ASX health care stocks were smashed in 2025. CSL collapsed, Pro Medicus paused. Is there an opportunity in 2026?

It was a tough 2025 for 2 of the market’s most loved growth engines.

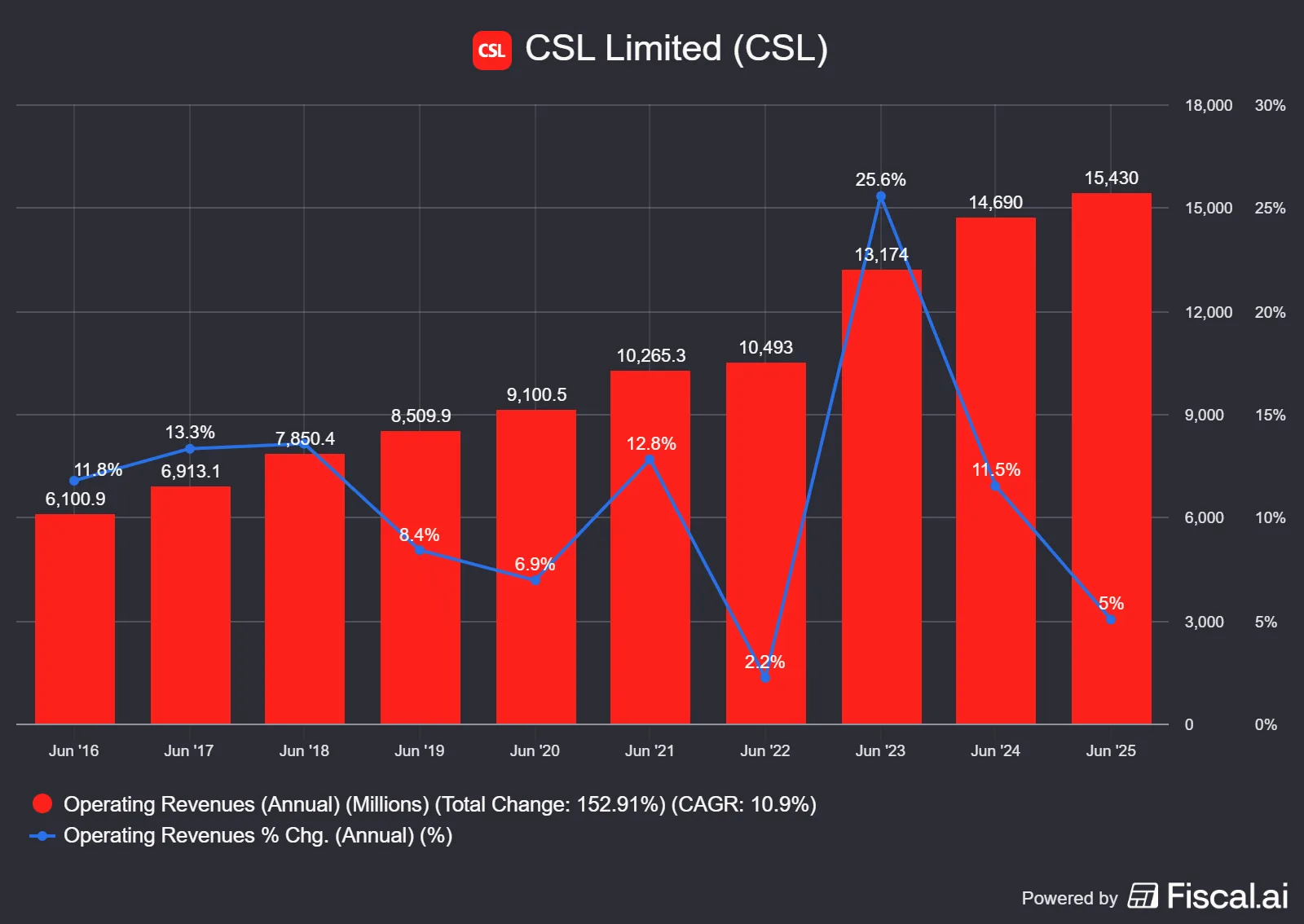

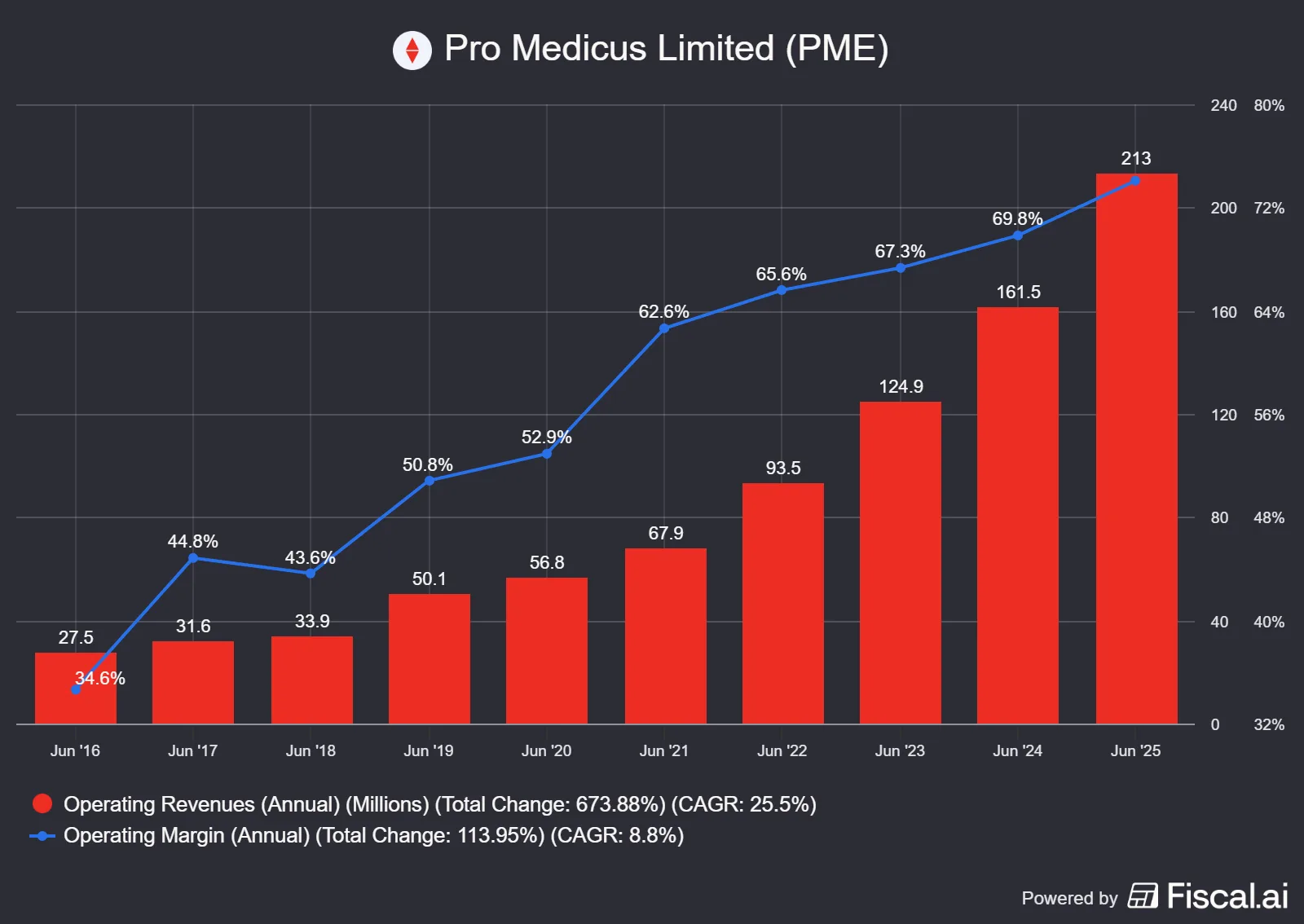

The ASX has a way of humbling investors right when a narrative feels “unbreakable”. In 2025, 2 ASX health care companies took a battering as investors sold long time staples and portfolio favourites. CSL Limited (ASX: CSL) collapsed, Pro Medicus Limited’s (ASX: PME) momentum paused and they dragged the ASX health care index is down roughly 24% over the last 12 months. These portfolio staples and long-time favourites moved from “bottom drawer” to the exit door. Looking closer, it appears less like a collapse in fundamentals and more like a reset in valuation, expectations, and the price investors are willing to pay for “quality”.

CSL’s perfect storm

CSL stands out like a sore thumb. Shares are down more than a third this year as the company downgraded its numbers, paused a spin-off and saw a volatile US market and structurally lower influenza vaccination rates.

From a long-term thesis perspective, CSL remains a global leader in plasma therapies and vaccines. It has unrivalled scale in plasma collection, a broad portfolio of life saving treatments and a deep R&D pipeline. The underlying drivers remain:

- ageing populations

- rising diagnosis rates; and

- the lack of like-for-like substitutes in many of its niches.

