The Rectifier Technologies Ltd (ASX: RFT) share price knocked the lights out this morning, rising by more than 80%.

Why is the Rectifier share price skyrocketing?

RFT share price

Big order from Tritium

Rectifier manufactures the power modules that are sold to Tritium, who then install them in their Electric Vehicle (EV) charger station units.

Over the last few years, Tritium has quickly become one of the world’s leading EV charger manufacturers.

Even President Joe Biden praised Tritium’s decision to build its first US manufacturing facility in Tennessee at a White House event.

Tritium expects to manufacture up to 30,000 EV chargers a year.

A lot of these EV chargers will need power modules – that’s where Rectifier comes into play.

This morning, Rectifier announced it’s received purchase orders from Tritium worth around US$20 million. It’s the biggest order since the pair started working together in 2017.

Financial performance rectified

The value of the purchase orders is a significant amount and almost represents half of Rectifier’s market capitalisation of around AUD$53 million before the announcement.

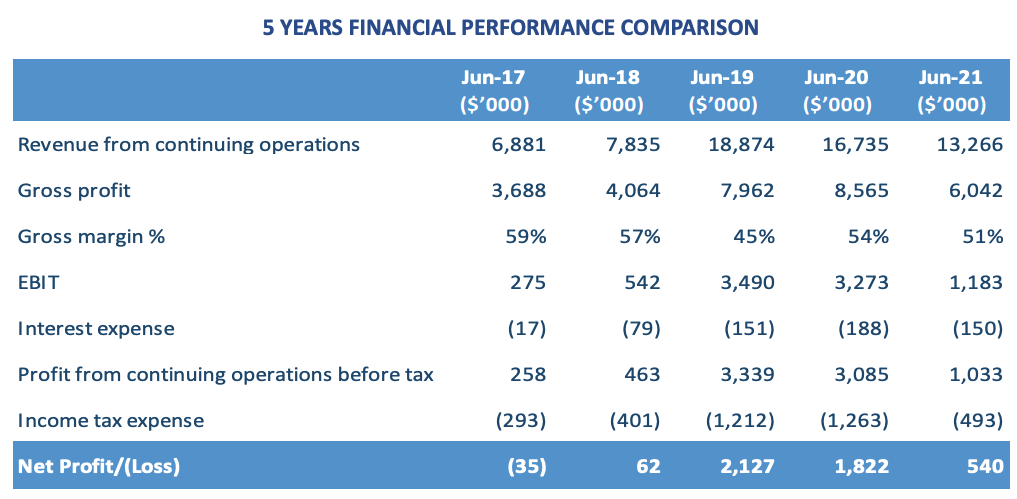

To put things into perspective, the order alone nearly doubles last year’s revenue in FY21 as seen below.

Essentially, the order represents a massive step-change in Rectifier’s financial performance.

My thoughts

Investors ought to be wary of the fact that customer concentration risk remains high as Rectifier continues to rely on its big brother, Tritium.

I also believe it’s important to constantly evaluate why Tritium is choosing Rectifier over bigger power module companies overseas.

I think Tritium has continued to work with Rectifier because of lower shipping costs relative to overseas competitors and reliability. Why break something that’s not broken?

Given the higher shipping costs due to supply chain issues, Tritium is now more inclined to source parts locally.

The share price has run ahead of itself today mainly due to excitement.

Whilst it’s great to feel such adrenalin, it’s also important to monitor the fundamentals of the business and industry.

This is why I’ll be monitoring the performance of Tritium in the US, in particular their ability to execute.

Building a manufacturing facility is one thing, but producing and rolling out the EV chargers is another.

If you’re looking to learn how to do your own ASX company valuations, take our free share valuation course

, which takes you through 6 common share valuation techniques, step by step.