Here’s the current market update by David Bassanese, Chief Economist of Betashares: The S&P/ASX 200 (INDEXASX: XJO) is up 1.3% after a 2.3% decline in the previous week.

Global markets

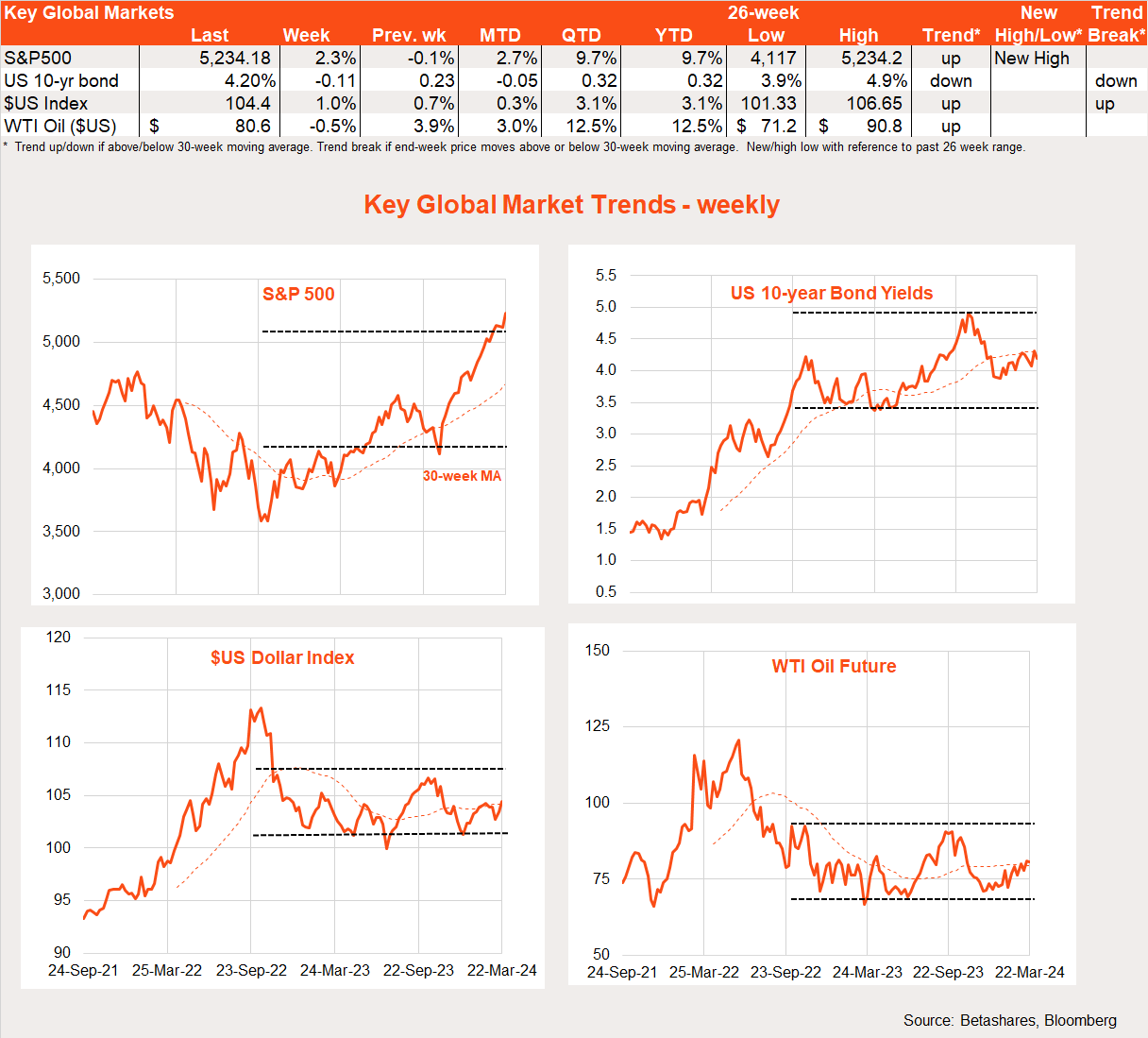

US stocks bounced back solidly last week and bond yields declined as the US Federal Reserve retained its expectation of three rate cuts this year at its March meeting – despite upgrading its near-term growth and inflation outlook.

In short, while markets in recent weeks have displayed some nervousness around higher-than-expected US inflation reports, the Fed’s still (perhaps surprising) sanguine outlook has limited the damage on Wall Street so far.

