When I woke up this week and saw that the Altium Limited (ASX: ALU) share price had jumped 25% in one day I was so disappointed!

I wanted to buy some Altium shares because I noticed, surprisingly, that it hadn’t really budged since the beginning of the year.

Altium share price

What does Altium do?

At Rask, we’ve covered Altium for many years for our members. In my opinion, Altium is easily one of the best technology companies in Australia, and so it should be on every ASX investor’s watchlist. Not just for its blistering growth, which is the most important factor for long-term investors, but it also pays a generous dividend because it is hyper-profitable. Altium is right in the crosshairs of the Rask philosophy and scores extremely well in our analyst team’s quality scorecard.

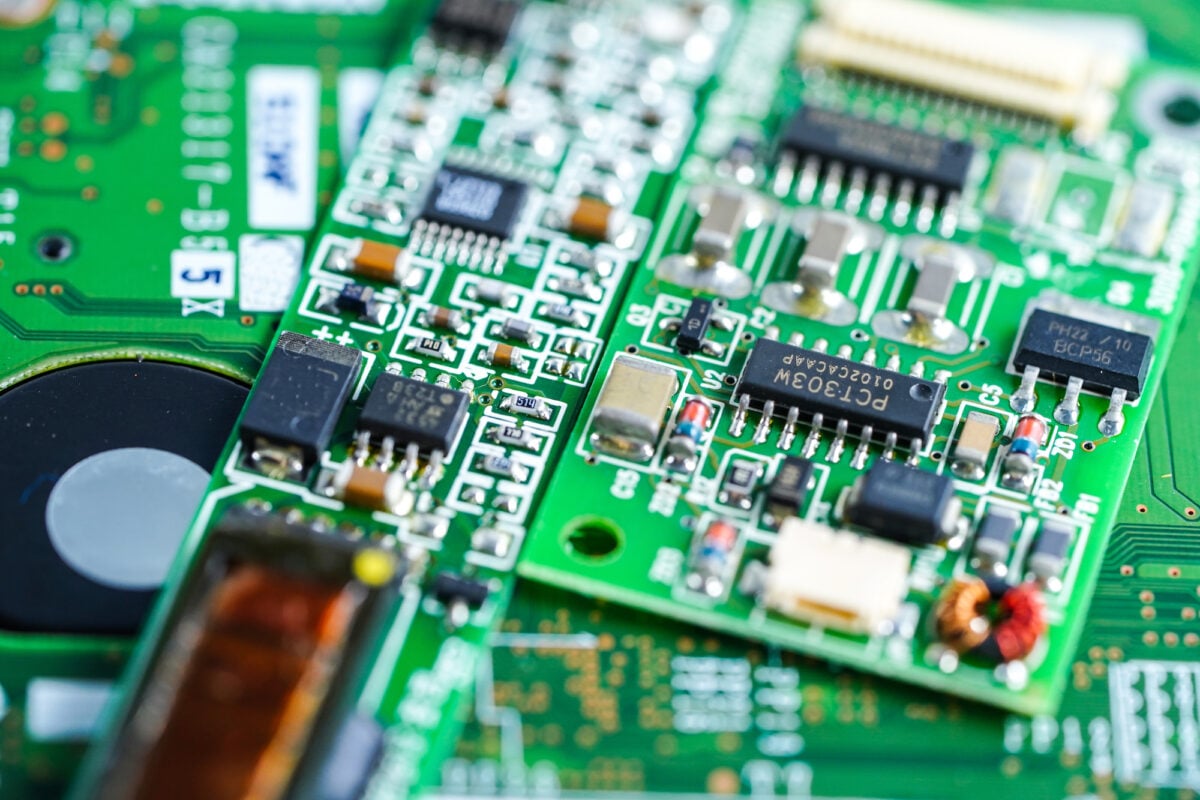

At its core, Altium is one of the world’s leading software companies for engineers and designers who create Printed Circuit Boards or PCBs. PCBs are those little, typically green or blue, microchip boards that go inside every electronic device — phones, computers, fridges, cars, etc. Basically, anything that needs some type of ‘intelligence’ needs a PCB. And it needs a designer to carefully place components like switches or transistors on the board efficiently. This can then be passed to manufacturers or engineers, who can create the products and have them shipped to product makers.

Altium’s bread and butter is the high-end professional market but increasingly it is pushing into the enterprise market, where teams can get a cloud-based subscription to Altium’s software, known as Altium Designer, and collaborate.

Companies like Tesla (NASDAQ: TSLA) and Bosch use Altium, but they’ll often also use competitors’ products, from the likes of Cadence Systems (NASDAQ: CDNS), Autodesk (NASDAQ: ADSK) or Siemens, which purchased Mentor Graphics a few years ago as part of its push into automated manufacturing.

