A week after announcing it had achieved its previous target of $US100 million in annualised monthly revenue, Pushpay Holdings Ltd (ASX: PPH) (NZE: PPH) this morning updated investors on its financial performance.

Despite a

promising announcement last week the company said it was pleased to report $US106.4 million in revenue from the 2017 calendar year.

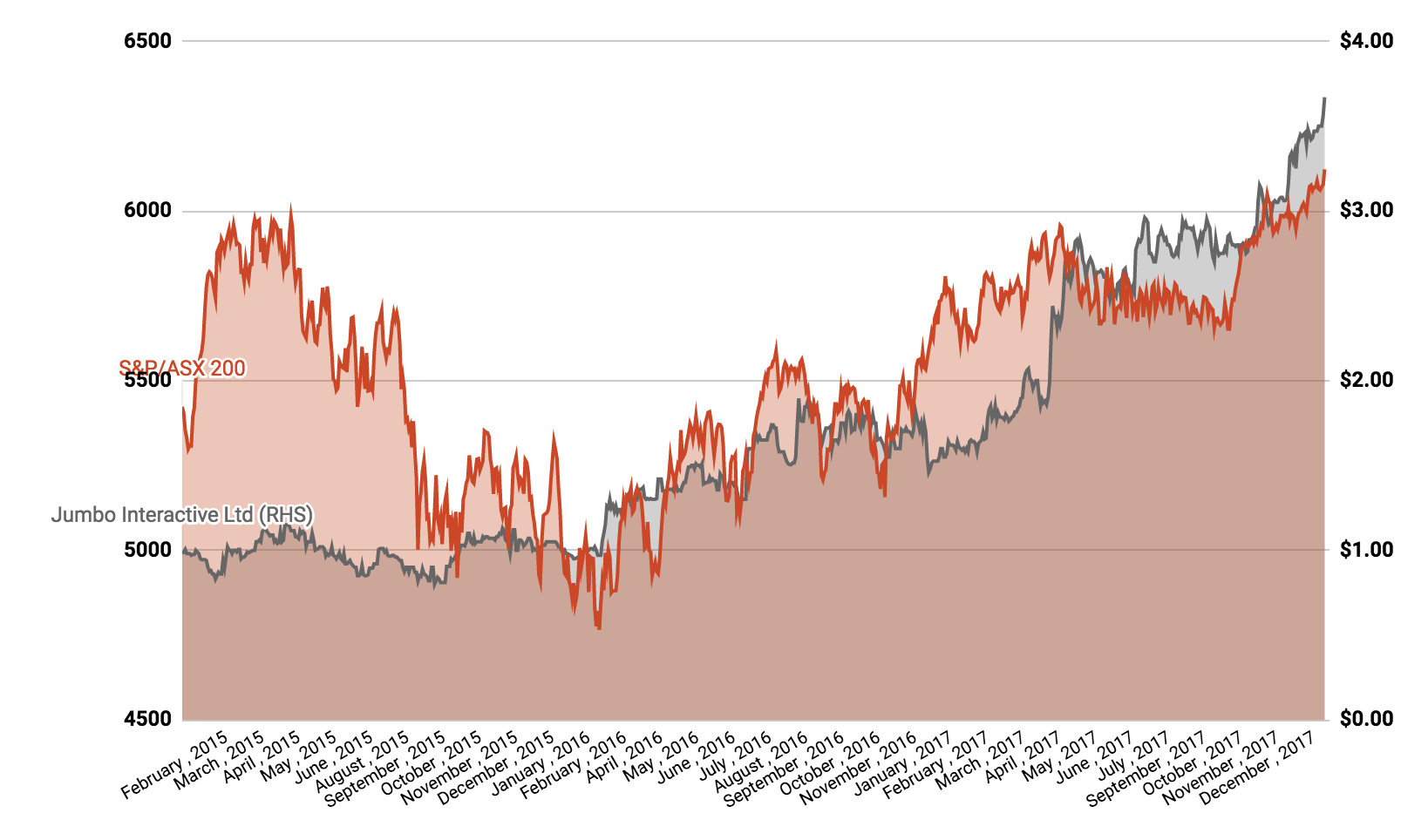

Pushpay Share Price

Data source: Google Finance

Data source: Google Finance

Pushpay is a $1.2 billion New Zealand-based software company which has developed a platform for Church-goers to donate to their religion or charity through technology. It is expanding in the large US market.

This morning Pushpay announced that it had achieved $US106.4 million in annualised monthly revenue, which it calls ACMR. The company set $US 100 million as its target to reach by December 2017.

“Surpassing US$100 million ACMR within 27 months after reaching US$10 million ACMR is a significant milestone for the business,” Chris Heaslip said. “Pushpay continues to build on its market leading position in a growing sector and has seen pleasing results in terms of the proportion of ACMR derived from large Customers.”

As at 30 September 2017, Pushpay generated annualised monthly revenue of $US67.5 million and it took less than 12 months to recover the costs of acquiring a customer.

From this time last year, the average revenue per customer has also jumped, from $US 785 per month to $US 1,233 per month, according to its ASX release. The Pushpay business appears quite scalable because although committed monthly revenue jumped more than 80% the number of staff members rose just 1.2%.

In the short term, Mr Heaslip said breaking even on monthly cash flow, meaning that its incoming cash from sales outweighs the outgoing costs, is a priority. “Pushpay remains in a position to reach its targets of FY18 NZ GAAP revenue guidance of US$70 million and breakeven on a monthly cash flow basis prior to the end of calendar 2018.”

In the longer term, he says the company is committed to capturing as much of the US faith sector as possible. “We continue to focus on scaling the business in the US faith sector in order to maximise shareholder value over the long term.”

In New Zealand, shares of Pushpay were trading 0.4% higher.

Keep Reading