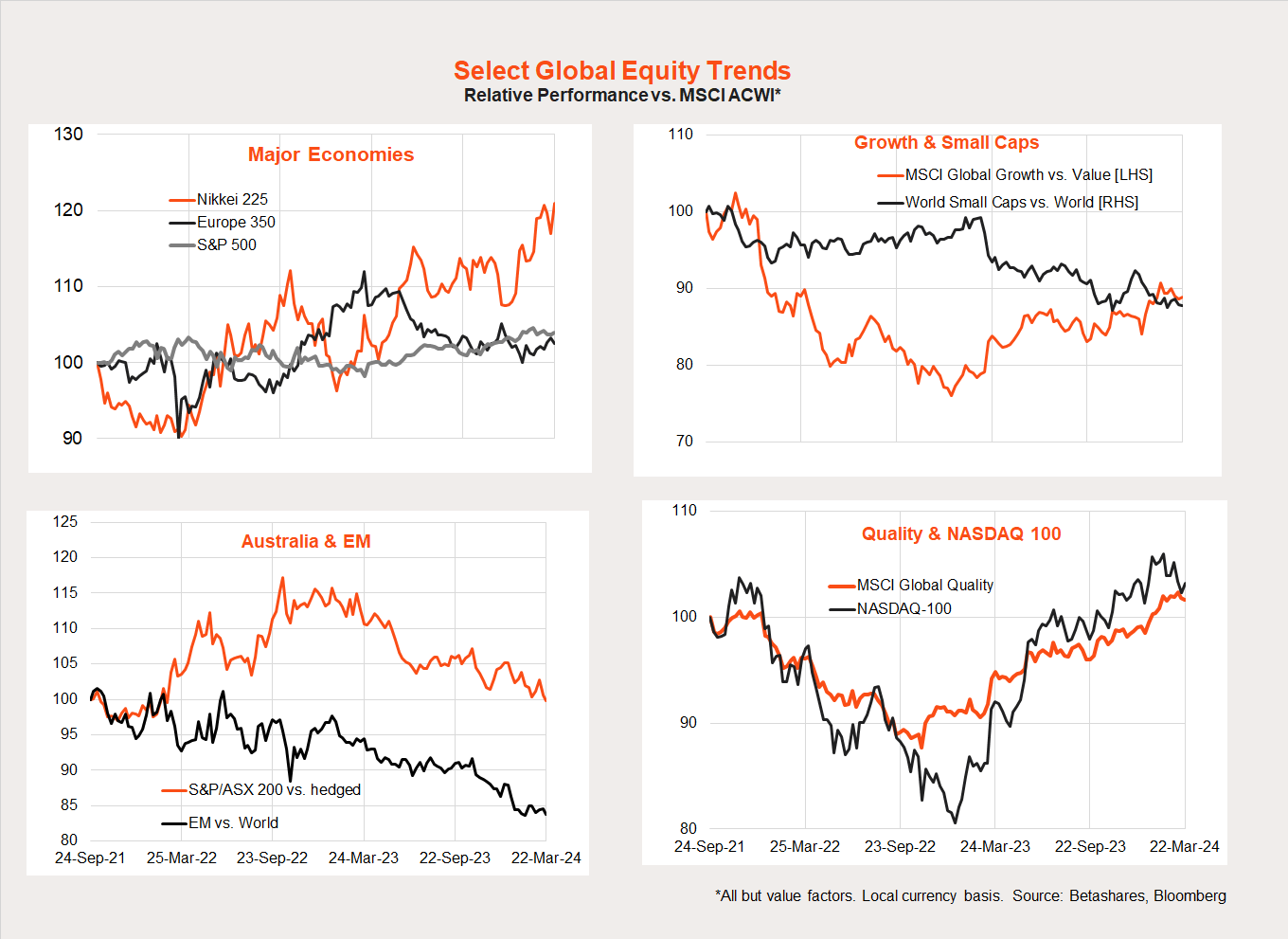

Excitement around AI also continued to support stocks last week with Nvidia announcing improved computer chip technology at its hotly anticipated conference for developers.

Not even Japan’s widely-expected decision to finally end its negative interest rate policy roiled markets. Official Japanese rates went from -0.1% to +0.1%! So far at least, the yen has remained fairly soft which in turn has continued to support Japanese equities. Although markets are now pricing in around 0.4% worth of further rate hikes by year end, yen strength may be limited by the fact that Japanese rates are likely to remain considerably lower than those of other developed economies.

Turning to the week ahead, a key focus will be Friday’s US core private consumption expenditure deflator (PCE), with prices excluding food and energy expected to rise 0.3%. after a 0.4% gain in January. This would keep annual core inflation steady at 2.8%.

As we saw in January, an otherwise uncomfortably high core reading is already factored into the market given the high CPI result a few weeks ago. The Fed’s continued comfort is also supportive. That said, it’s hard to believe that markets won’t react negatively if we see a 0.4% or more gain in the core PCE.

Also worth watching this week is further commentary from Fed officials – including Jerome Powell – especially if there’s any push back on timing of expected rate cuts.

