The Retail Food Group Limited (ASX: RFG) share price has recovered some lost ground on Friday ahead of the Christmas break.

Retail Food Group (RFG) is the name behind casual dining and coffee brands such as Gloria Jeans, Pizza Capers, Michel’s Patisserie and much more.

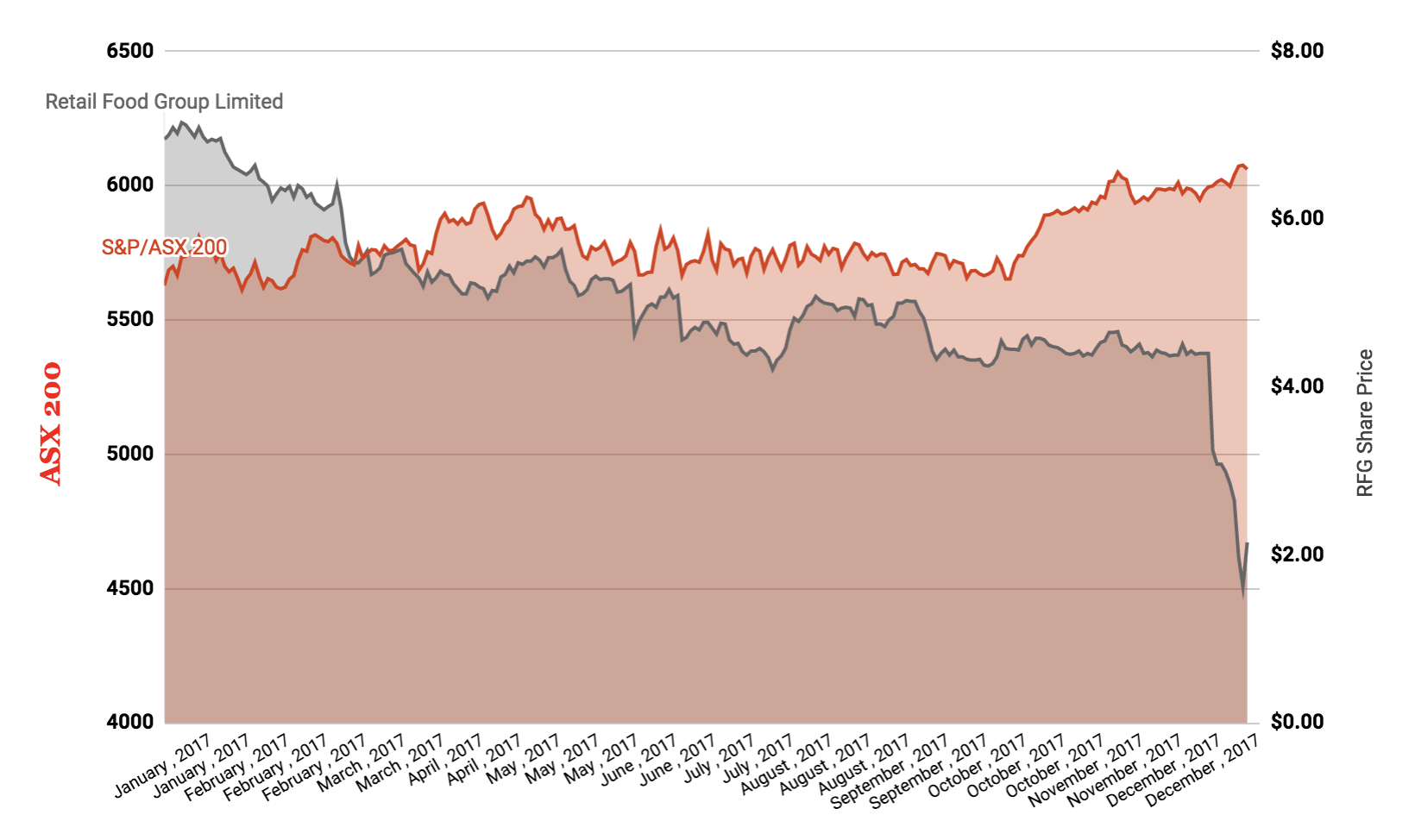

RFG V. ASX 200

As can be seen in the price chart above, RFG shares have been sold down over the past few months.

Most recently, allegations of franchisee mistreatment surfaced in Fairfax Media (ASX: FXJ). Then the company announced a profit guidance downgrade.

However, over the past two ASX trading days, the RFG share price has bounced back. On Thursday the company’s shares closed more than 30% higher, at $2.15.

ASX Probes RFG

Yesterday, the company was probed by the ASX given the recent trading of its shares and its profit guidance downgrade. Specifically, it asked when the company became of its lower profit guidance for the coming half year.

RFG responded by saying, “RFG has acted promptly and without delay in this matter.” It also confirmed that it remains in compliance with the ASX listing rules.

Investors appear to have warmed to the company’s update ahead of the Christmas break.

RFG shares have suffered a similar selloff to that of the rival pizza chain, Domino’s Pizza Enterprises Ltd. (ASX: DMP), early in 2017.

Earlier this year, Domino’s was the subject of rumours of staff underpayment and franchisee mistreatment. As a result, Domino’s shares have fallen nearly 30% in 2017.

Keep Reading: