Metcash Limited (MTS) Boosts Dividend On Hardware Sales

Metcash Limited (ASX:MTS) shareholders will receive a larger dividend from the retail company following an improved profit result from its hardware division.

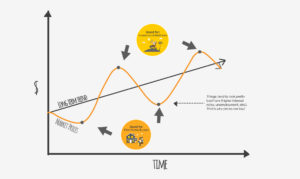

People underestimate what they can do in five years but overestimate what they can do in one.

Anonymous

You can find everything you need to know in the Rask investment philosophy. These are the exact steps I follow for myself and for the Rask community who trust us.

In short:

Metcash Limited (ASX:MTS) shareholders will receive a larger dividend from the retail company following an improved profit result from its hardware division.

Buying a first home is always a challenge. Sydney and Melbourne prices, in particular, seem to be very expensive.

AMP Limited (ASX:AMP) this morning announced David Murray will become its new Chairperson effectively immediately.

This morning, New Zealand’s Gentrack Group Ltd (ASX:GTK) announced the takeover of Evolve Analytics and Evolve Parent Limited for $44.2 million.

The Australian Dollar (A$) ⇨ US Dollar ($) (AUDUSD) has continued its decent today, falling 0.7% to US 73.70 cents according to Yahoo! Finance.

Here are three money, finance or investing books Australian investors should read as soon as possible.

Shares of New Zealand-based software developer Pushpay Holdings Ltd (ASX:PPH) is expected to return to ASX trading on Tuesday following a trading halt and sell-down by co-founder Eliot Crowther.

With the Westpac Banking Corp (ASX:WBC) share price trading up 2% on Friday, shareholders seemingly shrugged off an ASIC announcement that it has commenced legal proceedings against the bank for poor advice.

BHP Billiton Limited (ASX:BHP) shareholders woke to the news that Australia’s largest mining company will plough an additional $US2.9 billion ($3.83 billion) investment in Western Australia’s Pilbara region.

Want to level-up your analytical skills and investing insights but don’t know where to start? Join 50,000 Australian investors on our mailing list and we’ll send you our favourite podcasts, courses, resources and investment articles every Sunday morning. Grab a coffee and let Owen and the team bring you the best insights.

Here you go: A $50,000 per year passive income special report

Join more 50,000 Australian investors who read our weekly investing newsletter and we’ll send you our passive income investing report right now.

Simply enter your email address and we’ll send it to you. No tricks. Unsubscribe anytime.

Unsubscribe anytime. Read our Terms, Financial Services Guide, Privacy Policy. We’ll never sell your email address. Our company is Australian owned.