Australian markets

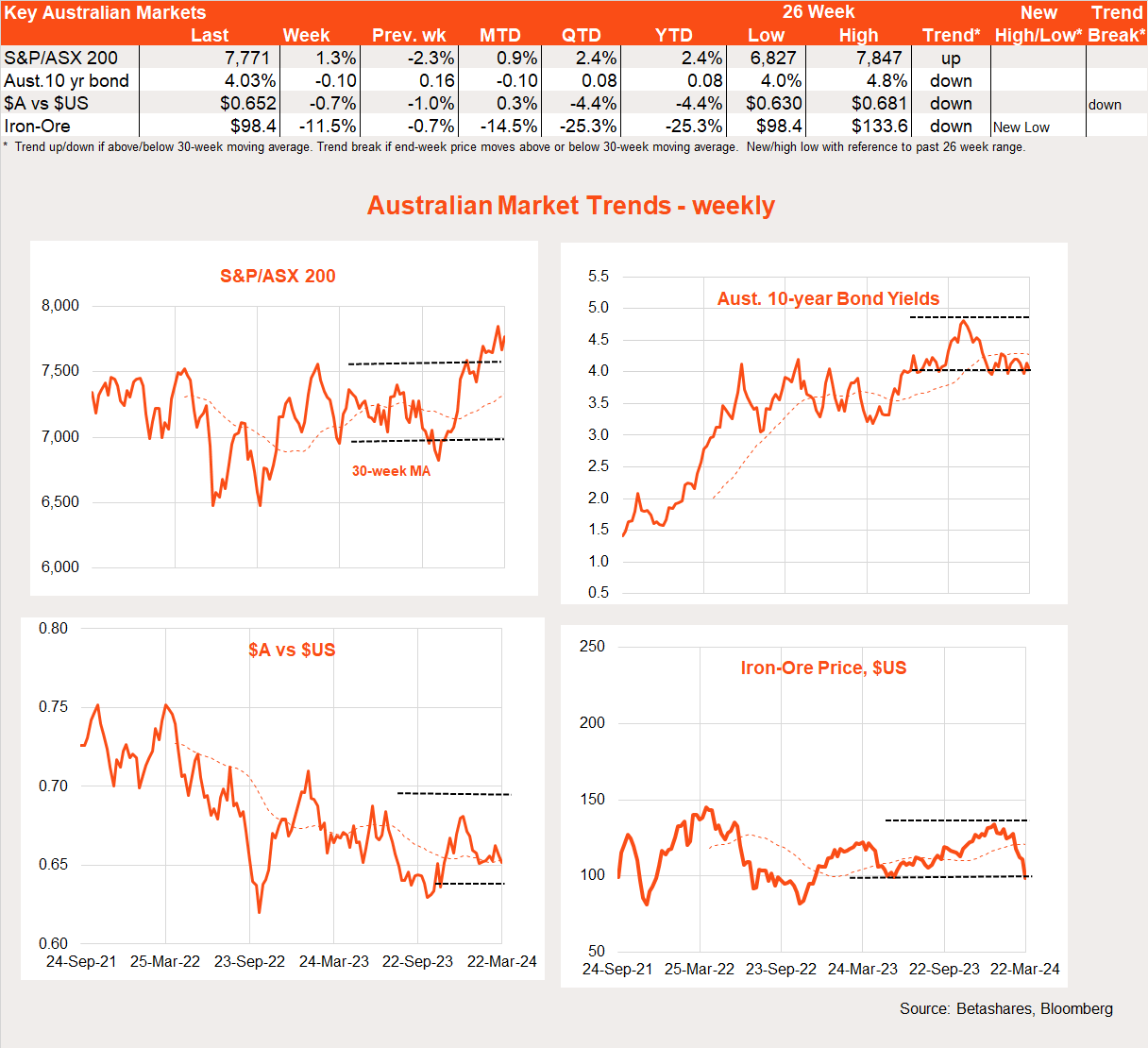

Local stocks also bounced back last week, with the S&P/ASX 200 up 1.3% after a 2.3% decline the previous week. Most notable last week was a further slump in iron-ore prices, which shed 11.5% as pessimism around the Chinese outlook continued. Along with a firmer $US, this saw the $A edge lower to US65.2c.

Key local highlights last week were the RBA meeting and the blockbuster February labour market report. Although opinions differ, my reading of the RBA statement last week was that it represented a glacial shift towards a more neutral policy bias.

That said, whatever the RBA may have been thinking was likely shaken by the 117k surge in employment during February, which helped push the unemployment rate back down to 3.7%. Even allowing for recent extreme year-end volatility in employment growth, the strong bounce largely erases what had been tentative signs of slowing in employment demand.

Given weakness in forward indicators such as job advertisements, however, some slowing in employment growth – and an eventual bounce back in the unemployment rate – still seems likely by year end. As a result, I’m holding fast to my expectation for two RBA rate cuts later this year.

We’ll learn more with Wednesday’s release of the February monthly CPI. I’m counting on a further encouraging decline in annual trimmed mean inflation to 3.7% from 3.8% – which would be consistent with underlying inflation slowing a little more quickly than current RBA expectations.

Have a great week!