Welcome to the pilot episode of Core, Satellite, Avoid

online pharmacy order biaxin without prescription with best prices today in the USA

! In this new episode format of The Australian Investors Podcast, I — Owen Rask — am joined by Rask’s very own Melissa Vincent

buy https://cancer.coloradowomenshealth.com/images/ucgynonc/estrace.html online https://cancer.coloradowomenshealth.com/images/ucgynonc/estrace.html no prescription pharmacy

to run the microscope over 5 popular Exchange-Traded Funds (ETFs).

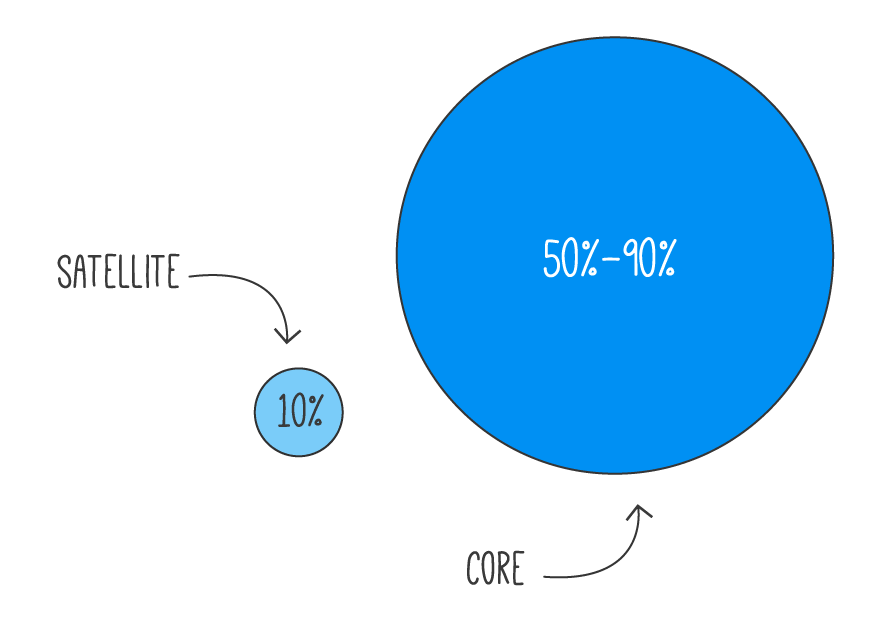

As part of our review of the ETFs, I give you my assessment of whether these funds/ETFs could form part of a balanced Core portfolio, a Satellite allocation or should (frankly!) be avoided. Of course, I lean into the Rask Philosophy.

On this week’s Core, Satellite, Avoid, Owen and Mel cover these 5 ETFs:

- Global X Battery & Lithium ETF (ASX: ACDC)

- VanEck Global Clean Energy ETF (ASX: CLNE)

- BetaShares Global Sustainability Leaders ETF (ASX: ETHI)

- iShares Future Tech Innovators ETF (ASX: ITEK)

- Vanguard Ethically Conscious International Shares Index ETF (ASX: VESG)

All five of these ETFs have a ‘future focus’ — some play into themes about sustainability, and others focus on technology and how to capitalise on technology trends which could solve important problems for all of us.