Getting started in investing can be daunting, with all sorts of technical terms and theories to get your head around. But, it’s actually never been easier. If I were starting out today, here’s how I’d do it.

The value of diversification

Diversification is one of the most common investing terms you’ll come across.

And it’s not just jargon. Diversification is vitally important because it’s all about minimising risk.

Let’s look at a simple example.

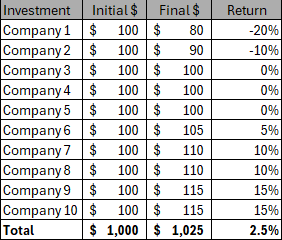

Say I invest $1,000 in one company like Fortescue Ltd (ASX: FMG), and it drops by 20% (this may or may not be a real scenario). I’m now left with $800. But, if I’d invested $100 each in 10 companies, the below table is an example of what might happen.

A couple of the companies lost money, many of them did nothing, and some went up. Overall, my money grew by 2.5%, despite the fact that one of the companies lost 20%.

This is how diversification can benefit your portfolio, and it’s why we often advocate for exchange-traded funds (ETFs).

Diversification with ETFs

Exchange-traded funds, known as ETFs, are an excellent way to get quick access to a diversified portfolio.

Rather than buying a single ASX company like Woolworths Group Ltd (ASX: WOW) or Westpac Banking Corp (ASX: WBC), an ETF lets you buy a group of companies with a single purchase.

For example, the Vanguard Australian Shares Index ETF (ASX: VAS) gives you units in the top 200 companies listed on the ASX by market cap. Or the iShares S&P 500 ETF (ASX: IVV) gives you access to the top 500 companies on the US stock exchange. Both of these ETFs feature as core parts of the Rask Invest portfolios.

These ETFs are great options to give you low-cost exposure to a broad range of companies.

However, you can go one step further.

See, the above ETFs are diversified in terms of the number of companies they hold, but they’re both concentrated on a single market (Australia or the US) and both only invest in shares.

If you wanted a fully diversified portfolio, you’d want some Australian and American shares, but also probably some bonds, some fixed interest investments, and maybe some emerging market shares.

If I were getting started in investing today, here’s how I’d get myself a fully diversified portfolio in under 30 seconds, and for as little as $200.

The world of diversified ETFs

Ready?

I would buy the Vanguard Diversified High Growth Index ETF (ASX: VDHG).

Vanguard, one of the world’s biggest investment managers, offers a range of diversified ETFs, which are ETFs that invest in a portfolio of other ETFs.

That means in a single purchase, you get access to Australian shares, US shares, international and emerging market shares, bonds, fixed interest, small caps, and more.

If you’ve got a Vanguard Personal Investor Account, you can invest in VDHG for as little as $200, and with most other brokers as little as $500. The annual management fee for this ETF is 0.27%. That’s a great deal for any new investor.

VDHG is the high-growth version, but Vanguard also offers more balanced and defensive diversified ETFs for those looking for a little less risk. And it’s not just Vanguard. Betashares also offer a high-quality range of diversified ETFs.

I don’t say all this as an advertisement for Vanguard or Betashares, but because I really believe this is the simplest and quickest way to get started with investing.

It’s easy to overcomplicate things. People get caught up with different strategies and formulas and valuation tools and tariff news and on and on.

But if I was starting again today, I would probably just be investing a regular amount every month into a diversified ETF.

Or, if you want to make it even easier, you can let Rask manage it for you with a Rask Invest account.