SiteMinder Ltd (ASX: SDR) could be the ASX-listed technology company you’ve been looking for.

Picture this: Sitting at a hotel desk; phone ringing off the hook; bookings left, right, and centre; guests checking in and out, and the management system is a large green calendar book from Officeworks, bought yearly for the last 47 years.

It may seem a bit extreme. But these archaic management ‘processes’ are real-life experiences for some.

From double-ups to misses altogether, the chaos of coordinating bookings is essential to running a smooth show.

This is where SiteMinder steps in.

SiteMinder’s software centralises reservations from online and offline channels. This could be global giants like Booking Holdings (NASDAQ: BKNG), Airbnb (NASDAQ: ABNB) and Expedia (NASDAQ: EXPE), or smaller players to their own websites.

Founded in 2006, SiteMinder now serves 50,000+ boutique hotels and chains right thru to igloos, cabins, castles, holiday parks, resorts and 2.4 million rooms!

Recently, we had the team from Seneca Financial Solutions on our Australian Investors Podcast to talk about the business model.

Why SiteMinder wins

I like businesses with durable moats.

Each new participant to the SiteMinder platform makes it more and more valuable, pulling in both hotels and online travel agencies, which grows the distribution on both sides of the transaction.

In turn, this creates an excellent network effect.

SiteMinder’s smart hotel platform brings together distribution, payments and insights while providing upselling opportunities through add-on suggestions at the right moment. All this contributes to increasing Average Revenue Per User (ARPU), while also making the product stickier.

Once a hotel integrates SiteMinder into its property management system, the software manages reservations, check-ins, and rooms, as well as connections with agencies, becoming an integral part of everyday life. It not only becomes sticky, but it also creates a wealth of data, giving insights into all types of travellers to sharpen everything from pricing and length of stay, to better capture demand.

Through its ability to offer multi-property modules, SiteMinder can win larger clients with global footprints.

How to track SiteMinder

Keeping a close eye on SiteMinder means following some key markers in each report.

First, I’d be looking for movements in Annual Recurring Revenue (ARR).

Companies can throw “ARR” around rather loosely, and because it’s not a properly defined measure under accounting standards, management teams can tweak it to suit their needs. So be cautious when comparing between businesses and industries.

In SiteMinder’s case, this is annualised subscription fees, plus normalised transaction fees. The normalised transaction revenue is the prior quarter’s transaction revenue from subscriber customers x 4. This takes into account when promotions end. In the company’s favour, management treats ARR as a point in time run rate, not a true forecast of actual revenue.

Unit economics are also essential.

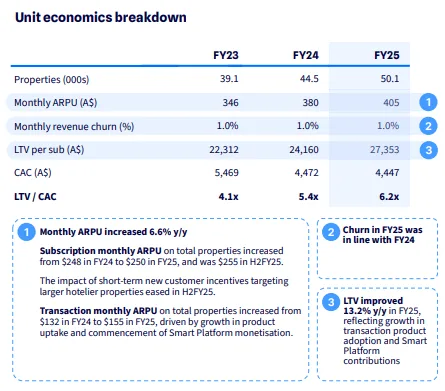

The number of properties, monthly ARPU and churn rates tell the story of the number of customers available to SiteMinder, and what they can extract. It can also indicate how satisfied customers are and whether they’re staying loyal. Meanwhile Customer Acquisition Cost (CAC) reveals the expenses incurred to acquire a new customer. Fortunately, SiteMinder is very good at presenting these numbers, as seen below from their 2025 full year results presentation.

For example, as you can see from the chart, to acquire a customer (e.g. a hotel or motel) it costs SiteMinder $4,447, on average. It covers that cost, in revenue, within 12 months ($405 x 12 months = $4,860). I think that’s impressive.

SiteMinder’s financial performance and valuation

For all the positives I’ve highlighted, SiteMinder is a loss making business.

For FY 2025 the company recorded a loss after tax of $24 million, up a touch from a $25 million loss in the prior year.

That’s on revenue of $224 million. With the current share price of $7.28 it has a market capitalisation of a touch over $2 billion.