Cadence Systems’ stock price

Is Altium a Gorilla?

When you’re presented with an industry in a state of rapid transformation, where lots of players seem to be growing (like the Internet of Things or IoT), it’s hard to answer with certainty ‘who’s winning?’

Basically, you have a few options if you plan to invest in one of these sectors:

- Use an ETF. For example, a sector-based fund/ETF would allow you to invest $10,000 into a diversified basket, like ‘global technology shares’. A thematic style fund or ETF might allow you to invest in ‘future technology’ and it will give you exposure to a full basket of different technology shares. You’ll get some IoT companies but you’ll probably get a few others that you do — or do not — want.

- Take the ‘Gorilla game’ approach. This approach is based on one of my favourite books from the Dotcom era. Basically, when you don’t know which company will win right away you can buy a handful of different companies (called “chimps”). Then, after months or years, you can identify the winner (“Gorilla”) and consolidate your holdings into that company. For example, invest $2,000 into 5 chimps now and then, by figuring out which company is setting the standard for that industry, you can consolidate into the winner. For example, sell companies #4 and #5 and put that money into #1 once you know with more precision who is likely to be #1.

- Do your homework and invest in the winner now. Through careful analysis and proper analyst homework, some investors will try to identify the industry winner ahead of time. Of the three strategies, this is the riskiest option because you might not pick the eventual winner. But, hear me out. For example, if you’re questioning why Altium says it’s the best but Cadence says the same, an easy way to get to the bottom of it is to go and speak to, say, 10 customers (designers or engineers), attend conferences, participate in online forums, etc, to hear what they say about it. But be careful of confirmation bias. I see a lot of individual investors go wrong with this type of analysis because of preconceived ideas. For example, before even researching the competitors they already believe ‘Altium is the best’, so they overweight confirming evidence. When they see one engineer say ‘I love Altium’ in a forum, their bias towards Altium is confirmed. But the industry is far bigger than one engineer. So my critical advice is to go into your research with an open mind, get 5, 10 or 20+ perspectives before committing. Find out why those customers hold their opinion. And then cross-check those with what the companies are saying. I’ve done this a few times, at different points, over the years.

In my research, I have come to understand that Altium isn’t the biggest right now, but its pure play focus on PCB design and professional designers is fascinating to me because I think things are shaping up like they could become #1. But we’re probably 1-2 years away from me having a ‘high conviction’ in this belief. The proposed acquisition of Altium by Autodesk was a big ‘hint’ from the industry that competitors might be worried about Altium, or simply see Altium’s potential.

Is AI a threat or opportunity?

Another uncertainty for Altium and its peers is AI. For example, “Cadence AI” is a new tool offered by Cadence Systems in its design suite, which allows users to enhance their designs to optimise steps in the design process and reduce wastage. For example, a circuit that might have taken a human 3 days could be designed in 75 minutes with ‘AI assistance’. It could also result in 14% less circuity because the board is optimised by the AI.

For me, most of the “AI” applications we’re seeing today are not direct replacements for entire industries but are vitally important for technology companies to adopt over the next 5 years. This is because I believe we will see most companies will be divided into two camps: the AI do, and the AI don’t.

Those that adopt AI, and those that avoid it.

Those who adopt it will be meaningfully more profitable, for themselves and their end users.

For example, Microsoft’s recent design to incorporate AI into Microsoft Office will mean its users can create full PowerPoint presentations in minutes, as opposed to an hour. In return, users will pay much more on their monthly Office365 subscription for the gained productivity – otherwise, they’ll be left behind.

Likewise, if Google Docs doesn’t begin to incorporate Google Bard (its AI service) it too will be left behind.

In response to industry dynamics, Altium has committed to increasing its spend in research and development. This could dampen its profit margins and potentially crimp its internal economics for some time. However, the beautiful thing about software companies like Altium, or other tech stars like WiseTech Global (ASX: WTC) or Pro Medicus (ASX: PME), is that they have ‘margin to burn’. If they want to invest an extra 2% of sales back into R&D, there’s heaps of profit margin left over to afford it — and keep growing.

Under the watchful eye of CEO Aram Mirkazemi, who I believe is a true ‘owner operator’ (even though he is not the founder), I take it on faith and track record that the R&D budget will be appropriately allocated. Holding around 7% of shares means he has around $450 million on the line if things don’t work out — that’s very good alignment for long-term investors.

Again, we should know within 1-2 years how this extra budget plays out, and have more context about whether, or not, it is indeed starting to eat the cooking of competitors, or simply take more share of the expanding market.

Altium: buy, hold or sell?

