On The Australian Investors Podcast this week, myself — investment analyst Owen Rask — and financial adviser Drew Meredith, CFP, are back to answer your questions, discuss the economy and reflect on results from companies like BHP Group (ASX: BHP), Tesla Inc (NASDAQ: TSLA) and how the NASDAQ 100 (NDQ) has performed.

The winner of this week’s ‘best questioner’ name is ‘Fashion Phil’ who asked about fleeing the index.

This week, Drew and I tackle:

- Why you should not flee the NASDAQ – phew!

- Podcast listeners don’t just read the headlines… do they?

- The top 25 value-creating stocks, as identified by BCG

- Should I only buy shares with fully franked dividends?

- What happens when an ETF fails?

- Updates from Tesla, Flight Centre, Zip Co, Woodside & BHP

What the world’s best companies / best stock performers have in common (source: BCG)

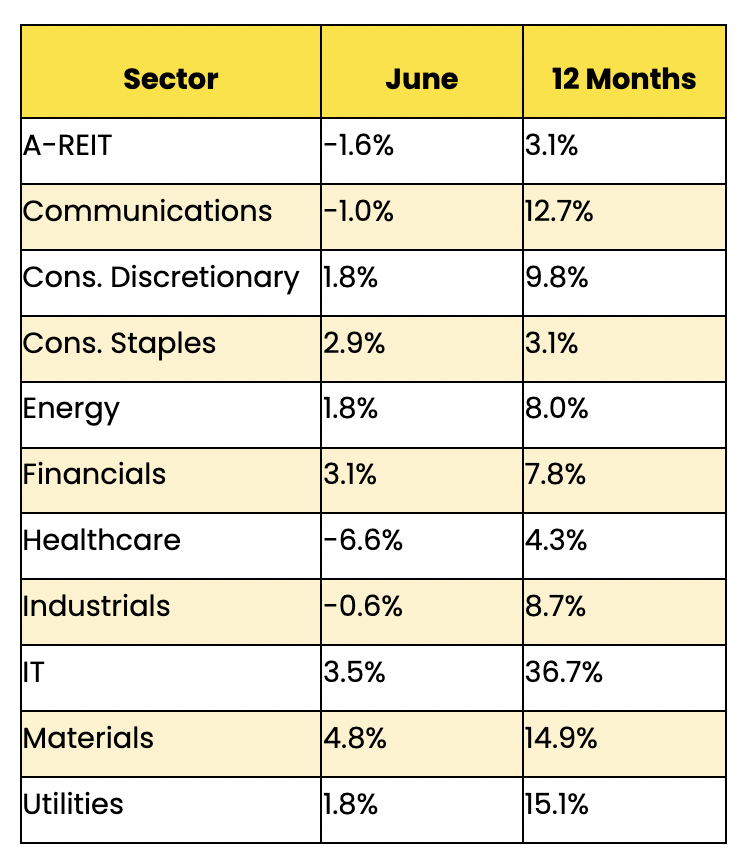

Australian GICS sector performance (June 30th, 2023)