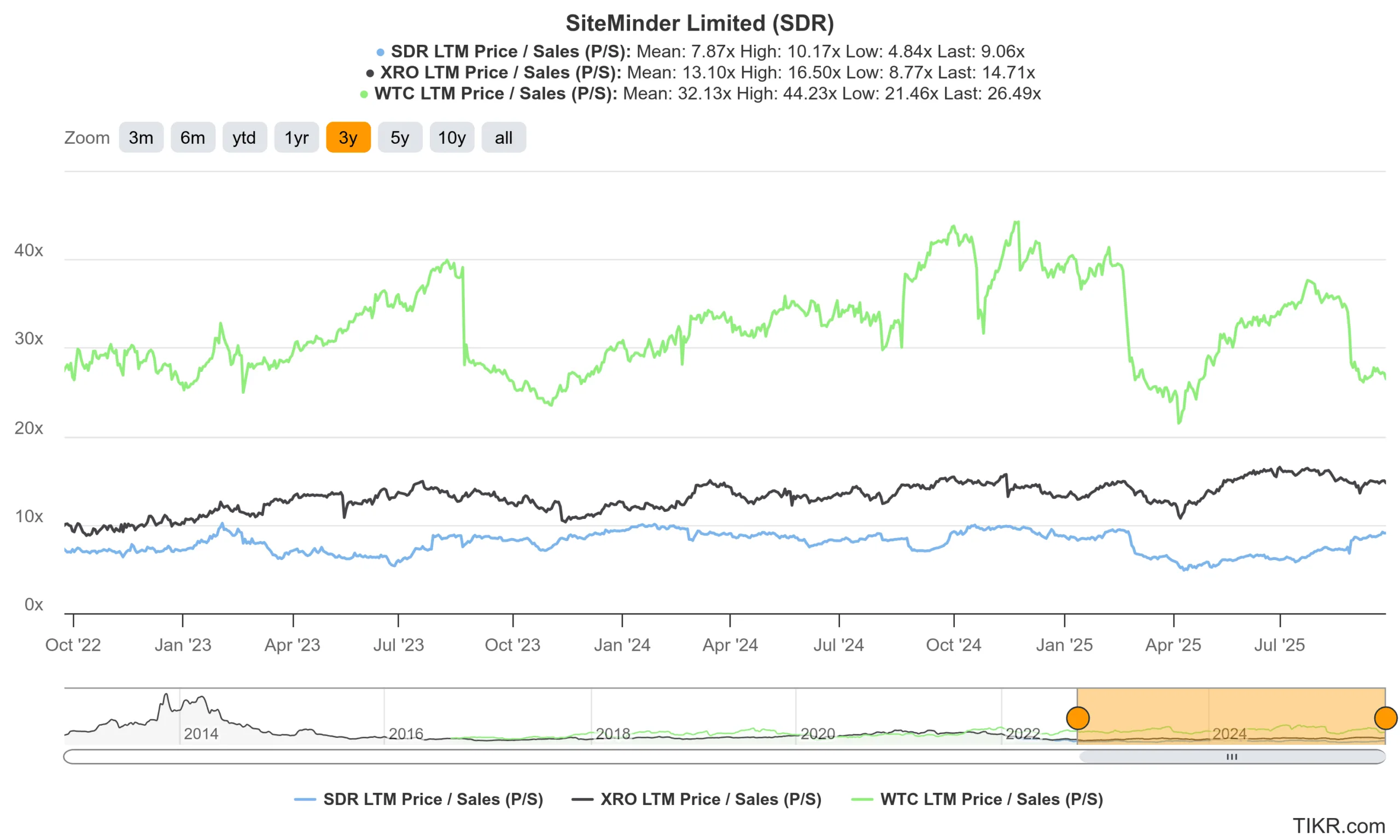

Therefore SDR shares trade on a price-to-sales multiple of around 9x. A pricey multiple, but it is lower than some of its high quality ASX tech peers, as shown by Tikr.com below.

While today it seems expensive, and perhaps the market has it priced to perfection, it’s worth considering what the future growth may look like.

SiteMinder has been growing its revenue at a three-year compound annual growth rate of 23.7% per year. While revenue grew by 17.7% (19.2% constant currency) in 2025, the outlook from the company is that revenue growth will accelerate towards 30% in the medium term, while maintaining profitability discipline.

So do we pay up today, for a potentially higher future return?

That’s the question.

While it’s undoubtedly heading in the right direction, you can get exposure to Siteminder in other ways. For example, you can access SiteMinder through our Rask Invest portfolios via our holding in ETFs such as the Betashares Australian Technology ETF (ASX: ATEC) (Siteminder is a ~1% position). Or if you own something like Vanguard Australian Shares Index ETF (ASX: VAS), you’ll get a tiny exposure to it as well.