A surface-level look at the S&P/ASX 200 (ASX: XJO) doesn’t reveal much pain.

The index is down less than 4% for the year, with the major banks and miners all in positive territory.

But a closer inspection shows carnage in certain parts of the market.

For example, the S&P ASX Technology Index is down 20% for the year after falling as much as 27% in March.

Xero Limited (ASX: XRO) has lost 30% of its value. Moreover, the Altium Limited (ASX: ALU) share price is now below its pre-pandemic levels.

Elsewhere, ASX 200 blue-chips are feeling the pain. The share prices of Wesfarmers Ltd (ASX: WES) and REA Group Limited (ASX: REA) are down 15% and 18% respectively.

But there looks to be light at the end of the tunnel. The ASX 200 rebounded 2.41% last week, with individual tech shares either equalling or surpassing that gain.

Is the ASX 200 tech correction over? Or is there further pain ahead?

What’s caused the ASX 200 tech correction?

It’s difficult to attribute any one factor to the ASX 200 tech correction.

But the combination of soaring inflation, interest rates increases, and Russia’s invasion of Ukraine have weighed on market sentiment.

Subsequently, investors have repositioned towards inflation and interest rate beneficiaries such as energy and financials at the expense of industrials and tech shares.

Why the correction could be over

Bank of America (BofA) runs a monthly fund manager survey to get an estimate of what the ‘smart money’ is doing.

In its February update, BofA clients revealed underweight tech positions, which were the largest in 16 years.

Cash allocations also reached their highest point since May 2020.

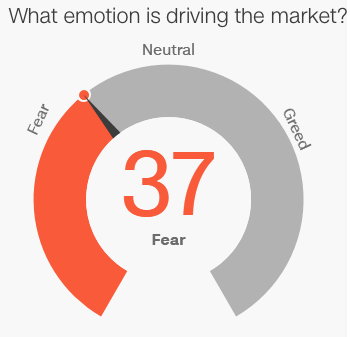

Another common benchmark of investor sentiment is CNN’s Fear & Green Index.

Currently, investors are considered fearful, inferring that the current sell-off might be overdone.

Not so fast

But there’s a growing part of the investing community, which is suggesting the sell-off is just getting started.

Famous short-seller Jim Chanos recently voiced concerns over the profitability of many high-flying tech shares.

“We have a number of sort of $100 stocks that we think are probably worthless because the business model is just broken and yet they’re reporting numbers that are not real”

He believes there is further downside on the horizon, particularly if inflation and interest rates continue to rise.

Final thoughts

It’s impossible to know for sure where ASX 200 shares are heading next.

But what investors can control is their current investments.

Am I well diversified or do I have my eggs in not enough baskets?

Is the thesis for investment still intact?

Does the company have sufficient cash to weather further downturns?

Now is a great time to review portfolios, cut any laggards and be ready for whatever comes next.