In my view, the core business remains, but a perfect storm pushed investors to reassess the near-term earnings trajectory. With Investor expectations lowered post sell-off, the risk reward is obviously greater. I would continue to sit on the side-lines and watch until we begin to see gross margin settle as we see the results of cost savings program outlined by management in the November capital markets day.

Perfect Pro Medicus’ recalibration

Pro Medicus sits at the other end of the spectrum.

Investors sold Pro Medicus, not because the business is broken, but perhaps because the share price ran too hard. Pro Medicus is elite. The company delivers extraordinary economics. Opearting earnings (aka, Earnings Before Interest & Tax – EBIT) margins north of 70%, low capital intensity and mission-critical enterprise imaging software embedded in leading hospitals. But after trading at well over 300x forward earnings, the share price has taken a breather.

Pro Medicus is arguably one of the best businesses in the world. With continued growth into US hospitals and technology that appears to be streets ahead of the competition, I feel this may be a good opportunity to dollar cost average into a high quality company.

My final thoughts

The market hasn’t abandoned these ASX health care icons but it in 2025 investors definitely reassessed how much they were willing to pay for their earnings.

CSL and Pro Medicus still hold world-class IP, high returns on capital and deep customer relationships. With the sell off, the risk reward has potentially improved, particularly if CSL can execute on its strategic initiatives and Pro Medicus can continue to win contracts and maintain (or even expand) margins.

Two companies that are worth a position on your watchlist when considering a satellite position and exposure to the tailwinds of health care globally.