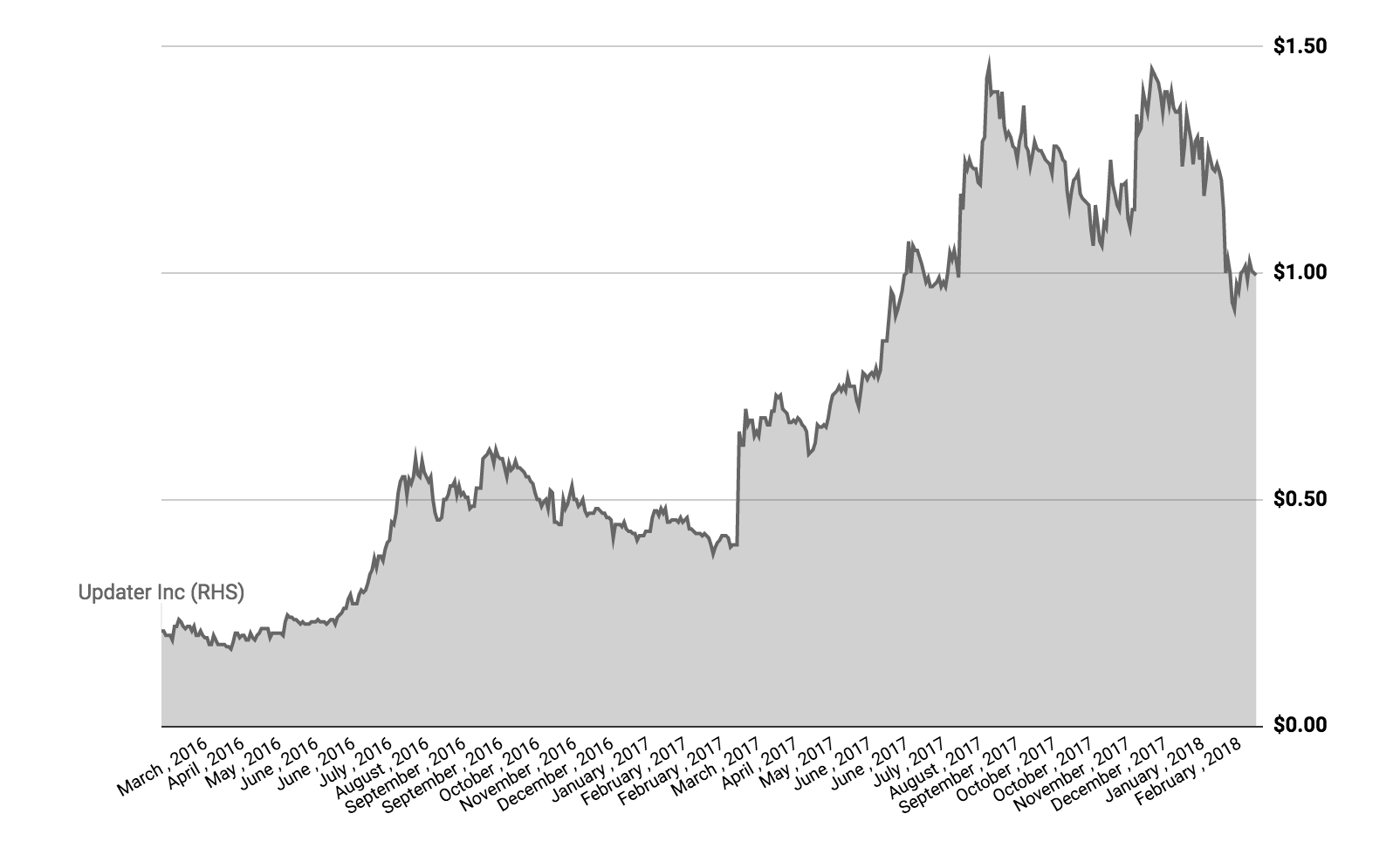

Updater Inc (ASX: UPD) released its preliminary final results to the market this morning, causing shares to rise 15% to $1.14 at the time of writing.

Updater is a $600 million New York-based technology company which helps people when they move house. From real estate agents through to title management and moving companies.

On Tuesday, Updater reported that:

- Revenue grew 267% to US$2.235 million

- Loss after tax was US$13.7 million

- Cash and cash equivalents were US$49.7 million (approximately A$63.6 million)

- Updater has an estimated 15% market share of Moves Processed in the USA

A few months ago, Updater management stated that the company would aim to sell business products in 5 new ‘verticals’ (verticals = business lines such as insurance or full-service moving):

If these goals are met, Updater management expects that 2018 revenue will rise to US$19 million to US$23 million – up to a 10x increase from 2017. That would be solid progress for a company that was recently identified as a top short-selling idea by Tribeca Investment Partners, who thought:

“With little in the way of revenue, no earnings in sight, and a >$700m market cap, the share price has run too hard.”

Short sellers bet that companies are overpriced, and try to make profits when the share price falls. Tribeca appears to be saying that Updater is overpriced for what it has achieved so far. It will be interesting to see if Tribeca changes their view following Updater’s latest forecasts.

Join Rask’s Investor Club Newsletter Today

You can join Rask’s FREE investor’s club newsletter today for all of the latest news and education on investing. Join today – it doesn’t cost a thing. BUT, you’ll need a good sense of humour and a willingness to learn.

Keep Reading

Disclaimer: This article contains general information only. It is no substitute for licensed financial advice and should not be relied upon. By using our website you agree to our Disclaimer & Terms of Use and Privacy Policy.