In a “mutual agreement”, Vocus Group Ltd (ASX: VOC) CEO Geoff Horth has been shown the door by the telecommunications company’s board.

Vocus Group is the $1.5 billion company behind telco brands such as Dodo, Primus, Orrcon, Commander and more. The Vocus Group of today was formed by a series of large-scale acquisitions including M2 Group, Amcom and Nextgen Networks.

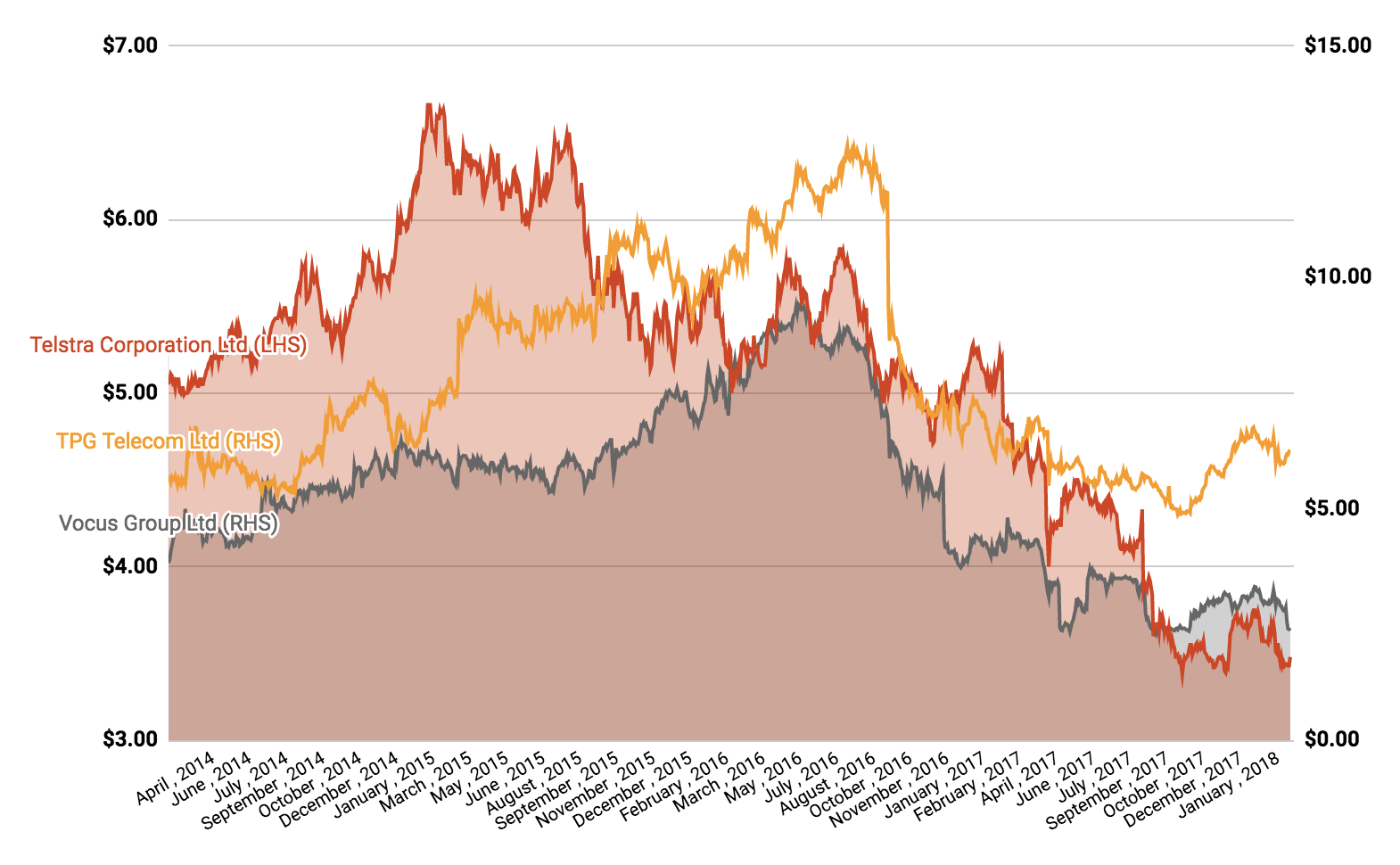

It competes directly with the likes of TPG Telecom Ltd (ASX: TPM), Optus and

Telstra Corporation Ltd (ASX: TLS).

Each of the big telcos and the industry as a whole have been rattled by the arrival of the National Broadband Network (NBN), which seeks to bring faster speeds to more households.

In an announcement to the ASX this morning, Vocus Group said Mr Horth will step down from the top position ahead of schedule, despite Vocus’ plans to divest its New Zealand business.

“Geoff has served as Vocus CEO during undoubtedly the most challenging chapter in its journey to date, wrestling with the simultaneous tasks of integrating several large, complex businesses, combining different corporate cultures and while the Australian telco sector was under substantial structural upheaval, in light of the roll-out of the NBN & the exponential growth in demand for data networks,” Chairman Vaughan Bowen said.

Mr Horth lead M2 Group for five years before the merger with Vocus Communications in February 2016.

“Geoff leaves the company with the sincere appreciation of the Board, for his unrelenting endeavour under the most trying of circumstances and with the wide-reaching respect of our executive and our team, as well our customers, suppliers and other stakeholders.”

Vocus’ CEO of Wholesale & Distribution, Michael Simmons, will fill the role of interim Group CEO as the company undertakes its search for Mr Horth’s replacement. Mr Simmons was the founding CEO of SP Telemedia, now part of TPG Telecom.

“Geoff leaves the company with the sincere appreciation of the Board, for his unrelenting endeavour under the most trying of circumstances and with the wide-reaching respect of our executive and our team, as well our customers, suppliers and other stakeholders,” Mr Bowen added.

“The Board greatly appreciates Michael stepping into the Interim CEO role, ensuring we retain momentum on the key areas of focus across the Group.”

Vocus shares ended up 1.7% on Monday.

Keep Reading

- Great Quotes From Warren Buffett’s 2017 Letter to Shareholders

- Surviving And Profiting From The Market Rout

Disclaimer: This article contains general information only. It is no substitute for licensed financial advice and should not be relied upon. By using our website you agree to our Disclaimer & Terms of Use and Privacy Policy.