The Altium share price is up 31% in just 5 days. Is the company one-third more valuable than this time last week? I doubt it. However, I do believe the company was undervalued coming into the results.

While I wouldn’t call Altium shares ‘cheap’ I have learned time and again that if we truly are long-term investors (meaning we plan to own investments for 10+ years or more), it should almost never be an ‘all or nothing’ approach to buying and selling decisions.

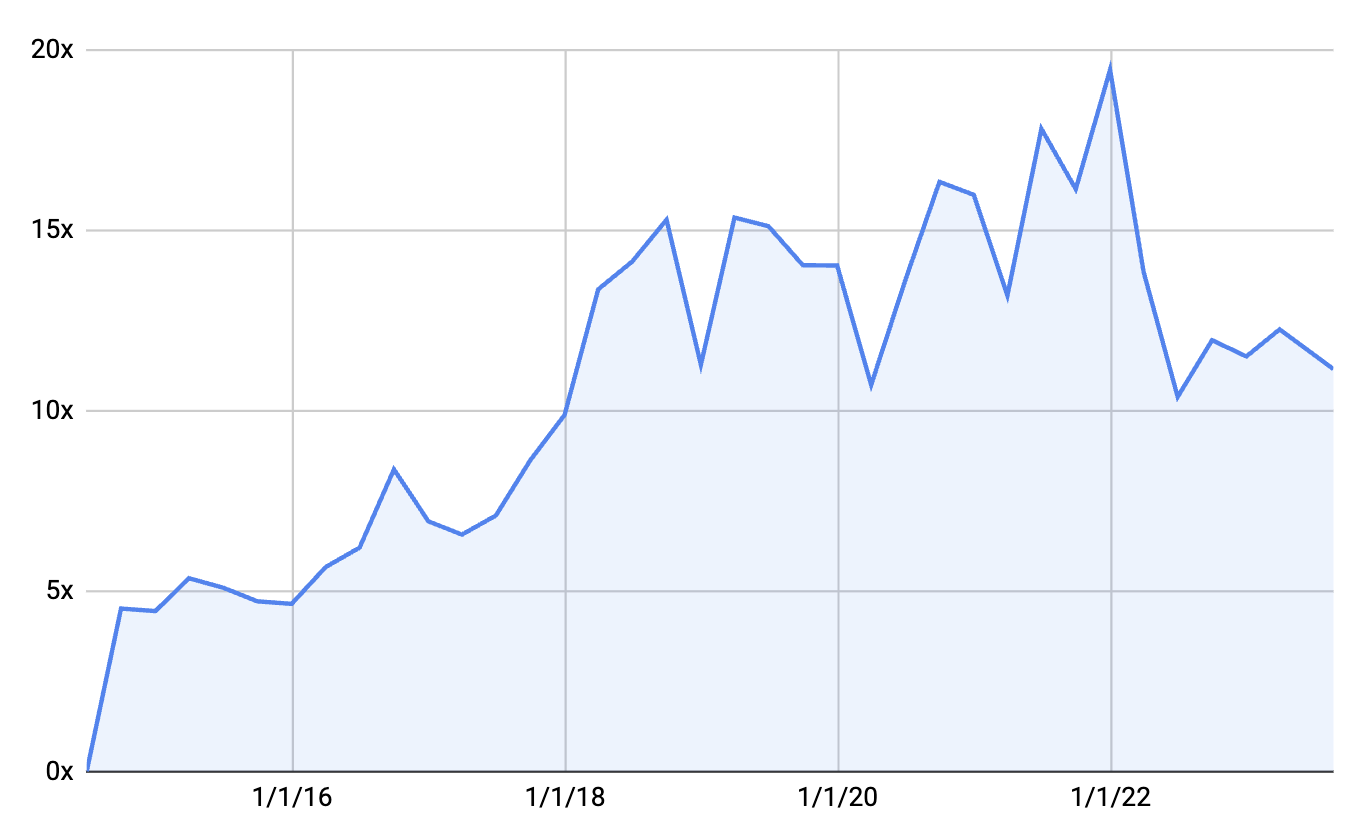

To that end, I’d happily continue to hold shares today because I think there is one reality that five years from now Altium is a 3x bigger company (Cadence is nearly 20x bigger). Another reality is it fails to keep pace with the rapid innovation in the sector, so be mindful of the downside and weight the position accordingly.

Finally, I’d also be happy to buy a small parcel to get some skin in the game. But I wouldn’t say it’s deeply undervalued. And volatility is expected.

Altium is a wonderful company, with a track record of success, run by a good operator, in a massively expanding market.

If you like this discussion of Altium, be sure to take a look at my recent article on why I still own Pro Medicus and Xero Limited (ASX: XRO) shares.